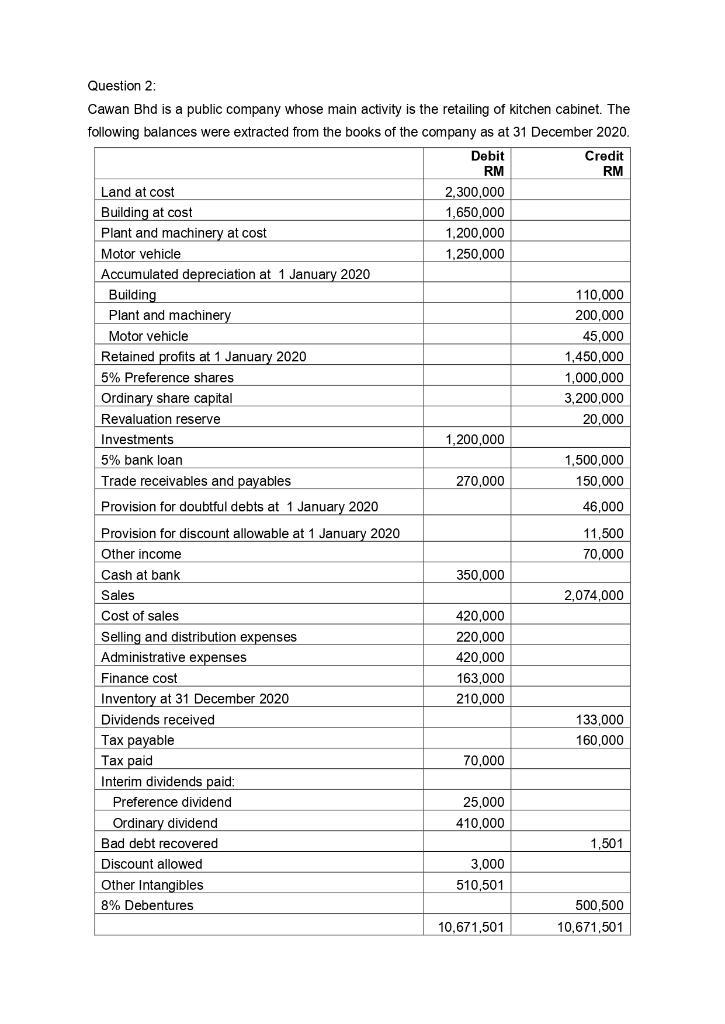

Question: Question 2: Cawan Bhd is a public company whose main activity is the retailing of kitchen cabinet. The following balances were extracted from the

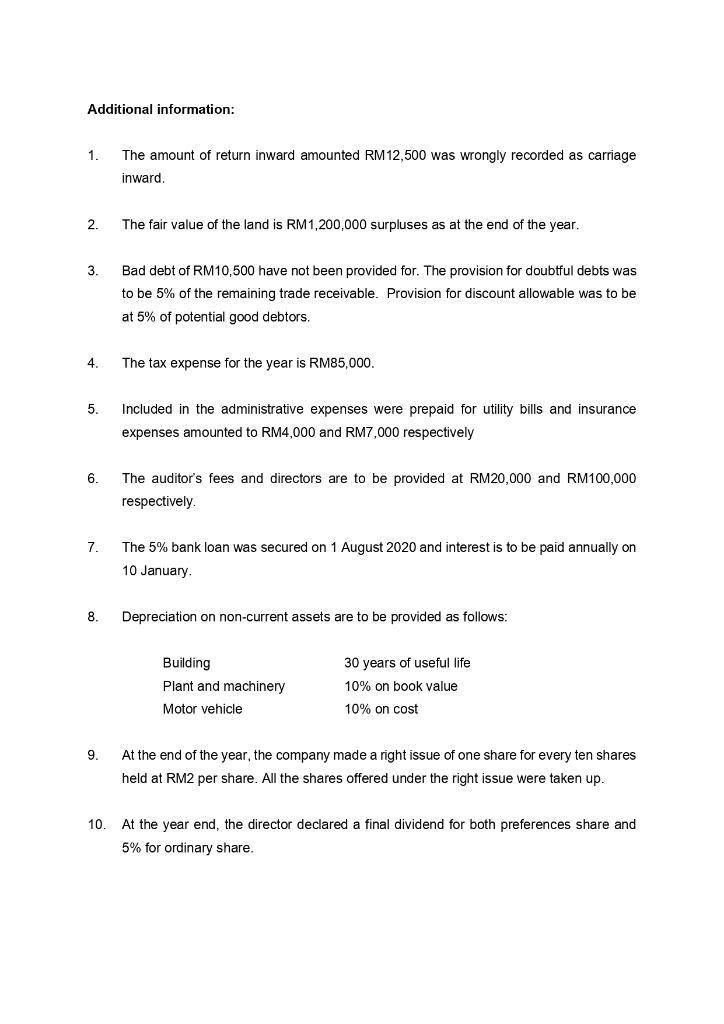

Question 2: Cawan Bhd is a public company whose main activity is the retailing of kitchen cabinet. The following balances were extracted from the books of the company as at 31 December 2020. Land at cost Building at cost Plant and machinery at cost Motor vehicle Accumulated depreciation at 1 January 2020 Building Plant and machinery Motor vehicle Retained profits at 1 January 2020 5% Preference shares Ordinary share capital Revaluation reserve Investments 5% bank loan Trade receivables and payables Provision for doubtful debts at 1 January 2020 Provision for discount allowable at 1 January 2020 Other income Cash at bank Sales Cost of sales Selling and distribution expenses Administrative expenses. Finance cost Inventory at 31 December 2020 Dividends received Tax payable Tax paid Interim dividends paid: Preference dividend Ordinary dividend Bad debt recovered Discount allowed Other Intangibles 8% Debentures Debit RM 2,300,000 1,650,000 1,200,000 1,250,000 1,200,000 270,000 350,000 420,000 220,000 420,000 163,000 210,000 70,000 25,000 410,000 3,000 510,501 10,671,501 Credit RM 110,000 200,000 45,000 1,450,000 1,000,000 3,200,000 20,000 1,500,000 150,000 46,000 11,500 70,000 2,074,000 133,000 160,000 1,501 500,500 10,671,501 Additional information: 1. 2. 3. 4. 5. 6. 7. 8. 9. The amount of return inward amounted RM12,500 was wrongly recorded as carriage inward. The fair value of the land is RM 1,200,000 surpluses as at the end of the year. Bad debt of RM10,500 have not been provided for. The provision for doubtful debts was to be 5% of the remaining trade receivable. Provision for discount allowable was to be at 5% of potential good debtors. The tax expense for the year is RM85,000. Included in the administrative expenses were prepaid for utility bills and insurance expenses amounted to RM4,000 and RM7,000 respectively The auditor's fees and directors are to be provided at RM20,000 and RM100,000 respectively. The 5% bank loan was secured on 1 August 2020 and interest is to be paid annually on 10 January. Depreciation on non-current assets are to be provided as follows: Building Plant and machinery Motor vehicle 30 years of useful life 10% on book value 10% on cost At the end of the year, the company made a right issue of one share for every ten shares held at RM2 per share. All the shares offered under the right issue were taken up. 10. At the year end, the director declared a final dividend for both preferences share and 5% for ordinary share. Required: (a) Prepare a Statement of Comprehensive Income for the year ended 31 December 2020 (show your working). (12 marks) (b) Prepare a Statement of Financial Position as at 31 December 2020 (show your working). (18 marks) [30 marks]

Step by Step Solution

3.53 Rating (150 Votes )

There are 3 Steps involved in it

8 Sales 2074000 12500 Cost of goods sald 420000 12500 X 30 61500 Goross profit Selling ... View full answer

Get step-by-step solutions from verified subject matter experts