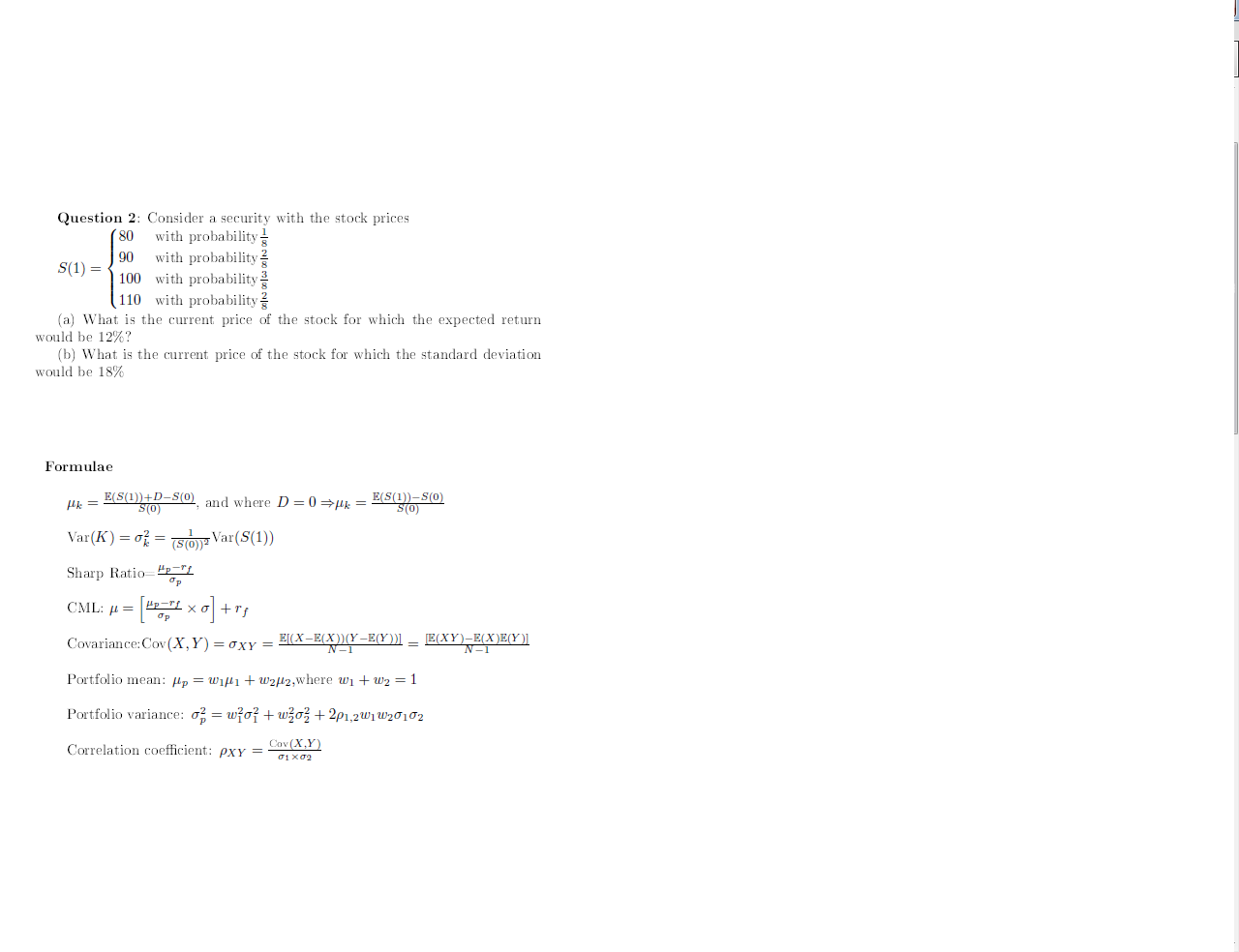

Question: Question 2: Consider a security with the stock prices (80 with probability 90 with probability S(1) = 100 with probability 110 with probability (a) What

Question 2: Consider a security with the stock prices (80 with probability 90 with probability S(1) = 100 with probability 110 with probability (a) What is the current price of the stock for which the expected return would be 12%? (b) What is the current price of the stock for which the standard deviation would be 18% Formulae W = E(S(1))+D-S(O), and where D=0= = 90 Var(K) = 01 = (SO)? Var(S(1)) Sharp Ratio CML: = ["L x O] +r; Covariance:Cov(X,Y)= XY = E(X-E(X)(Y-E(Y))] = E(XY)-E(X)E(Y)] N - 1 Portfolio mean: Hp = wiki + w212,where wi+w2 = 1 Portfolio variance: o2 = wo + wzo3 + 221,2W1 W20102 Correlation coefficient: Pxy = Common

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts