Question: QUESTION 2 Emacs Co. issued 19-year, $1,000 face value bonds one year ago at a coupon rate of 6.9 percent. The bonds make semiannual payments.

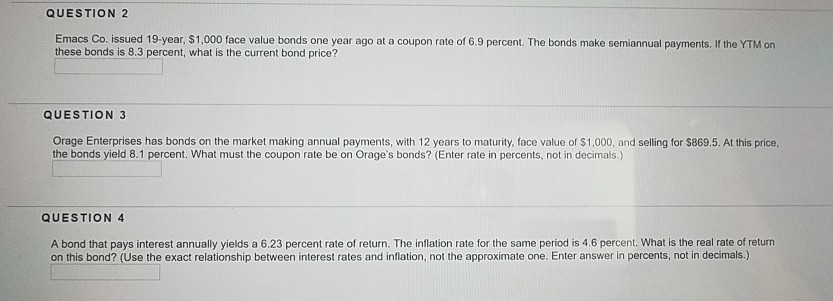

QUESTION 2 Emacs Co. issued 19-year, $1,000 face value bonds one year ago at a coupon rate of 6.9 percent. The bonds make semiannual payments. If the YTM on these bonds is 8.3 percent, what is the current bond price? QUESTION 3 Orage Enterprises has bonds on the market making annual payments, with 12 years to maturity, face value of $1,000, and selling for $869.5. At this price, the bonds yield 8.1 percent. What must the coupon rate be on Orage's bonds? (Enter rate in percents, not in decimals.) QUESTION 4 A bond that pays interest annually yields a 6.23 percent rate of return. The inflation rate for the same period is 4.6 percent. What is the real rate of return on this bond? (Use the exact relationship between interest rates and inflation, not the approximate one. Enter answer in percents, not in decimals.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts