Question: QUESTION 2: EAGLE LTD (CHAPTER 4- FULL COSTING) - 4 marks You have been asked to suggest a method of deducing the full cost of

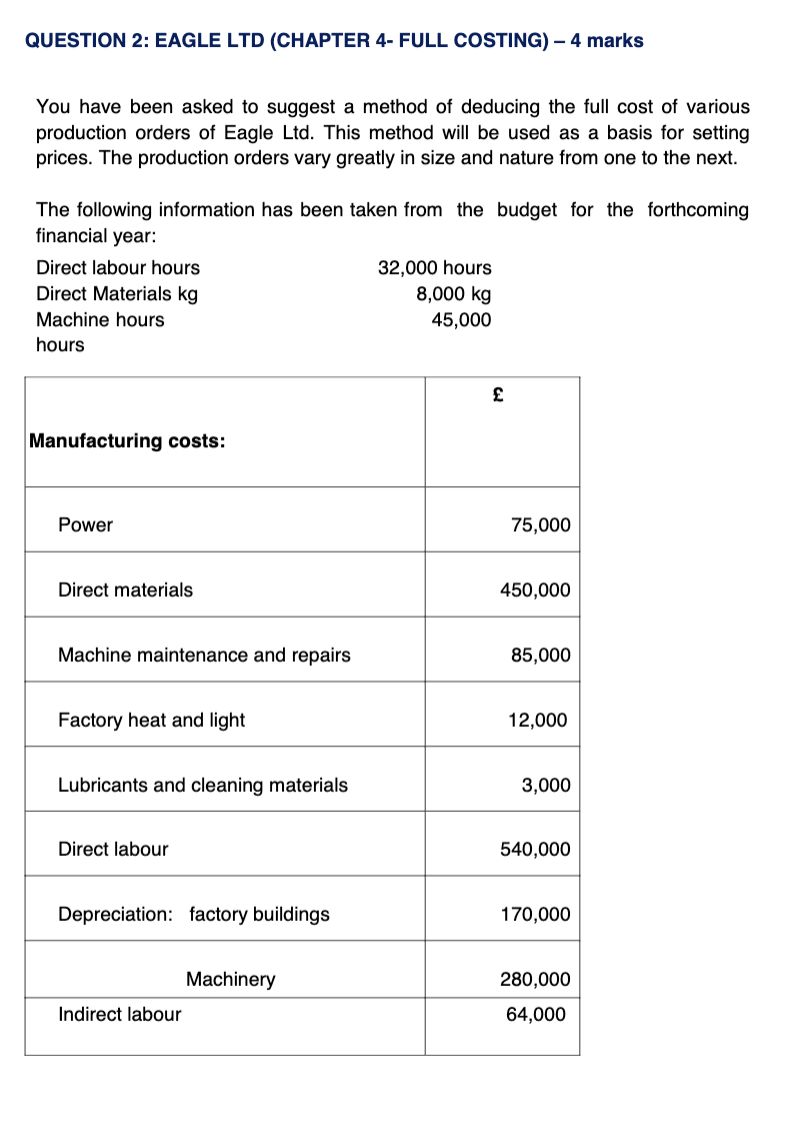

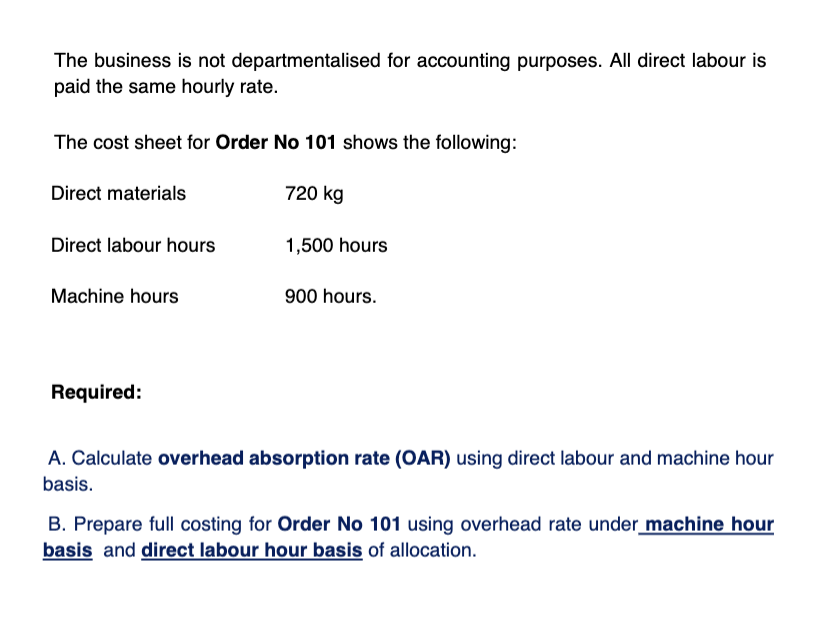

QUESTION 2: EAGLE LTD (CHAPTER 4- FULL COSTING) - 4 marks You have been asked to suggest a method of deducing the full cost of various production orders of Eagle Ltd. This method will be used as a basis for setting prices. The production orders vary greatly in size and nature from one to the next. The following information has been taken from the budget for the forthcoming financial year: Direct labour hours 32,000 hours Direct Materials kg 8,000 kg Machine hours 45,000 hours Manufacturing costs: Power 75,000 Direct materials 450,000 Machine maintenance and repairs 85,000 Factory heat and light 12,000 Lubricants and cleaning materials 3,000 Direct labour 540,000 Depreciation: factory buildings 170,000 Machinery Indirect labour 280,000 64,000 The business is not departmentalised for accounting purposes. All direct labour is paid the same hourly rate. The cost sheet for Order No 101 shows the following: Direct materials 720 kg Direct labour hours 1,500 hours Machine hours 900 hours. Required: A. Calculate overhead absorption rate (OAR) using direct labour and machine hour basis. B. Prepare full costing for Order No 101 using overhead rate under machine hour basis and direct labour hour basis of allocation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts