Question: QUESTION 2 Based on current market values, the FIN340 Company has calculated its capital structure weightings to be comprised of 60% common stock, 10% preferred

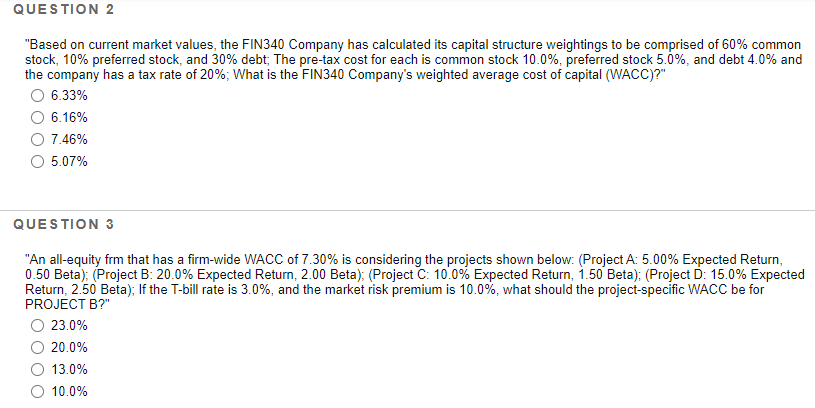

QUESTION 2 "Based on current market values, the FIN340 Company has calculated its capital structure weightings to be comprised of 60% common stock, 10% preferred stock, and 30% debt; The pre-tax cost for each is common stock 10.0%, preferred stock 5.0%, and debt 4.0% and the company has a tax rate of 20%; What is the FIN340 Company's weighted average cost of capital (WACC)?" 6.33% 6.16% O 7.46% 5.07% QUESTION 3 "An all-equity frm that has a firm-wide WACC of 7.30% is considering the projects shown below: (Project A: 5.00% Expected Return, 0.50 Beta) (Project B: 20.0% Expected Return, 2.00 Beta): (Project C: 10.0% Expected Return, 1.50 Beta) (Project D: 15.0% Expected Return, 2.50 Beta); If the T-bill rate is 3.0%, and the market risk premium is 10.0%, what should the project-specific WACC be for PROJECT B?" 23.0% 20.0% O 13.0% 10.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts