Question: Question 2: Consider a one period bond which has a face value of 100 and does not pay any coupon. An investor has a per-period

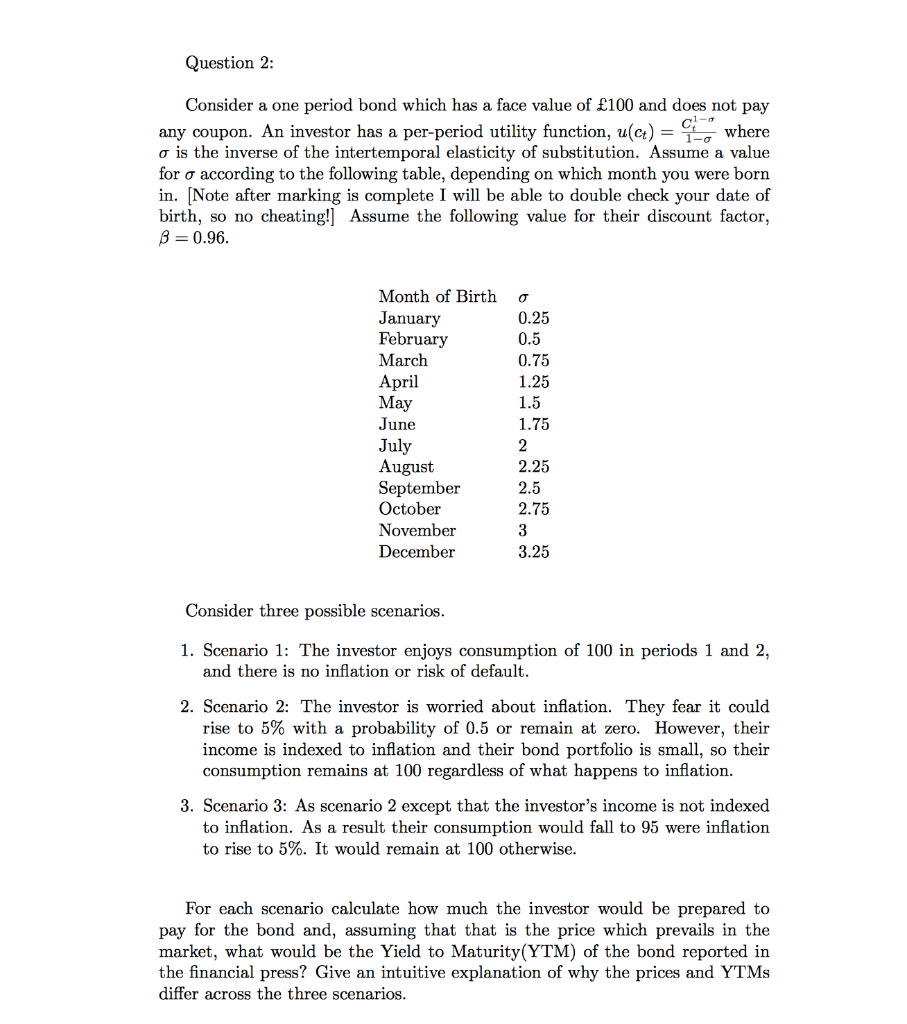

Question 2: Consider a one period bond which has a face value of 100 and does not pay any coupon. An investor has a per-period utility function, u(ct) = SE, where o is the inverse of the intertemporal elasticity of substitution. Assume a value for o according to the following table, depending on which month you were born in. [Note after marking is complete I will be able to double check your date of birth, so no cheating!] Assume the following value for their discount factor, B=0.96. Month of Birth January February March April May June July August September October November December o 0.25 0.5 0.75 1.25 1.5 1.75 2 2.25 2.5 2.75 3 3.25 Consider three possible scenarios. 1. Scenario 1: The investor enjoys consumption of 100 in periods 1 and 2, and there is no inflation or risk of default. 2. Scenario 2: The investor is worried about inflation. They fear it could rise to 5% with a probability of 0.5 or remain at zero. However, their income is indexed to inflation and their bond portfolio is small, so their consumption remains at 100 regardless of what happens to inflation. 3. Scenario 3: As scenario 2 except that the investor's income is not indexed to inflation. As a result their consumption would fall to 95 were inflation to rise to 5%. It would remain at 100 otherwise. For each scenario calculate how much the investor would be prepared to pay for the bond and, assuming that that is the price which prevails in the market, what would be the Yield to Maturity(YTM) of the bond reported in the financial press? Give an intuitive explanation of why the prices and YTMs differ across the three scenarios. Question 2: Consider a one period bond which has a face value of 100 and does not pay any coupon. An investor has a per-period utility function, u(ct) = SE, where o is the inverse of the intertemporal elasticity of substitution. Assume a value for o according to the following table, depending on which month you were born in. [Note after marking is complete I will be able to double check your date of birth, so no cheating!] Assume the following value for their discount factor, B=0.96. Month of Birth January February March April May June July August September October November December o 0.25 0.5 0.75 1.25 1.5 1.75 2 2.25 2.5 2.75 3 3.25 Consider three possible scenarios. 1. Scenario 1: The investor enjoys consumption of 100 in periods 1 and 2, and there is no inflation or risk of default. 2. Scenario 2: The investor is worried about inflation. They fear it could rise to 5% with a probability of 0.5 or remain at zero. However, their income is indexed to inflation and their bond portfolio is small, so their consumption remains at 100 regardless of what happens to inflation. 3. Scenario 3: As scenario 2 except that the investor's income is not indexed to inflation. As a result their consumption would fall to 95 were inflation to rise to 5%. It would remain at 100 otherwise. For each scenario calculate how much the investor would be prepared to pay for the bond and, assuming that that is the price which prevails in the market, what would be the Yield to Maturity(YTM) of the bond reported in the financial press? Give an intuitive explanation of why the prices and YTMs differ across the three scenarios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts