Question: Question 2: Define the various asset classes in the diagram. Be as thorough as possible in explaining the features of each security. Explain in detail

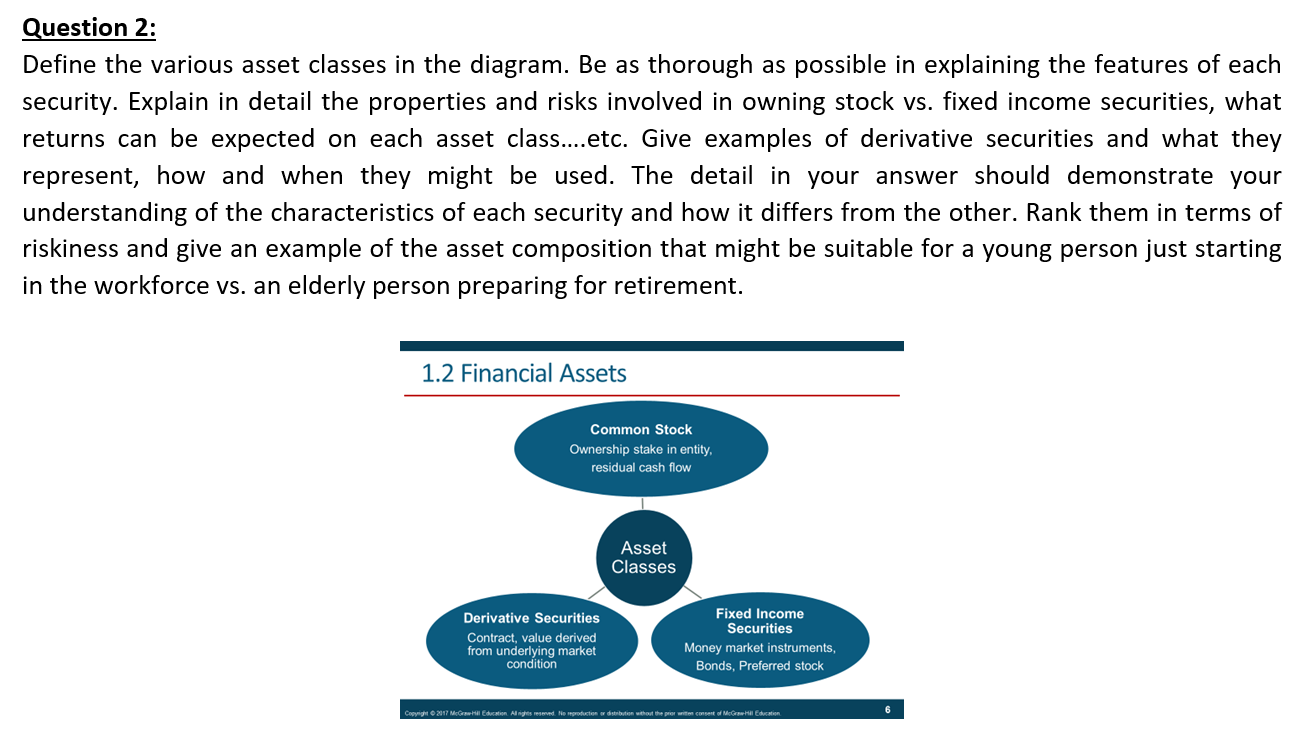

Question 2: Define the various asset classes in the diagram. Be as thorough as possible in explaining the features of each security. Explain in detail the properties and risks involved in owning stock vs. fixed income securities, what returns can be expected on each asset class....etc. Give examples of derivative securities and what they represent, how and when they might be used. The detail in your answer should demonstrate your understanding of the characteristics of each security and how it differs from the other. Rank them in terms of riskiness and give an example of the asset composition that might be suitable for a young person just starting in the workforce vs. an elderly person preparing for retirement. 1.2 Financial Assets Common Stock Ownership stake in entity, residual cash flow Asset Classes Derivative Securities Contract, value derived from underlying market condition Fixed Income Securities Money market instruments, Bonds, Preferred stock Copyright 2017 McGraw-Hill Education Alrights reserved. No reproducten ditution without the prior written consent of MeGall Education Question 2: Define the various asset classes in the diagram. Be as thorough as possible in explaining the features of each security. Explain in detail the properties and risks involved in owning stock vs. fixed income securities, what returns can be expected on each asset class....etc. Give examples of derivative securities and what they represent, how and when they might be used. The detail in your answer should demonstrate your understanding of the characteristics of each security and how it differs from the other. Rank them in terms of riskiness and give an example of the asset composition that might be suitable for a young person just starting in the workforce vs. an elderly person preparing for retirement. 1.2 Financial Assets Common Stock Ownership stake in entity, residual cash flow Asset Classes Derivative Securities Contract, value derived from underlying market condition Fixed Income Securities Money market instruments, Bonds, Preferred stock Copyright 2017 McGraw-Hill Education Alrights reserved. No reproducten ditution without the prior written consent of MeGall Education

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts