Question: Question 2 (Cash Conversion Cycle - Calculation) Simple Industries turns its inventory 8 times each year; its average collection period is 50 days, and its

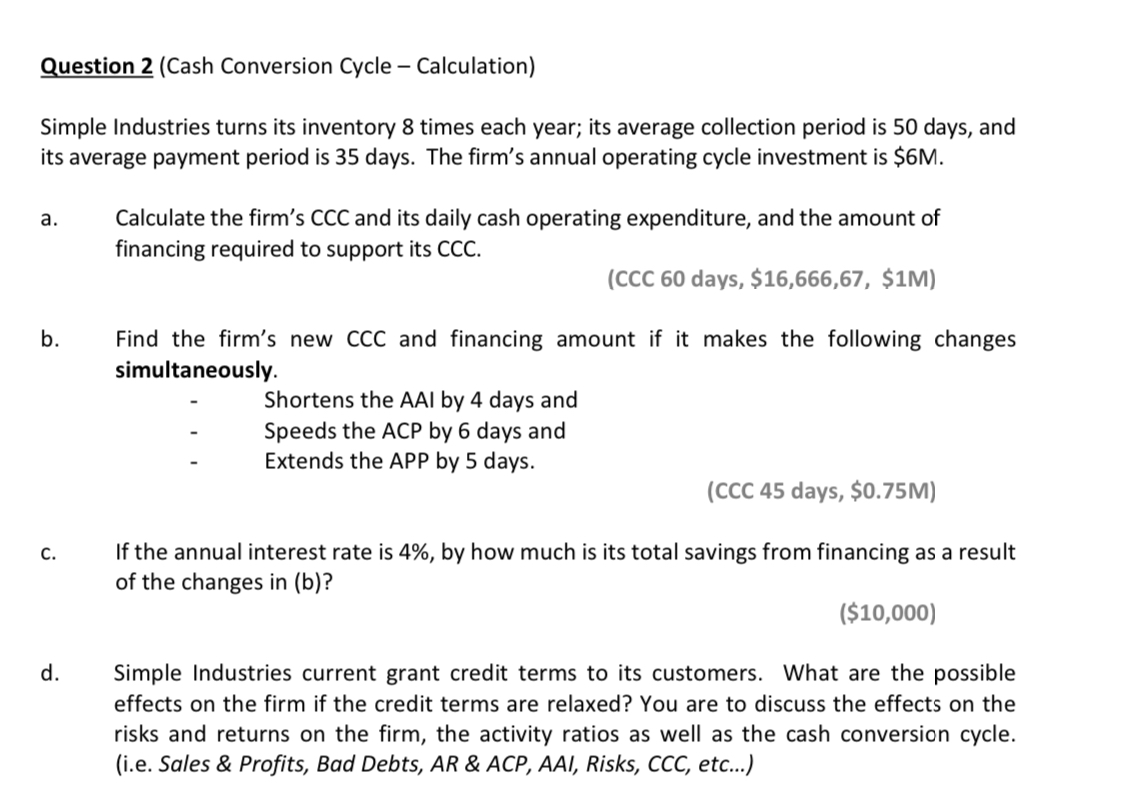

Question 2 (Cash Conversion Cycle - Calculation) Simple Industries turns its inventory 8 times each year; its average collection period is 50 days, and its average payment period is 35 days. The firm's annual operating cycle investment is $6M. a. Calculate the firm's CCC and its daily cash operating expenditure, and the amount of financing required to support its CCC. (CCC60days,$16,666,67,$1M) b. Find the firm's new CCC and financing amount if it makes the following changes simultaneously. Shortens the AAI by 4 days and Speeds the ACP by 6 days and Extends the APP by 5 days. (CCC45days,$0.75M) c. If the annual interest rate is 4%, by how much is its total savings from financing as a result of the changes in (b)? ($10,000) d. Simple Industries current grant credit terms to its customers. What are the possible effects on the firm if the credit terms are relaxed? You are to discuss the effects on the risks and returns on the firm, the activity ratios as well as the cash conversion cycle. (i.e. Sales \& Profits, Bad Debts, AR \& ACP, AAl, Risks, CCC, etc...)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts