Question: Question 2. Consider a random variable with an exponential distribution X ~ Exp[X] (i.e. it has pdf fx(2) = le-121,>o). (a) For c ER, calculate

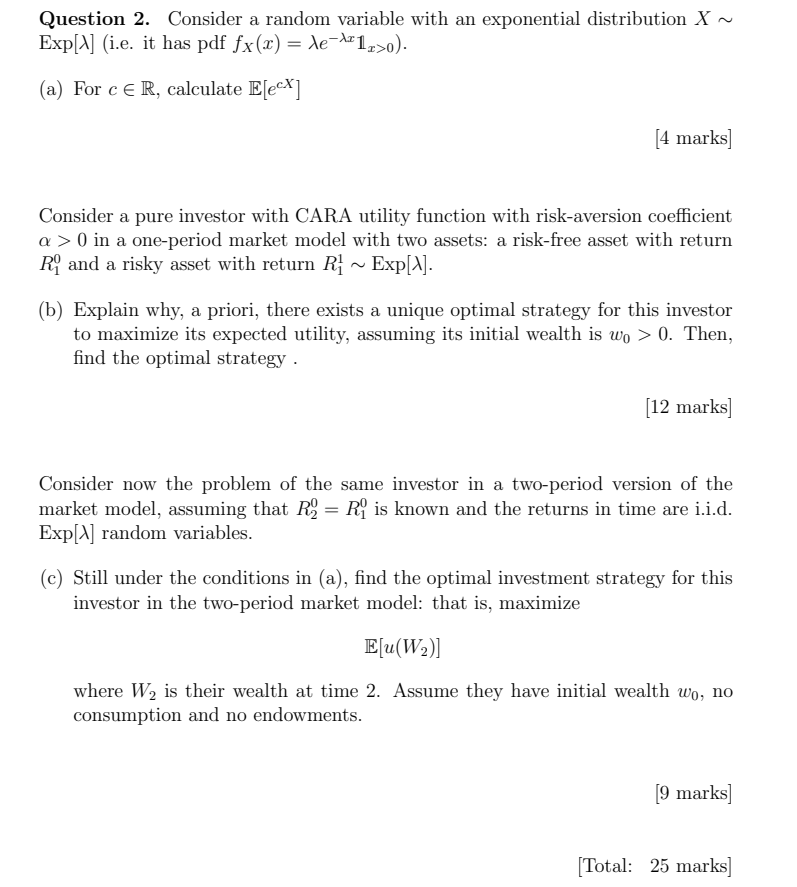

Question 2. Consider a random variable with an exponential distribution X ~ Exp[X] (i.e. it has pdf fx(2) = le-121,>o). (a) For c ER, calculate E[ecX] [4 marks] Consider a pure investor with CARA utility function with risk-aversion coefficient a > 0 in a one-period market model with two assets: a risk-free asset with return R and a risky asset with return R ~ Exp[^]. (b) Explain why, a priori, there exists a unique optimal strategy for this investor to maximize its expected utility, assuming its initial wealth is wo > 0. Then, find the optimal strategy. [12 marks] Consider now the problem of the same investor in a two-period version of the market model, assuming that R9 = R is known and the returns in time are i.i.d. Exp[A] random variables. (C) Still under the conditions in (a), find the optimal investment strategy for this investor in the two-period market model: that is, maximize E[u(W2)] where W2 is their wealth at time 2. Assume they have initial wealth wo, no consumption and no endowments. [9 marks] [Total: 25 marks] Question 2. Consider a random variable with an exponential distribution X ~ Exp[X] (i.e. it has pdf fx(2) = le-121,>o). (a) For c ER, calculate E[ecX] [4 marks] Consider a pure investor with CARA utility function with risk-aversion coefficient a > 0 in a one-period market model with two assets: a risk-free asset with return R and a risky asset with return R ~ Exp[^]. (b) Explain why, a priori, there exists a unique optimal strategy for this investor to maximize its expected utility, assuming its initial wealth is wo > 0. Then, find the optimal strategy. [12 marks] Consider now the problem of the same investor in a two-period version of the market model, assuming that R9 = R is known and the returns in time are i.i.d. Exp[A] random variables. (C) Still under the conditions in (a), find the optimal investment strategy for this investor in the two-period market model: that is, maximize E[u(W2)] where W2 is their wealth at time 2. Assume they have initial wealth wo, no consumption and no endowments. [9 marks] [Total: 25 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts