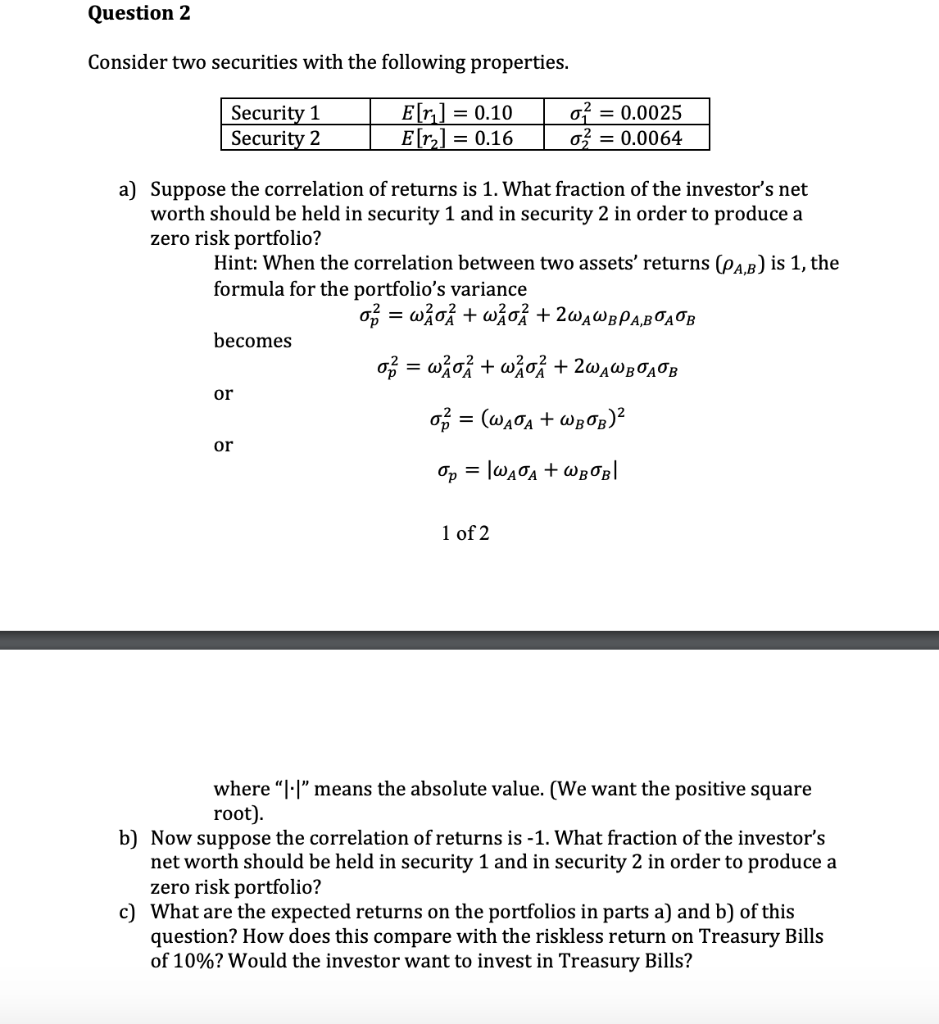

Question: Question 2 Consider two securities with the following properties. Security 1 Security 2 E[r,] = 0.10 E[r2] = 0.16 of= 0.0025 o2 0.0064 a) Suppose

Question 2 Consider two securities with the following properties. Security 1 Security 2 E[r,] = 0.10 E[r2] = 0.16 of= 0.0025 o2 0.0064 a) Suppose the correlation of returns is 1. What fraction of the investor's net worth should be held in security 1 and in security 2 in order to produce a zero risk portfolio? Hint: When the correlation between two assets' returns (pAB) is 1, the formula for the portfolio's variance 3 %3 + + 200 becomes + + or ( + w)? or p = 1 of 2 where "" means the absolute value. (We want the positive square root) b) Now suppose the correlation of returns is -1. What fraction of the investor's net worth should be held in security 1 and in security 2 in order to produce a zero risk portfolio? c) What are the expected returns on the portfolios in parts a) and b) of this question? How does this compare with the riskless return on Treasury Bills of 10%? Would the investor want to invest in Treasury Bills

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts