Question: Question 2 - Calculation of Basic and Diluted Earnings per share Kent Company has, in its Stockholder's equity as of December 31, 2021, 1,276,596 shares

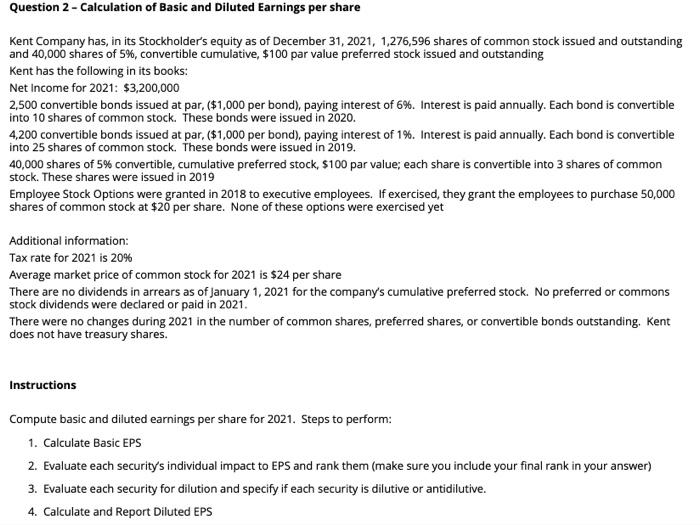

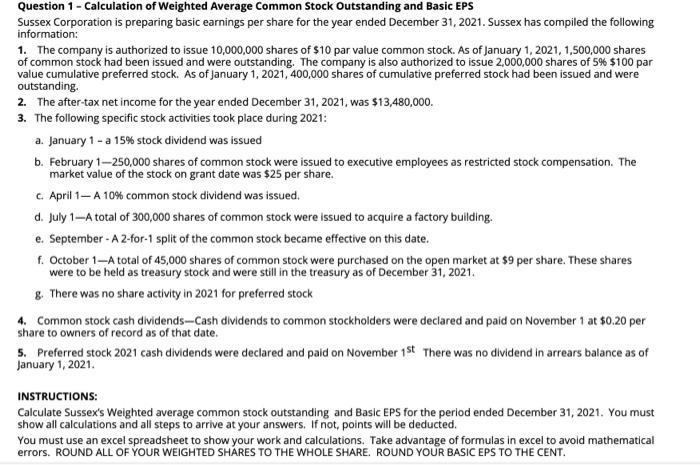

Question 2 - Calculation of Basic and Diluted Earnings per share Kent Company has, in its Stockholder's equity as of December 31, 2021, 1,276,596 shares of common stock issued and outstanding and 40,000 shares of 5%, convertible cumulative, $100 par value preferred stock issued and outstanding Kent has the following in its books: Net Income for 2021: $3,200,000 2,500 convertible bonds issued at par, ($1,000 per bond), paying interest of 6%. Interest is paid annually. Each bond is convertible into 10 shares of common stock. These bonds were issued in 2020. 4,200 convertible bonds issued at par, ($1,000 per bond), paying interest of 1%. Interest is paid annually. Each bond is convertible into 25 shares of common stock. These bonds were issued in 2019. 40,000 shares of 5% convertible, cumulative preferred stock, $100 par value; each share is convertible into 3 shares of common stock. These shares were issued in 2019 Employee Stock Options were granted in 2018 to executive employees. If exercised, they grant the employees to purchase 50,000 shares of common stock at $20 per share. None of these options were exercised yet Additional information: Tax rate for 2021 is 20% Average market price of common stock for 2021 is $24 per share There are no dividends in arrears as of January 1, 2021 for the company's cumulative preferred stock. No preferred or commons stock dividends were declared or paid in 2021 There were no changes during 2021 in the number of common shares, preferred shares, or convertible bonds outstanding. Kent does not have treasury shares. Instructions Compute basic and diluted earnings per share for 2021. Steps to perform: 1. Calculate Basic EPS 2. Evaluate each security's individual impact to EPS and rank them (make sure you include your final rank in your answer) 3. Evaluate each security for dilution and specify if each security is dilutive or antidilutive. 4. Calculate and Report Diluted EPS Question 1 - Calculation of Weighted Average Common Stock Outstanding and Basic EPS Sussex Corporation is preparing basic earnings per share for the year ended December 31, 2021. Sussex has compiled the following information: 1. The company is authorized to issue 10,000,000 shares of $10 par value common stock. As of January 1, 2021, 1,500,000 shares of common stock had been issued and were outstanding. The company is also authorized to issue 2,000,000 shares of 5% $100 par value cumulative preferred stock. As of January 1, 2021, 400,000 shares of cumulative preferred stock had been issued and were outstanding 2. The after-tax net income for the year ended December 31, 2021, was $13,480,000 3. The following specific stock activities took place during 2021: a. January 1 -a 15% stock dividend was issued b. February 1-250,000 shares of common stock were issued to executive employees as restricted stock compensation. The market value of the stock on grant date was $25 per share. c. April 1- A 10% common stock dividend was issued. d. July 1A total of 300,000 shares of common stock were issued to acquire a factory building. e. September - 2-for-1 split of the common stock became effective on this date. f. October 1-A total of 45,000 shares of common stock were purchased on the open market at $9 per share. These shares were to be held as treasury stock and were still in the treasury as of December 31, 2021. & There was no share activity in 2021 for preferred stock 4. Common stock cash dividends--Cash dividends to common stockholders were declared and paid on November 1 at $0.20 per share to owners of record as of that date. 5. Preferred stock 2021 cash dividends were declared and paid on November 1st There was no dividend in arrears balance as of January 1, 2021. INSTRUCTIONS: Calculate Sussex's Weighted average common stock outstanding and Basic EPS for the period ended December 31, 2021. You must show all calculations and all steps to arrive at your answers. If not, points will be deducted. You must use an excel spreadsheet to show your work and calculations. Take advantage of formulas in excel to avoid mathematical errors. ROUND ALL OF YOUR WEIGHTED SHARES TO THE WHOLE SHARE. ROUND YOUR BASIC EPS TO THE CENT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts