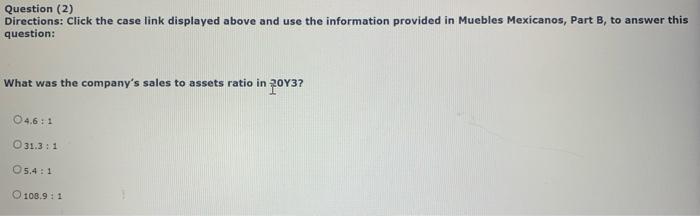

Question: Question (2) Directions: Click the case link displayed above and use the information provided in Muebles Mexicanos, Part B, to answer this question: What was

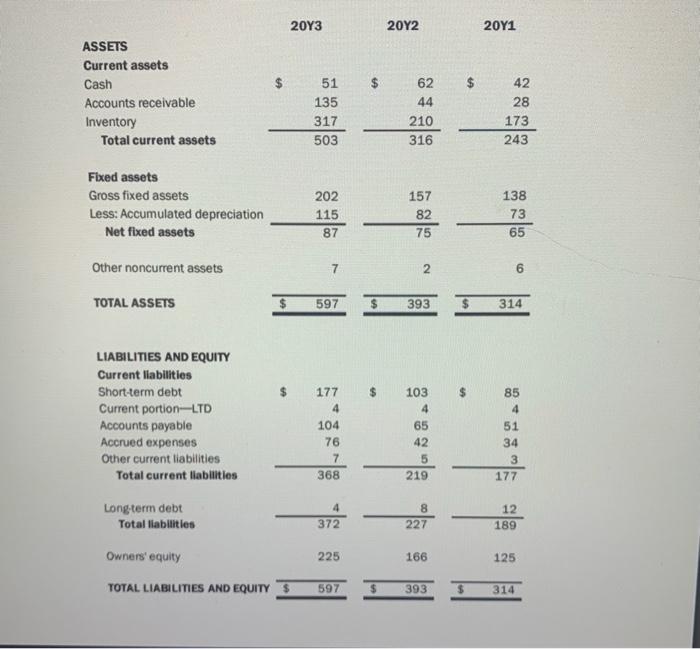

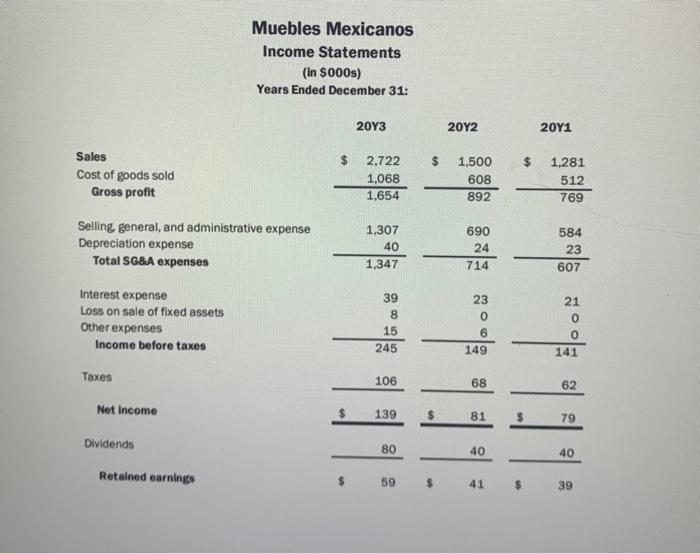

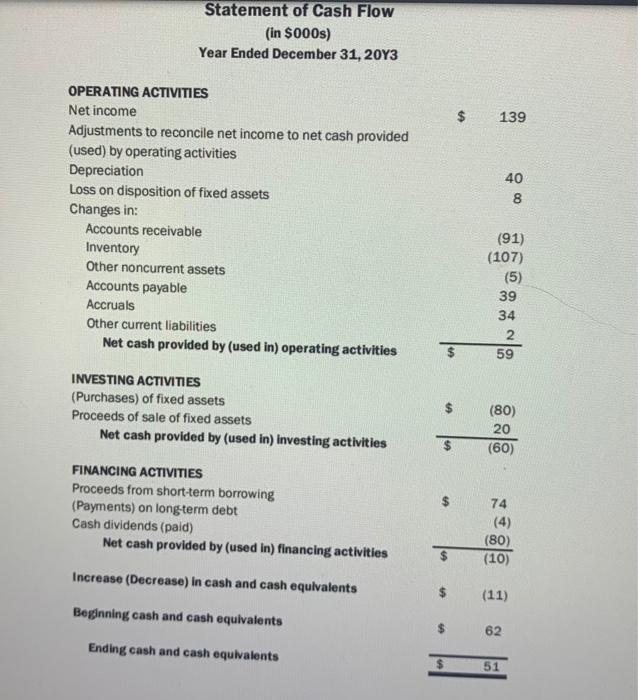

Question (2) Directions: Click the case link displayed above and use the information provided in Muebles Mexicanos, Part B, to answer this question: What was the company's sales to assets ratio in 2013? O4.6:1 31.3:1 5.4:1 108.9:1 20Y3 20Y2 20Y1 $ 42 ASSETS Current assets Cash Accounts receivable Inventory Total current assets 51 135 317 503 62 44 210 316 28 173 243 Fixed assets Gross fixed assets Less: Accumulated depreciation Net fixed assets 202 115 87 157 82 75 138 73 65 Other noncurrent assets 7 2 6 TOTAL ASSETS $ 597 $ 393 $ 314 $ 85 4 LIABILITIES AND EQUITY Current liabilities Short-term debt Current portion--LTD Accounts payable Accrued expenses Other current liabilities Total current liabilities 51 177 4 104 76 7 368 103 4 65 42 5 219 34 3 177 Long term debt Total liabilities 4 372 8 227 12 189 Owners' equity 225 166 125 TOTAL LIABILITIES AND EQUITY 597 393 $ 314 Muebles Mexicanos Income Statements (in $000s) Years Ended December 31: 20Y3 20Y2 2011 $ $ $ Sales Cost of goods sold Gross profit 2,722 1,068 1,654 1,500 608 1.281 512 769 892 Selling general, and administrative expense Depreciation expense Total SG&A expenses 1,307 40 1,347 690 24 714 584 23 607 Interest expense Loss on sale of fixed assets Other expenses Income before taxes 39 8 15 245 23 0 6 149 21 0 0 141 ****** *111: **** 111: Taxes 106 68 62 Net Income 139 81 $ 79 Dividends 80 40 40 Retained earnings 59 $ 41 39 Statement of Cash Flow (in $000s) Year Ended December 31, 20Y3 $ 139 40 8 OPERATING ACTIVITIES Net income Adjustments to reconcile net income to net cash provided (used) by operating activities Depreciation Loss on disposition of fixed assets Changes in: Accounts receivable Inventory Other noncurrent assets Accounts payable Accruals Other current liabilities Net cash provided by (used in) operating activities (91) (107) (5) 39 34 2 $ 59 INVESTING ACTIVITIES (Purchases) of fixed assets Proceeds of sale of fixed assets Net cash provided by (used in) investing activities (80) 20 (60) $ FINANCING ACTIVITIES Proceeds from short-term borrowing (Payments) on long-term debt Cash dividends (paid) Net cash provided by (used in) financing activities 74 (4) (80) (10) Increase (Decrease) in cash and cash equivalents $ (11) Beginning cash and cash equivalents 62 Ending cash and cash equivalents $ 51

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts