Question: Question 2 Eric operates his own computer repair business called Tech-Wizard Eric. You may ignore GST in this question. Eric uses the cash basis for

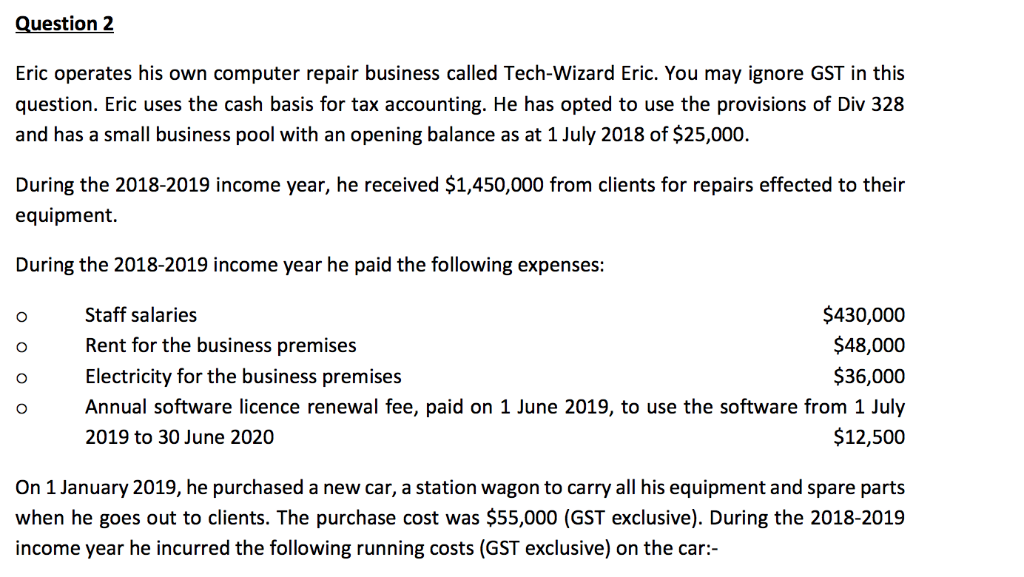

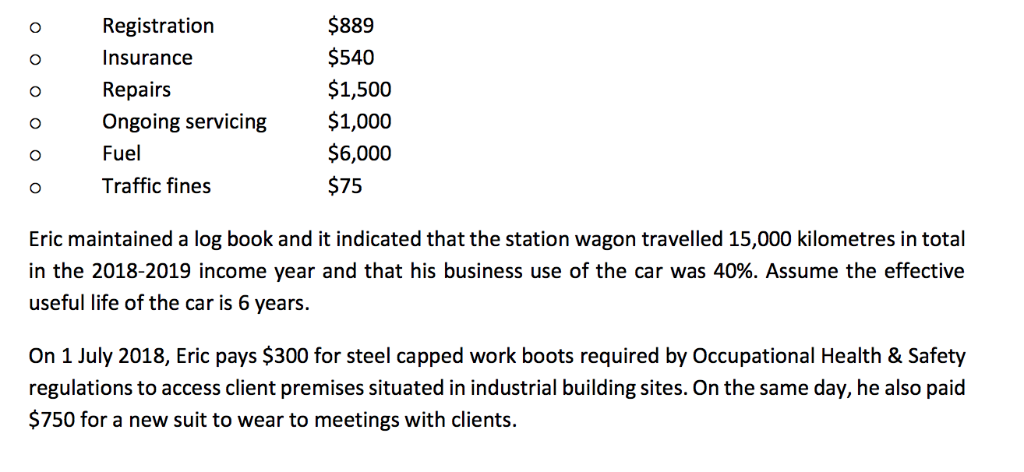

Question 2 Eric operates his own computer repair business called Tech-Wizard Eric. You may ignore GST in this question. Eric uses the cash basis for tax accounting. He has opted to use the provisions of Div 328 and has a small business pool with an opening balance as at 1 July 2018 of $25,000. During the 2018-2019 income year, he received $1,450,000 from clients for repairs effected to their equipment During the 2018-2019 income year he paid the following expenses: o Staff salaries o Rent for the business premises $430,000 $48,000 $36,000 o Electricity for the business premises C3 o Annual software licence renewal fee, paid on 1 June 2019, to use the software from 1 July 2019 to 30 June 2020 $12,500 On 1 January 2019, he purchased a new car, a station wagon to carry all his equipment and spare parts when he goes out to clients. The purchase cost was $55,000 (GST exclusive). During the 2018-2019 income year he incurred the following running costs (GST exclusive) on the car: $889 $540 $1,500 Registration o Insurance o Repairs o Ongoing servicing $1,000 o Fuel o Traffic fines $6,000 $75 Eric maintained a log book and it indicated that the station wagon travelled 15,000 kilometres in total in the 2018-2019 income year and that his business use of the car was 40%. Assume the effective useful life of the car is 6 years. On 1 July 2018, Eric pays $300 for steel capped work boots required by Occupational Health & Safety regulations to access client premises situated in industrial building sites. On the same day, he also paid $750 for a new suit to wear to meetings with clients. Eric also owns a residential rental property which he purchased in 2007. At the time, a quantity surveyor provided him with a report for tax purposes that indicated the construction cost of the property totalled $750,000. During the current income year, he rented the property for 50 weeks at a rent of $450 per week. Hie used a property management agent to manage the property. The property management agent's fee was 2.5% of rent collected. During the income year, Eric paid the following expenses related to the rental property: o o o o o o o Cleaning expenses, $1,000 Interest on the mortgage loan that financed the purchase of the property, $28,000 Pest control, $800 Landlord's insurance, $900 A new portable fire extinguisher, $275 Land taxes and council rates, $2,000 Electricity, $1,900. Eric visited the property three times during this income year using another of his own personal cars. He kept detailed records of these trips, and, based on the cents per kilometre method, the costs associated with these trips total $198 During the income year, the stove in the property malfunctioned, and Eric had to replace it. He purchased a new stove for $2,000 on 1 February 2019, but rather than place this in the property, he used it to replace his personal stove, that he originally acquired on 1 July 2016 for $1,000 and used in his residence from that date. He instead placed his old stove in the new apartment. You are required to: Calculate Eric's taxable income for the 2018-2019 income year. Show all your calculations and provide reasons for your answers, referencing relevant sections of the Income Tax Assessment Act, relevant case law and relevant ATO documents. All amounts shown in this question excludes GST where appropriate. Question 2 Eric operates his own computer repair business called Tech-Wizard Eric. You may ignore GST in this question. Eric uses the cash basis for tax accounting. He has opted to use the provisions of Div 328 and has a small business pool with an opening balance as at 1 July 2018 of $25,000. During the 2018-2019 income year, he received $1,450,000 from clients for repairs effected to their equipment During the 2018-2019 income year he paid the following expenses: o Staff salaries o Rent for the business premises $430,000 $48,000 $36,000 o Electricity for the business premises C3 o Annual software licence renewal fee, paid on 1 June 2019, to use the software from 1 July 2019 to 30 June 2020 $12,500 On 1 January 2019, he purchased a new car, a station wagon to carry all his equipment and spare parts when he goes out to clients. The purchase cost was $55,000 (GST exclusive). During the 2018-2019 income year he incurred the following running costs (GST exclusive) on the car: $889 $540 $1,500 Registration o Insurance o Repairs o Ongoing servicing $1,000 o Fuel o Traffic fines $6,000 $75 Eric maintained a log book and it indicated that the station wagon travelled 15,000 kilometres in total in the 2018-2019 income year and that his business use of the car was 40%. Assume the effective useful life of the car is 6 years. On 1 July 2018, Eric pays $300 for steel capped work boots required by Occupational Health & Safety regulations to access client premises situated in industrial building sites. On the same day, he also paid $750 for a new suit to wear to meetings with clients. Eric also owns a residential rental property which he purchased in 2007. At the time, a quantity surveyor provided him with a report for tax purposes that indicated the construction cost of the property totalled $750,000. During the current income year, he rented the property for 50 weeks at a rent of $450 per week. Hie used a property management agent to manage the property. The property management agent's fee was 2.5% of rent collected. During the income year, Eric paid the following expenses related to the rental property: o o o o o o o Cleaning expenses, $1,000 Interest on the mortgage loan that financed the purchase of the property, $28,000 Pest control, $800 Landlord's insurance, $900 A new portable fire extinguisher, $275 Land taxes and council rates, $2,000 Electricity, $1,900. Eric visited the property three times during this income year using another of his own personal cars. He kept detailed records of these trips, and, based on the cents per kilometre method, the costs associated with these trips total $198 During the income year, the stove in the property malfunctioned, and Eric had to replace it. He purchased a new stove for $2,000 on 1 February 2019, but rather than place this in the property, he used it to replace his personal stove, that he originally acquired on 1 July 2016 for $1,000 and used in his residence from that date. He instead placed his old stove in the new apartment. You are required to: Calculate Eric's taxable income for the 2018-2019 income year. Show all your calculations and provide reasons for your answers, referencing relevant sections of the Income Tax Assessment Act, relevant case law and relevant ATO documents. All amounts shown in this question excludes GST where appropriate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts