Question: Question (2): Below are three different bonds with different information. As the financial manager of the company, you are required to choose the best bond

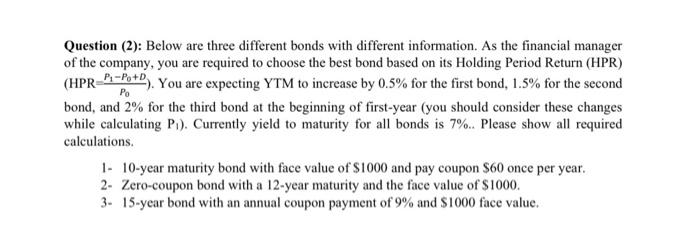

Question (2): Below are three different bonds with different information. As the financial manager of the company, you are required to choose the best bond based on its Holding Period Return (HPR) (HPRP-P+). You are expecting YTM to increase by 0.5% for the first bond, 1.5% for the second bond, and 2% for the third bond at the beginning of first-year (you should consider these changes while calculating P.). Currently yield to maturity for all bonds is 7%.. Please show all required calculations. 1- 10-year maturity bond with face value of $1000 and pay coupon $60 once per year. 2. Zero-coupon bond with a 12-year maturity and the face value of $1000. 3. 15-year bond with an annual coupon payment of 9% and $1000 face value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts