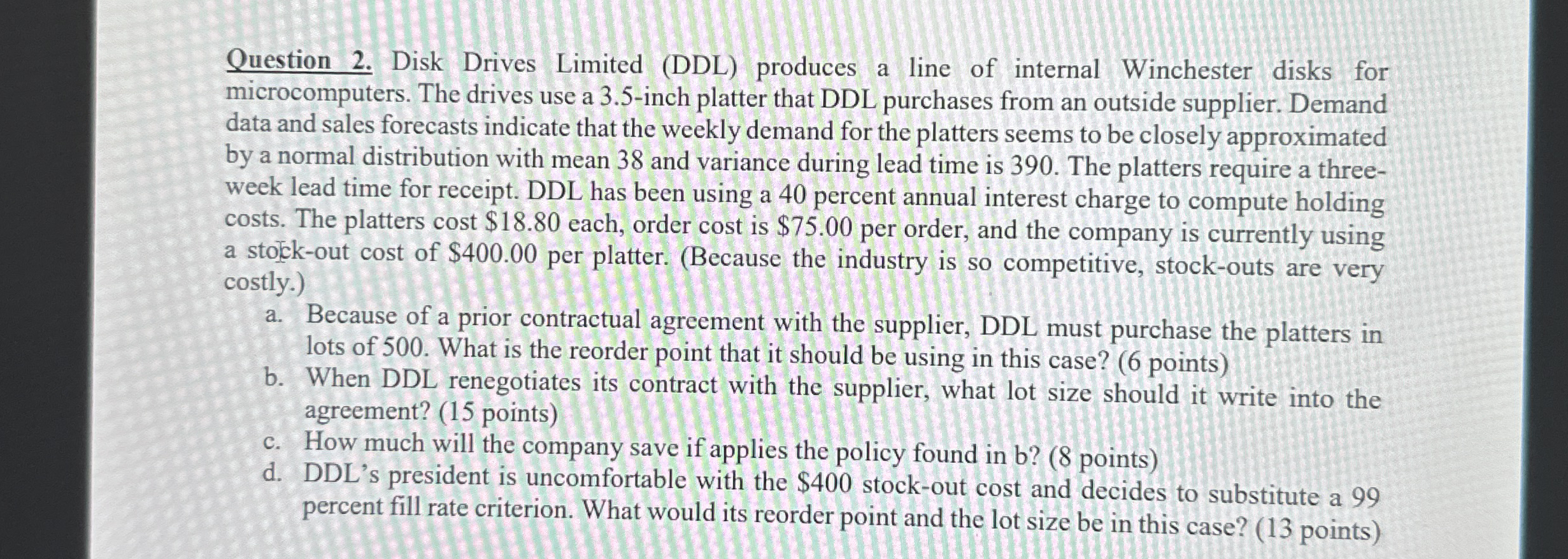

Question: Question 2 . Disk Drives Limited ( DDL ) produces a line of internal Winchester disks for microcomputers. The drives use a 3 . 5

Question Disk Drives Limited DDL produces a line of internal Winchester disks for microcomputers. The drives use a inch platter that DDL purchases from an outside supplier. Demand data and sales forecasts indicate that the weekly demand for the platters seems to be closely approximated by a normal distribution with mean and variance during lead time is The platters require a threeweek lead time for receipt. DDL has been using a percent annual interest charge to compute holding costs. The platters cost $ each, order cost is $ per order, and the company is currently using a stockout cost of $ per platter. Because the industry is so competitive, stockouts are very costly

a Because of a prior contractual agreement with the supplier, DDL must purchase the platters in lots of What is the reorder point that it should be using in this case? points

b When DDL renegotiates its contract with the supplier, what lot size should it write into the agreement? points

c How much will the company save if applies the policy found in b points

d DDLs president is uncomfortable with the $ stockout cost and decides to substitute a percent fill rate criterion. What would its reorder point and the lot size be in this case? points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock