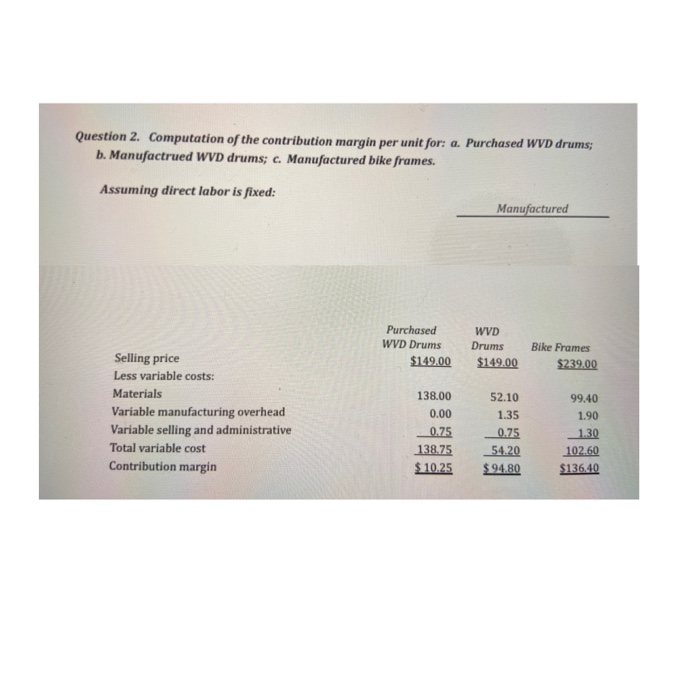

Question: Question 2. Computation of the contribution margin per unit for: a. Purchased WVD drums; b. Manufactrued WVD drums; c. Manufactured bike frames. Assuming direct labor

Question 2. Computation of the contribution margin per unit for: a. Purchased WVD drums; b. Manufactrued WVD drums; c. Manufactured bike frames. Assuming direct labor is fixed: Manufactured Purchased WVD Drums $149.00 WVD Drums $149.00 Bike Frames $239.00 Selling price Less variable costs: Materials Variable manufacturing overhead Variable selling and administrative Total variable cost Contribution margin 138.00 0.00 0.75 138.75 $10.25 52.10 1.35 0.75 54.20 $ 94.80 99.40 1.90 1.30 102.60 $136.40 Case 13-32 Make or Buy; Utilization of a Constrained Resource Case Background Tuff Stuff, Inc. is considering to increase sales of WVD drums as their main product. To produce WVD drums each drum requires 0.4 hour of welding machine that has a capacity of 2000 hours. To achieve the management's goal of increasing its revenues, they are planning to purchase WVD type drums from another another supplier at $138 each but can be sold at $149 after further packaging, Another option is to produce bike frames instead of WVD drums. These bike frames can be sold at $239. Statement of the Problem A make or buy decision, whether an item should be made internally or purchased from an external supplier? How to maximize contribution margin, rank products on the basis of their contribution margins per unit of the constrained resource? Objective: To determine the most profitable use of a constrained resource and the value of obtaining more of the constrained resource. To determine the best option for the company to increase its revenues. Though the bike frame's unit price is $239, much higher than WVD drums sold at $149, variable costs are relatively high as well. To prepare a make or buy analysis. Question 2. Computation of the contribution margin per unit for: a. Purchased WVD drums; b. Manufactrued WVD drums; c. Manufactured bike frames. Assuming direct labor is fixed: Manufactured Purchased WVD Drums $149.00 WVD Drums $149.00 Bike Frames $239.00 Selling price Less variable costs: Materials Variable manufacturing overhead Variable selling and administrative Total variable cost Contribution margin 138.00 0.00 0.75 138.75 $10.25 52.10 1.35 0.75 54.20 $ 94.80 99.40 1.90 1.30 102.60 $136.40 Case 13-32 Make or Buy; Utilization of a Constrained Resource Case Background Tuff Stuff, Inc. is considering to increase sales of WVD drums as their main product. To produce WVD drums each drum requires 0.4 hour of welding machine that has a capacity of 2000 hours. To achieve the management's goal of increasing its revenues, they are planning to purchase WVD type drums from another another supplier at $138 each but can be sold at $149 after further packaging, Another option is to produce bike frames instead of WVD drums. These bike frames can be sold at $239. Statement of the Problem A make or buy decision, whether an item should be made internally or purchased from an external supplier? How to maximize contribution margin, rank products on the basis of their contribution margins per unit of the constrained resource? Objective: To determine the most profitable use of a constrained resource and the value of obtaining more of the constrained resource. To determine the best option for the company to increase its revenues. Though the bike frame's unit price is $239, much higher than WVD drums sold at $149, variable costs are relatively high as well. To prepare a make or buy analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts