Question: Question 2: Cloud Inc. is a Canadian controlled private corporation. The following data summarized the operations of Cloud Inc. for the year ended Dec

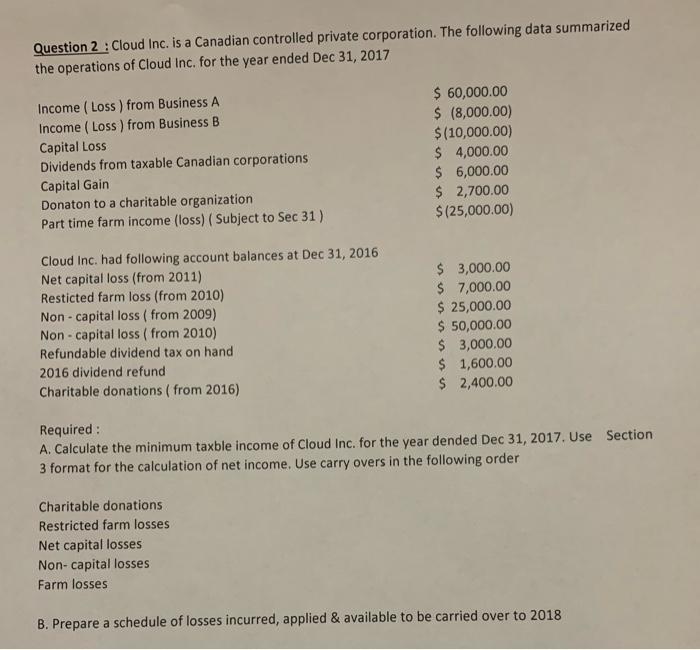

Question 2: Cloud Inc. is a Canadian controlled private corporation. The following data summarized the operations of Cloud Inc. for the year ended Dec 31, 2017 Income (Loss) from Business A $ 60,000.00 $ (8,000.00) Income (Loss) from Business B Capital Loss $(10,000.00) $4,000.00 Dividends from taxable Canadian corporations Capital Gain $ 6,000.00 Donaton to a charitable organization $ 2,700.00 Part time farm income (loss) (Subject to Sec 31 ) $(25,000.00) Cloud Inc. had following account balances at Dec 31, 2016 Net capital loss (from 2011) $3,000.00 Resticted farm loss (from 2010) $ 7,000.00 $ 25,000.00 Non capital loss (from 2009) Non capital loss (from 2010) Refundable dividend tax on hand $ 50,000.00 $ 3,000.00 2016 dividend refund $ 1,600.00 Charitable donations (from 2016) $ 2,400.00 Required: A. Calculate the minimum taxble income of Cloud Inc. for the year dended Dec 31, 2017. Use Section 3 format for the calculation of net income. Use carry overs in the following order Charitable donations Restricted farm losses Net capital losses Non-capital losses Farm losses B. Prepare a schedule of losses incurred, applied & available to be carried over to 2018

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

A Net Income before losses and charitable donations 6000000 400000 600000 Income from Busin... View full answer

Get step-by-step solutions from verified subject matter experts