Question: QUESTION 2 Briefly explain the historical simulation approach to compute value at risk (VaR). Two risk managers compute VaRs for the same portfolio over the

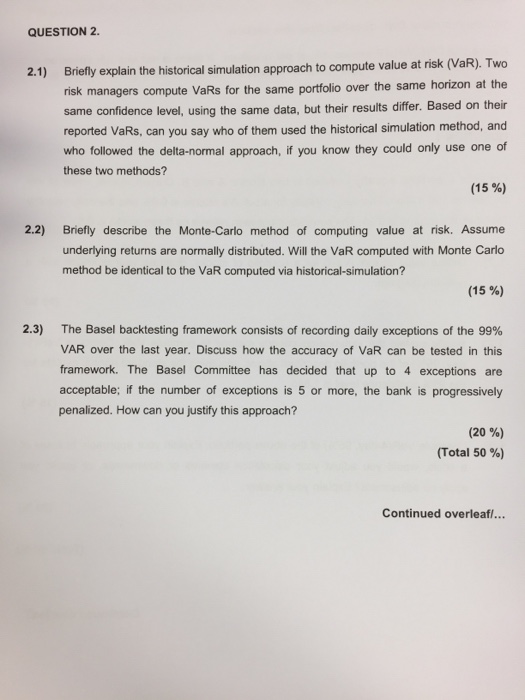

QUESTION 2 Briefly explain the historical simulation approach to compute value at risk (VaR). Two risk managers compute VaRs for the same portfolio over the same horizon at the same confidence level, using the same data reported VaRs, can you say who of them used the historical simulation method, and who followed the delta-normal approach, if you know they could only use one of these two methods? 2.1) , but their results differ. Based on their (15 %) 2.2) Briefly describe the Monte-Carlo method of computing value at risk. Assume underlying returns are normally distributed. Will the VaR computed with Monte Carlo method be identical to the VaR computed via historical-simulation? (15 %) 2.3) The Basel backtesting framework consists of recording daily exceptions of the 99% VAR over the last year. Discuss how the accuracy of VaR can be tested in this framework. The Basel Committee has decided that up to 4 exceptions are acceptable; if the number of exceptions is 5 or more, the bank is progressively penalized. How can you justify this approach? (20 %) (Total 50 %) Continued overleaf QUESTION 2 Briefly explain the historical simulation approach to compute value at risk (VaR). Two risk managers compute VaRs for the same portfolio over the same horizon at the same confidence level, using the same data reported VaRs, can you say who of them used the historical simulation method, and who followed the delta-normal approach, if you know they could only use one of these two methods? 2.1) , but their results differ. Based on their (15 %) 2.2) Briefly describe the Monte-Carlo method of computing value at risk. Assume underlying returns are normally distributed. Will the VaR computed with Monte Carlo method be identical to the VaR computed via historical-simulation? (15 %) 2.3) The Basel backtesting framework consists of recording daily exceptions of the 99% VAR over the last year. Discuss how the accuracy of VaR can be tested in this framework. The Basel Committee has decided that up to 4 exceptions are acceptable; if the number of exceptions is 5 or more, the bank is progressively penalized. How can you justify this approach? (20 %) (Total 50 %) Continued overleaf

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts