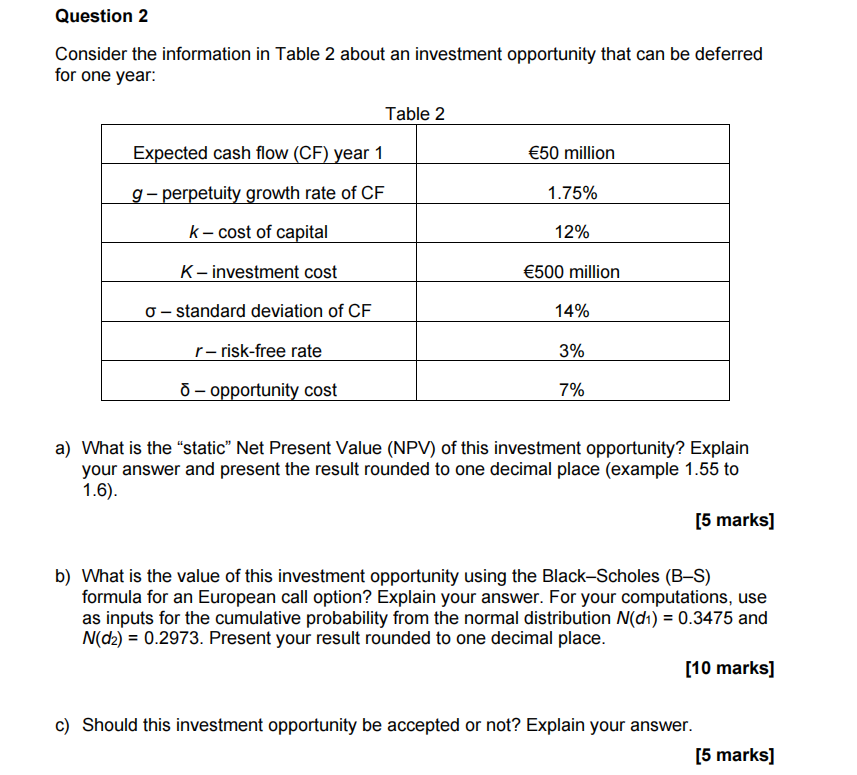

Question: Question 2 Consider the information in Table 2 about an investment opportunity that can be deferred for one year: Table 2 Expected cash flow (CF)

Question 2 Consider the information in Table 2 about an investment opportunity that can be deferred for one year: Table 2 Expected cash flow (CF) year 1 50 million g-perpetuity growth rate of CF 1.75% k-cost of capital 12% K-investment cost 500 million 0 - standard deviation of CF 14% r-risk-free rate 3% o - opportunity cost 7% a) What is the "static" Net Present Value (NPV) of this investment opportunity? Explain your answer and present the result rounded to one decimal place (example 1.55 to 1.6). [5 marks] b) What is the value of this investment opportunity using the Black-Scholes (B-S) formula for an European call option? Explain your answer. For your computations, use as inputs for the cumulative probability from the normal distribution N(di) = 0.3475 and N(dz) = 0.2973. Present your result rounded to one decimal place. [10 marks] C) Should this investment opportunity be accepted or not? Explain your answer. [5 marks] Question 2 Consider the information in Table 2 about an investment opportunity that can be deferred for one year: Table 2 Expected cash flow (CF) year 1 50 million g-perpetuity growth rate of CF 1.75% k-cost of capital 12% K-investment cost 500 million 0 - standard deviation of CF 14% r-risk-free rate 3% o - opportunity cost 7% a) What is the "static" Net Present Value (NPV) of this investment opportunity? Explain your answer and present the result rounded to one decimal place (example 1.55 to 1.6). [5 marks] b) What is the value of this investment opportunity using the Black-Scholes (B-S) formula for an European call option? Explain your answer. For your computations, use as inputs for the cumulative probability from the normal distribution N(di) = 0.3475 and N(dz) = 0.2973. Present your result rounded to one decimal place. [10 marks] C) Should this investment opportunity be accepted or not? Explain your answer. [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts