Question: Question 2 ( Binomial model ) ( 2 0 marks ) This question has two independent parts, ( a ) and ( b ) .

Question Binomial model marks

This question has two independent parts, a and b

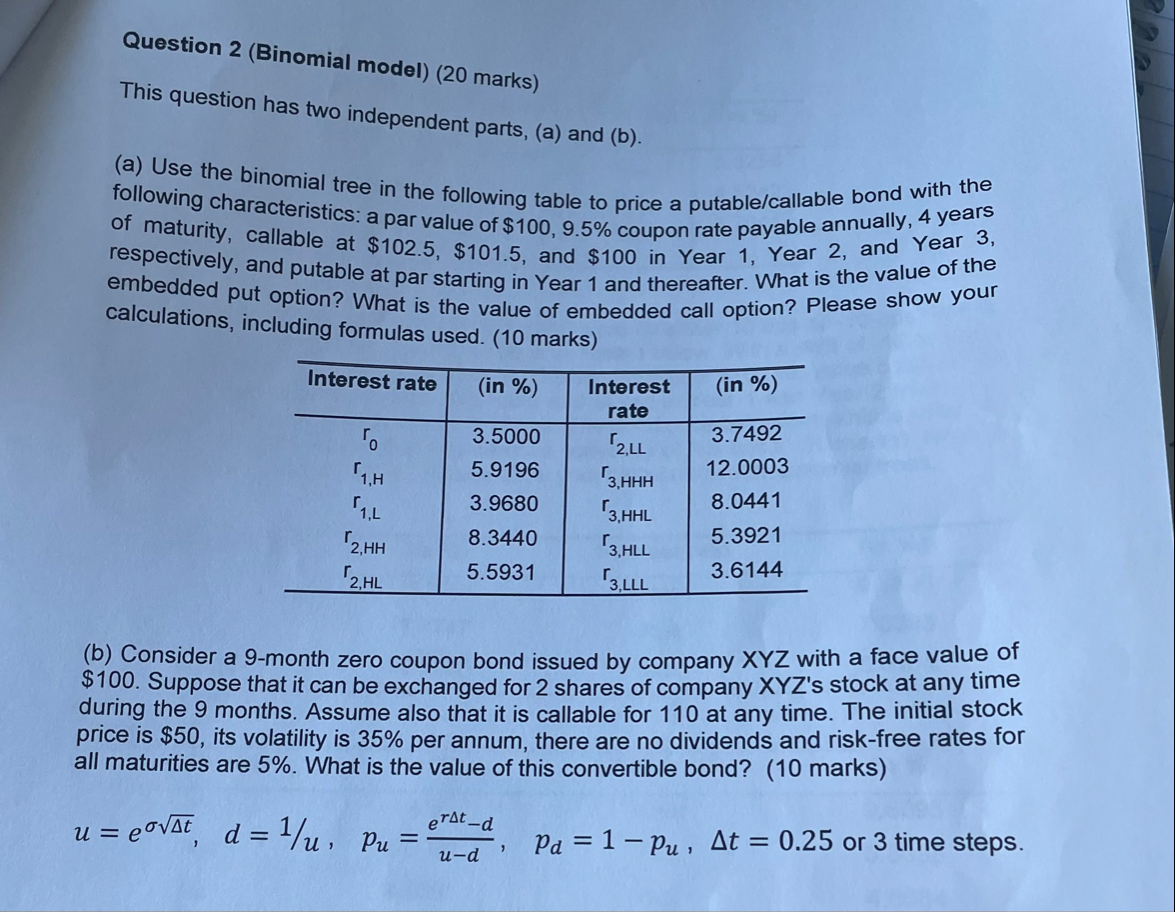

a Use the binomial tree in the following table to price a putablecallable bond with the following characteristics: a par value of $ coupon rate payable annually, years of maturity, callable at $$ and $ in Year Year and Year respectively, and putable at par starting in Year and thereafter. What is the value of the embedded put option? What is the value of embedded call option? Please show your calculations, including formulas used. marks

tableInterest rate,in tableInterestratein

b Consider a month zero coupon bond issued by company with a face value of $ Suppose that it can be exchanged for shares of company XYZs stock at any time during the months. Assume also that it is callable for at any time. The initial stock price is $ its volatility is per annum, there are no dividends and riskfree rates for all maturities are What is the value of this convertible bond? marks

or time steps

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock