Question: QUESTION 2 - CAPITAL BUDGETING (25 POINTS) Part a. A shoe making machine costs $80,000 today. You are considering buying this machine. The machine will

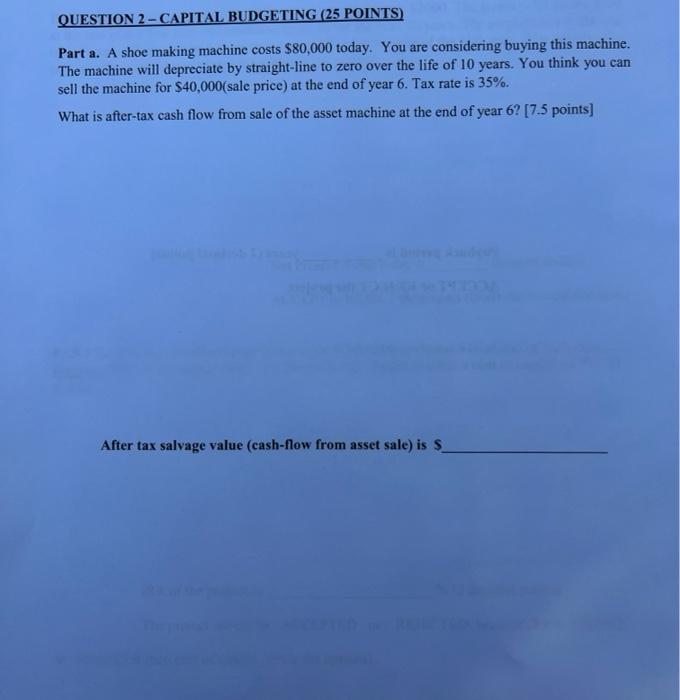

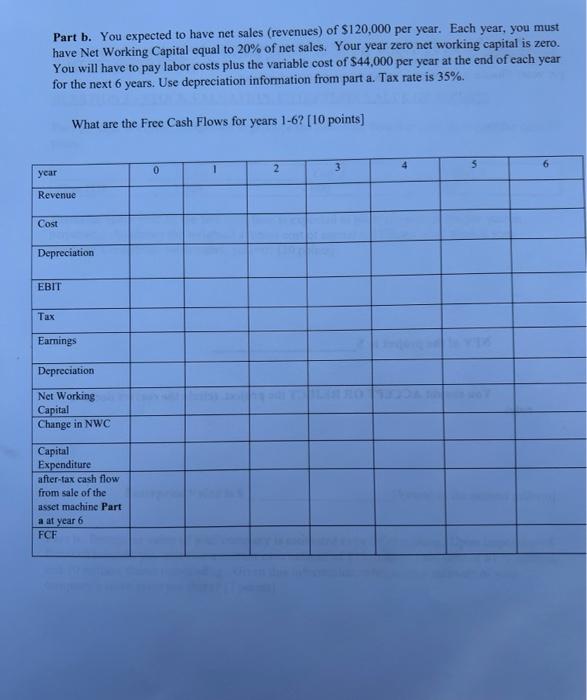

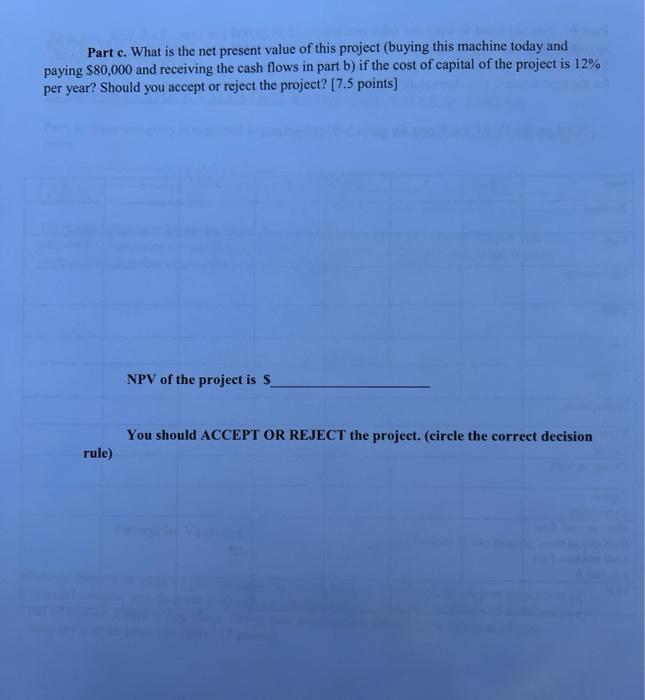

QUESTION 2 - CAPITAL BUDGETING (25 POINTS) Part a. A shoe making machine costs $80,000 today. You are considering buying this machine. The machine will depreciate by straight-line to zero over the life of 10 years. You think you can sell the machine for $40,000(sale price) at the end of year 6. Tax rate is 35%. What is after-tax cash flow from sale of the asset machine at the end of year 6? [7.5 points) After tax salvage value (cash-flow from asset sale) is $ Part b. You expected to have net sales (revenues) of $120,000 per year. Each year, you must have Net Working Capital equal to 20% of net sales. Your year zero net working capital is zero. You will have to pay labor costs plus the variable cost of $44,000 per year at the end of each year for the next 6 years. Use depreciation information from part a. Tax rate is 35%. What are the Free Cash Flows for years 1-6? [10 points) 6 4 0 1 2 3 year Revenue Cost Depreciation EBIT Tax Earnings Depreciation Net Working Capital Change in NWC Capital Expenditure after-tax cash flow from sale of the asset machine Part a at year 6 FCF Parte. What is the net present value of this project (buying this machine today and paying $80,000 and receiving the cash flows in part b) if the cost of capital of the project is 12% per year? Should you accept or reject the project? [7.5 points] NPV of the project is s You should ACCEPT OR REJECT the project. (circle the correct decision rule)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts