Question: Question 2: Comparison Methods (9 marks) Two mutually exclusive projects are under consideration. The cash flow diagrams below depict the costs and savings. Option A

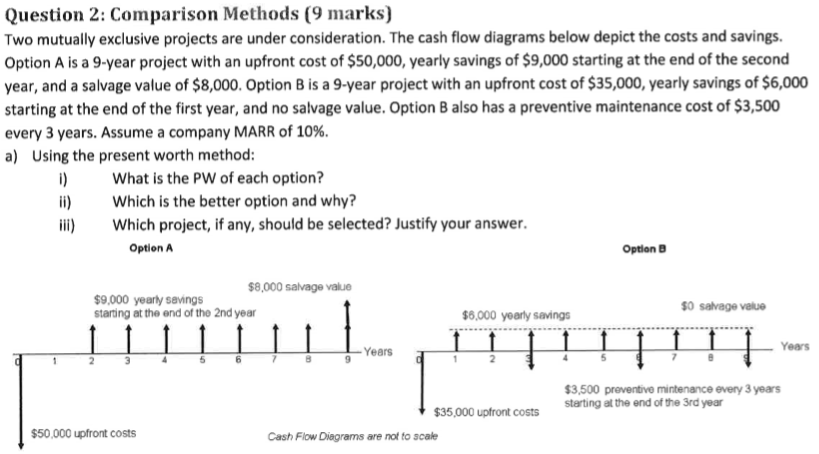

Question 2: Comparison Methods (9 marks) Two mutually exclusive projects are under consideration. The cash flow diagrams below depict the costs and savings. Option A is a 9-year project with an upfront cost of $50,000, yearly savings of $9,000 starting at the end of the second year, and a salvage value of $8,000. Option B is a 9-year project with an upfront cost of $35,000, yearly savings of $6,000 starting at the end of the first year, and no salvage value. Option B also has a preventive maintenance cost of $3,500 every 3 years. Assume a company MARR of 10%. a) Using the present worth method: What is the PW of each option? Which is the better option and why? Which project, if any, should be selected? Justify your answer. Option A Option $8,000 salvage value $9,000 yearly savings starting at the end of the 2nd year $0 salvage value $6,000 yearly savings UUHUHUL Year's $3,500 preventive mintenance every 3 years starting at the end of the 3rd year $35,000 upfront costs $50,000 upfront costs Cash Flow Diagrams are not to scale Question 2: Comparison Methods (9 marks) Two mutually exclusive projects are under consideration. The cash flow diagrams below depict the costs and savings. Option A is a 9-year project with an upfront cost of $50,000, yearly savings of $9,000 starting at the end of the second year, and a salvage value of $8,000. Option B is a 9-year project with an upfront cost of $35,000, yearly savings of $6,000 starting at the end of the first year, and no salvage value. Option B also has a preventive maintenance cost of $3,500 every 3 years. Assume a company MARR of 10%. a) Using the present worth method: What is the PW of each option? Which is the better option and why? Which project, if any, should be selected? Justify your answer. Option A Option $8,000 salvage value $9,000 yearly savings starting at the end of the 2nd year $0 salvage value $6,000 yearly savings UUHUHUL Year's $3,500 preventive mintenance every 3 years starting at the end of the 3rd year $35,000 upfront costs $50,000 upfront costs Cash Flow Diagrams are not to scale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts