Question: Question 2 Consider a 2-year American put with a strike price K =$52 maturing 24 months (2 years) from today. The stock is currently trading

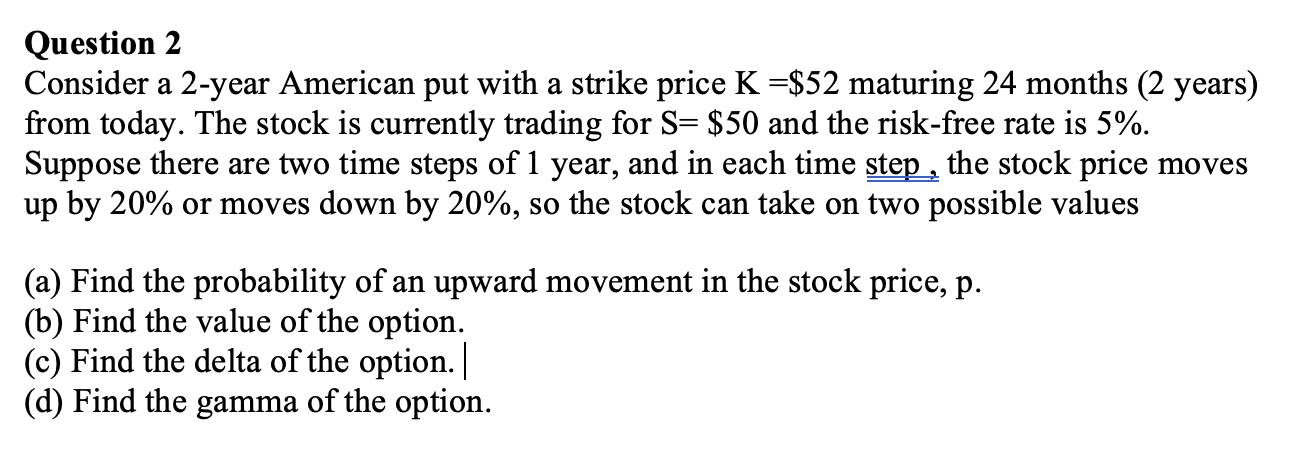

Question 2 Consider a 2-year American put with a strike price K =$52 maturing 24 months (2 years) from today. The stock is currently trading for S= $50 and the risk-free rate is 5%. Suppose there are two time steps of 1 year, and in each time step , the stock price moves up by 20% or moves down by 20%, so the stock can take on two possible values (a) Find the probability of an upward movement in the stock price,p. (b) Find the value of the option. (c) Find the delta of the option. | (d) Find the gamma of the option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts