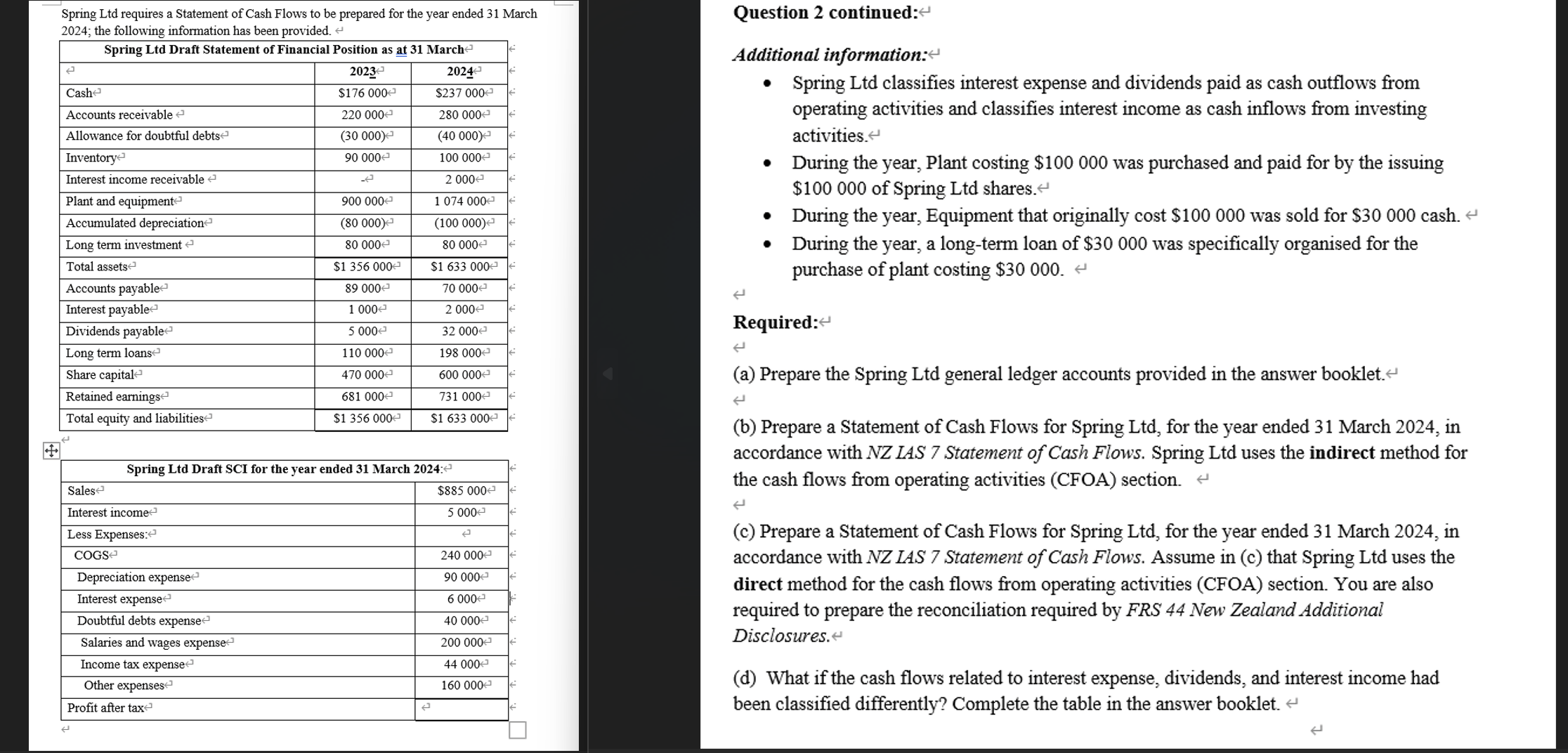

Question: Question 2 continued: Additional information: Spring Ltd classifies interest expense and dividends paid as cash outflows from operating activities and classifies interest income as cash

Question continued:

Additional information:

Spring Ltd classifies interest expense and dividends paid as cash outflows from

operating activities and classifies interest income as cash inflows from investing

activities.

During the year, Plant costing $ was purchased and paid for by the issuing

$ of Spring Ltd shares.

During the year, Equipment that originally cost $ was sold for $ cash.

During the year, a longterm loan of $ was specifically organised for the

purchase of plant costing $

Required:

a Prepare the Spring Ltd general ledger accounts provided in the answer booklet.

b Prepare a Statement of Cash Flows for Spring Ltd for the year ended March in

accordance with NZ LAS Statement of Cash Flows. Spring Ltd uses the indirect method for

the cash flows from operating activities CFOA section.

c Prepare a Statement of Cash Flows for Spring Ltd for the year ended March in

accordance with NZ LAS Statement of Cash Flows. Assume in c that Spring Ltd uses the

direct method for the cash flows from operating activities CFOA section. You are also

required to prepare the reconciliation required by FRS New Zealand Additional

Disclosures.

d What if the cash flows related to interest expense, dividends, and interest income had

been classified differently? Complete the table in the answer booklet.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock