Question: QUESTION 2 C. The CAPM is primarily a theoretical model and is rarely used in practice to estimate the cost of capital. ANSWER ALL PARTS

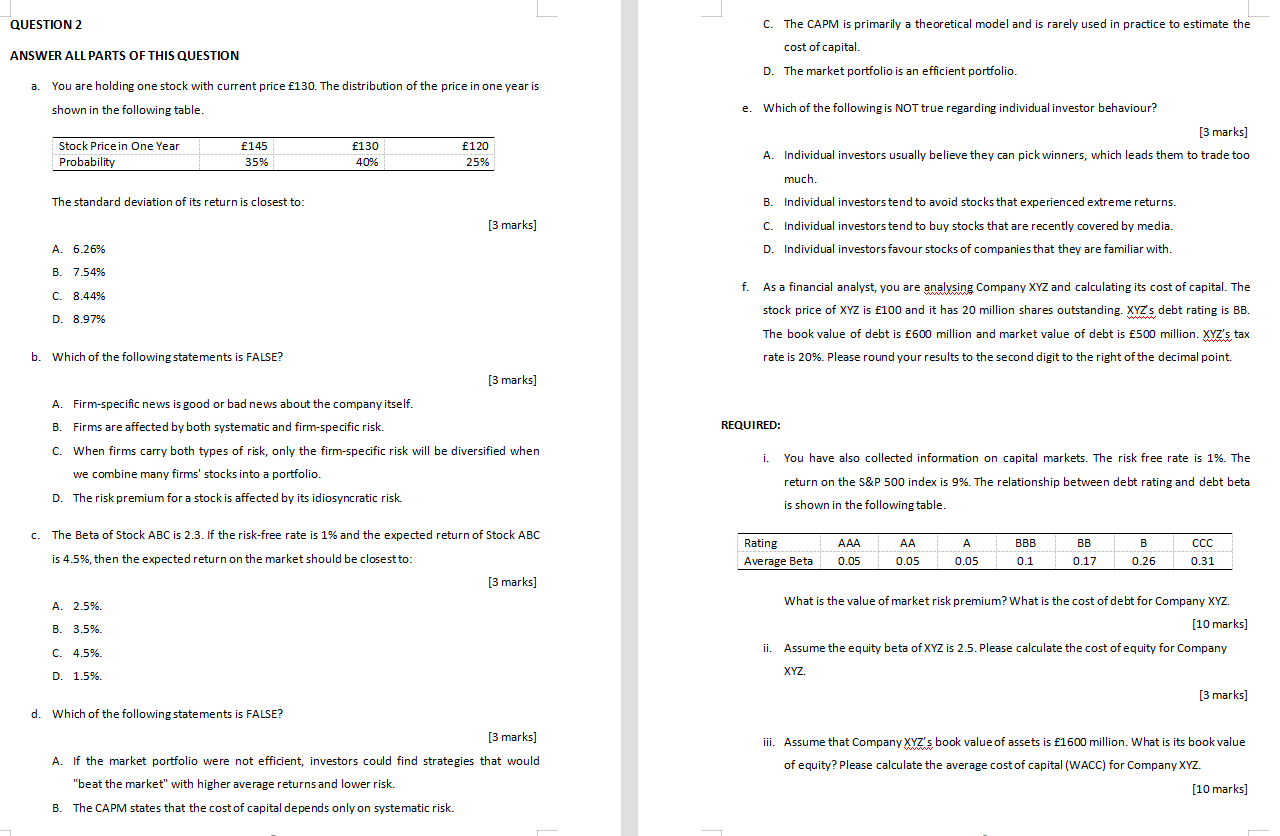

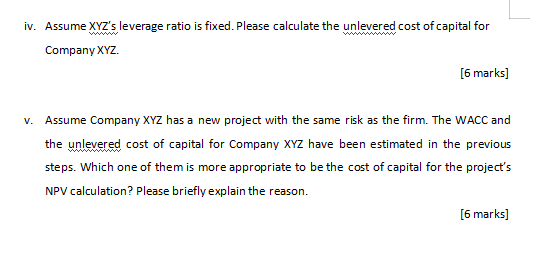

QUESTION 2 C. The CAPM is primarily a theoretical model and is rarely used in practice to estimate the cost of capital. ANSWER ALL PARTS OF THIS QUESTION D. The market portfolio is an efficient portfolio. a. You are holding one stock with current price 130. The distribution of the price in one year is shown in the following table e. Which of the following is NOT true regarding individual investor behaviour? [3 marks] A. Individual investors usually believe they can pick winners, which leads them to trade too 130 Stock Price in One Year Probability 145 35% 120 25% 40% much. The standard deviation of its return is closest to: [3 marks] B. Individual investors tend to avoid stocks that experienced extreme returns C. Individual investors tend to buy stocks that are recently covered by media. D. Individual investors favour stocks of companies that they are familiar with. A. 6.26% B. 7.54% f. C. 8.44% D. 8.97% As a financial analyst, you are analysing Company XYZ and calculating its cost of capital. The stock price of XYZ is 100 and it has 20 million shares outstanding. XYZ s debt rating is BB. The book value of debt is 600 million and market value of debt is 500 million. XYZ's tax rate is 20%. Please round your results to the second digit to the right of the decimal point. b. Which of the following statements is FALSE? [3 marks] REQUIRED: A. Firm-specific news is good or bad news about the company itself. B. Firms are affected by both systematic and firm-specific risk. C. When firms carry both types of risk, only the firm-specific risk will be diversified when we combine many firms' stocks into a portfolio. D. The risk premium for a stock is affected by its idiosyncratic risk i. You have also collected information on capital markets. The risk free rate is 1%. The return on the S&P 500 index is 9%. The relationship between debt rating and debt beta is shown in the following table. C. The Beta of Stock ABC is 2.3. If the risk-free rate is 1% and the expected return of Stock ABC AA A BBB Rating Average Beta is 4.5%, then the expected return on the market should be closest to: AAA 0.05 BB 0.17 B 0.26 CCC 0.31 0.05 0.05 0.1 [3 marks] A. 2.5% What is the value of market risk premium? What is the cost of debt for Company XYZ. [10 marks] B. 3.5%. ii. C. 4.5% Assume the equity beta of XYZ is 2.5. Please calculate the cost of equity for Company XYZ D. 1.5% [3 marks] d. Which of the following statements is FALSE? [3 marks] A. If the market portfolio were not efficient, investors could find strategies that would "beat the market" with higher average returns and lower risk. B. The CAPM states that the cost of capital depends only on systematic risk. iii. Assume that company XYZ's book value of assets is 1600 million. What is its book value of equity? Please calculate the average cost of capital (WACC) for Company XYZ. [10 marks] iv. Assume XYZ's leverage ratio is fixed. Please calculate the unlevered cost of capital for Company XYZ. [6 marks] v. Assume Company XYZ has a new project with the same risk as the firm. The WACC and the unlevered cost of capital for Company XYZ have been estimated in the previous steps. Which one of them is more appropriate to be the cost of capital for the project's NPV calculation? Please briefly explain the reason. [6 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts