Question: Question 2 (cont') Additional Information: A. As at 1 April 2018, the tax written down values of the company's plant and machinery under the Pooling

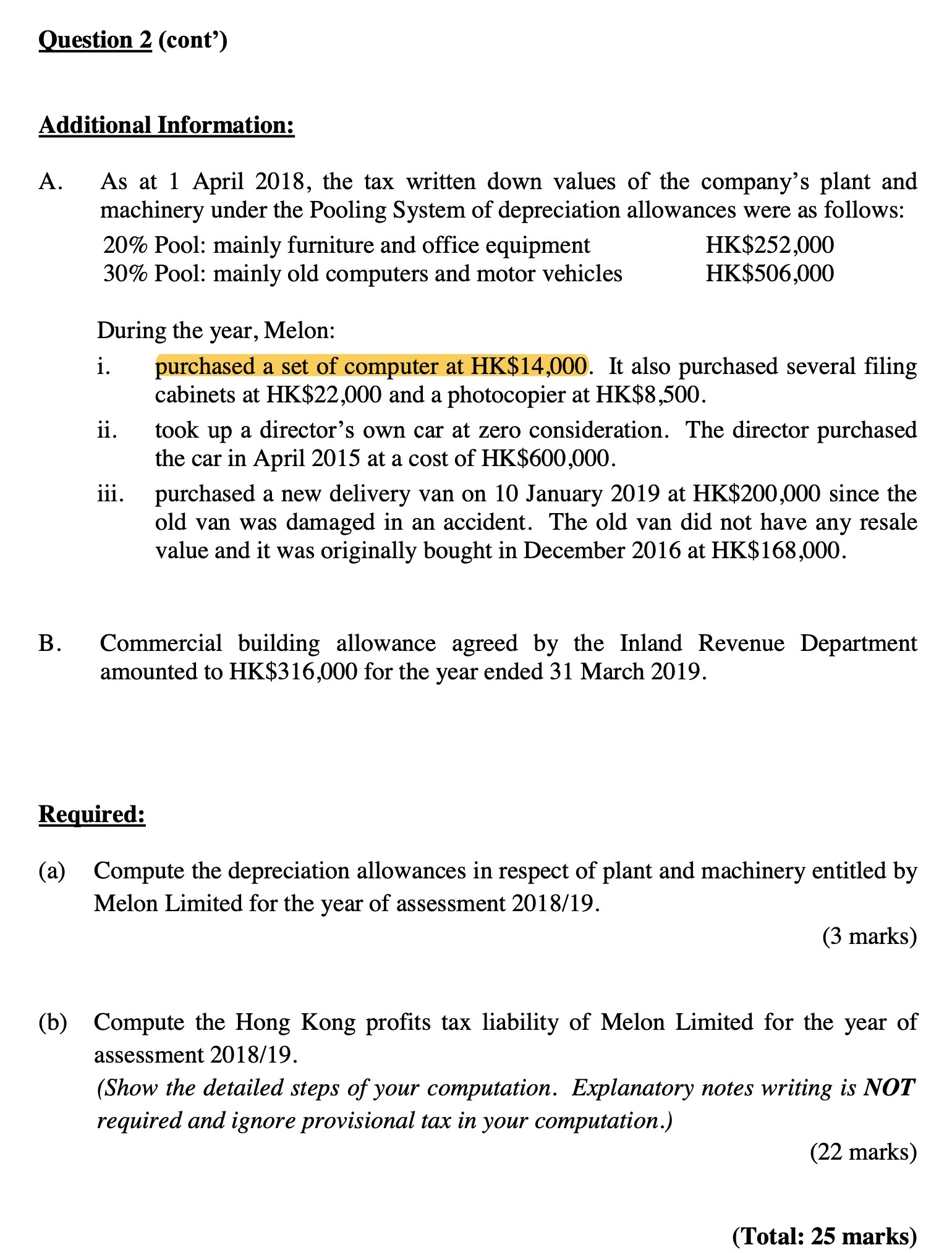

Question 2 (cont') Additional Information: A. As at 1 April 2018, the tax written down values of the company's plant and machinery under the Pooling System of depreciation allowances were as follows: 20% Pool: mainly furniture and office equipment HK$252,000 30% Pool: mainly old computers and motor vehicles HK$506,000 During the year, Melon: 1. purchased a set of computer at I-IK$14,000. It also purchased several ling cabinets at HK$22,000 and a photocopier at HK$8,500. ii. took up a director's own car at zero consideration. The director purchased the car in April 2015 at a cost of HK$600,000. iii. purchased a new delivery van on 10 January 2019 at HK$200,000 since the old van was damaged in an accident. The old van did not have any resale value and it was originally bought in December 2016 at HK$168,000. B. Commercial building allowance agreed by the Inland Revenue Department amounted to HK$316,000 for the year ended 31 March 2019. Re uired: (a) Compute the depreciation allowances in respect of plant and machinery entitled by Melon Limited for the year of assessment 201 8/ 19. (3 marks) (b) Compute the Hong Kong prots tax liability of Melon Limited for the year of assessment 2018/19. (Show the detailed steps of your computation. Explanatory notes writing is NOT required and ignore provisional tax in your computation.) (22 marks) (Total: 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts