Question: question 2 b) After putting $10,000 down on a piece of property, Alia began paying $2500 quarterly for nine years. Given an interest rate of

question 2

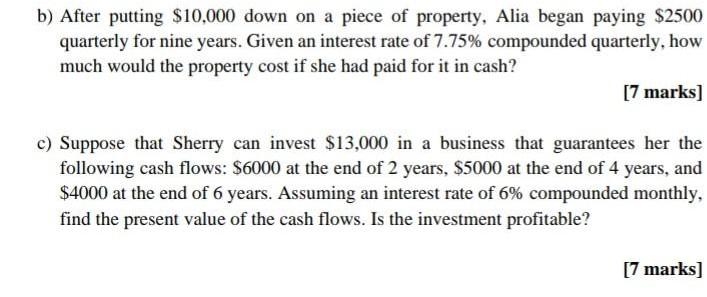

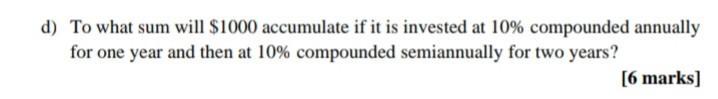

b) After putting $10,000 down on a piece of property, Alia began paying $2500 quarterly for nine years. Given an interest rate of 7.75% compounded quarterly, how much would the property cost if she had paid for it in cash? [7 marks) c) Suppose that Sherry can invest $13,000 in a business that guarantees her the following cash flows: $6000 at the end of 2 years, $5000 at the end of 4 years, and $4000 at the end of 6 years. Assuming an interest rate of 6% compounded monthly, find the present value of the cash flows. Is the investment profitable? [7 marks) d) To what sum will $1000 accumulate if it is invested at 10% compounded annually for one year and then at 10% compounded semiannually for two years? [6 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts