Question: QUESTION 2. (Continued) II. You are a trader for StableFolio Ltd. One of your portfolios is long 100 calls on a futures contract with strike

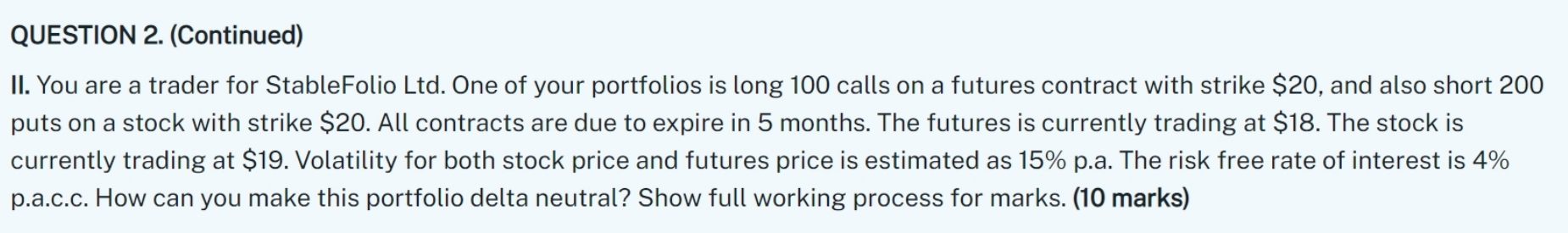

QUESTION 2. (Continued) II. You are a trader for StableFolio Ltd. One of your portfolios is long 100 calls on a futures contract with strike \$20, and also short 200 puts on a stock with strike $20. All contracts are due to expire in 5 months. The futures is currently trading at $18. The stock is currently trading at $19. Volatility for both stock price and futures price is estimated as 15% p.a. The risk free rate of interest is 4% p.a.c.c. How can you make this portfolio delta neutral? Show full working process for marks. (10 marks) QUESTION 2. (Continued) II. You are a trader for StableFolio Ltd. One of your portfolios is long 100 calls on a futures contract with strike \$20, and also short 200 puts on a stock with strike $20. All contracts are due to expire in 5 months. The futures is currently trading at $18. The stock is currently trading at $19. Volatility for both stock price and futures price is estimated as 15% p.a. The risk free rate of interest is 4% p.a.c.c. How can you make this portfolio delta neutral? Show full working process for marks. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts