Question: QUESTION 2 Below are weekly prices for Lumber Liquidators (LL). Date Prices Feb 16 14.21 Feb 8 12.33 Feb 1 12.34 Jan 25 12.91 Jan

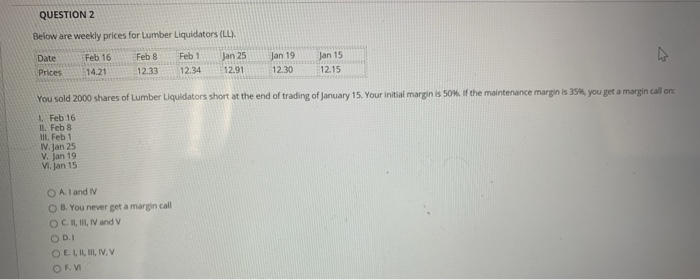

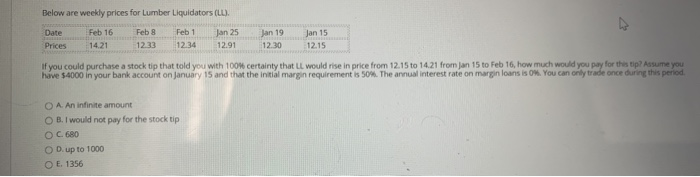

QUESTION 2 Below are weekly prices for Lumber Liquidators (LL). Date Prices Feb 16 14.21 Feb 8 12.33 Feb 1 12.34 Jan 25 12.91 Jan 19 12.30 Jan 15 12.15 You sold 2000 shares of Lumber Liquidators short at the end of trading of January 15. Your initial margin is 50%. If the maintenance margin is 35%, you get a margin call on 1 Feb 16 11. Feb 8 TIL Feb 1 1. Jan 25 V. Jan 19 V. Jan 15 O AI and IV O B. You never get a margin call OC. II, II, IV and V ODI O E LII, III, IV, V OFM Below are weekly prices for Lumber Liquidators (LL). Date Prices Feb 16 14.21 Feb 8 1233 Feb 1 12.34 Jan 25 12.91 Jan 19 12.30 Jan 15 12.15 If you could purchase a stock tip that told you with 100% certainty that it would rise in price from 12.15 to 14.21 from Jan 15 to Feb 16, how much would you pay for this tip? Assume you have $4000 in your bank account on January 15 and that the initial margin requirement is 50%. The annual interest rate on margin loans is 0%. You can only trade once during this period O A. An infinite amount OB. I would not pay for the stock tip OC. 680 OD, up to 1000 O E. 1356

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts