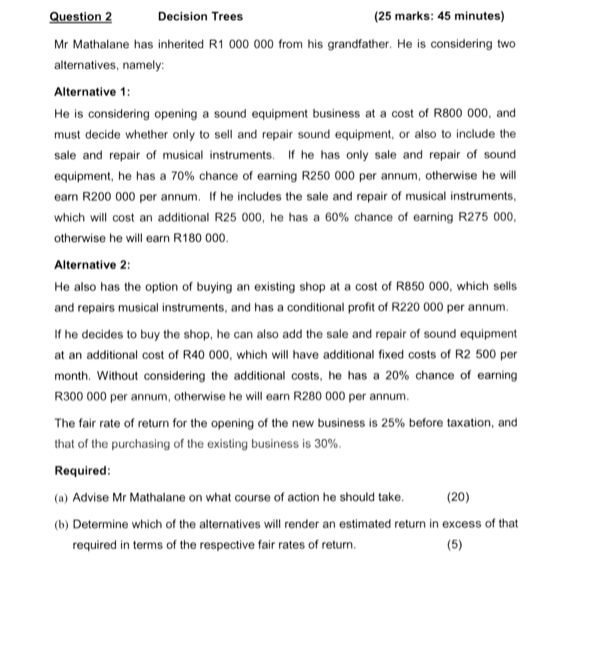

Question: Question 2 Decision Trees ( 2 5 marks: 4 5 minutes ) Mr Mathalane has inherited R 1 0 0 0 0 0 0 from

Question

Decision Trees

marks: minutes

Mr Mathalane has inherited R from his grandfather. He is considering two

alternatives, namely:

Alternative :

is considering opening a sound equipment business at a cost of R and

must decide whether only to sell and repair sound equipment, or also to include the

sale and repair of musical instruments. If he has only sale and repair of sound

equipment, he has a chance of earning R per annum, otherwise he will

earn R per annum. If he includes the sale and repair of musical instruments,

which will cost an additional R he has a chance of earning R

otherwise he will earn R

Alternative :

He also has the option of buying an existing shop at a cost of R which sells

and repairs musical instruments, and has a conditional profit of R per annum.

If he decides to buy the shop, he can also add the sale and repair of sound equipment

at an additional cost of R which will have additional fixed costs of R per

month. Without considering the additional costs, he has a chance of earning

R per annum, otherwise he will earn R per annum.

The fair rate of return for the opening of the new business is before taxation, and

that of the purchasing of the existing business is

Required:

a Advise Mr Mathalane on what course of action he should take.

b Determine which of the alternatives will render an estimated return in excess of that

required in terms of the respective fair rates of return.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock