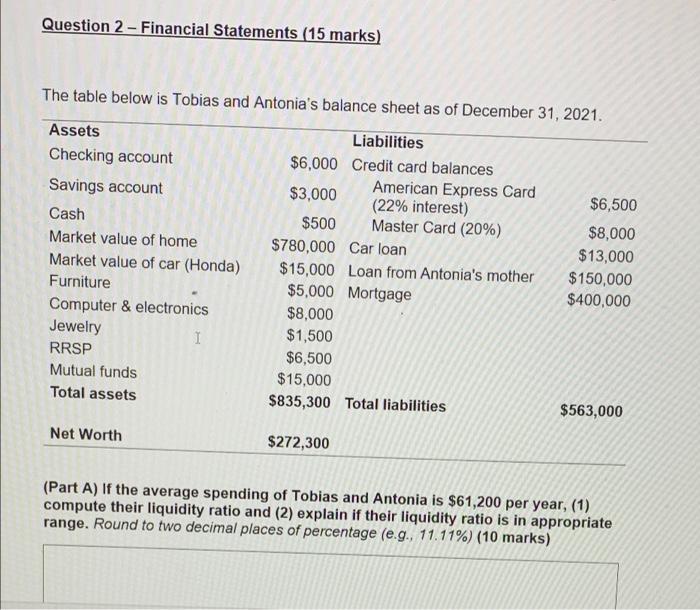

Question: Question 2 - Financial Statements (15 marks) The table below is Tobias and Antonia's balance sheet as of December 31, 2021. $6,500 Assets Checking account

Question 2 - Financial Statements (15 marks) The table below is Tobias and Antonia's balance sheet as of December 31, 2021. $6,500 Assets Checking account Savings account Cash Market value of home Market value of car (Honda) Furniture Computer & electronics Jewelry 1 RRSP Mutual funds Total assets Liabilities $6,000 Credit card balances $3,000 American Express Card (22% interest) $500 Master Card (20%) $780,000 Car loan $15,000 Loan from Antonia's mother $5,000 Mortgage $8,000 $1,500 $6,500 $15,000 $835,300 Total liabilities $8,000 $13,000 $150,000 $400,000 $563,000 Net Worth $272,300 (Part A) If the average spending of Tobias and Antonia is $61,200 per year, (1) compute their liquidity ratio and (2) explain if their liquidity ratio is in appropriate range. Round to two decimal places of percentage (e.g. 11.11%) (10 marks) (Part A) If the average spending of Tobias and Antonia is $61,200 per year, (1) compute their liquidity ratio and (2) explain if their liquidity ratio is in appropriate range. Round to two decimal places of percentage (e.g., 11.11%) (10 marks) (Part B) How much interest could be saved annually if Tobias and Antonia can convert credit card debt to investment loan? They can get investment loan at 6% interest. (5 marks) Question 2 - Financial Statements (15 marks) The table below is Tobias and Antonia's balance sheet as of December 31, 2021. $6,500 Assets Checking account Savings account Cash Market value of home Market value of car (Honda) Furniture Computer & electronics Jewelry 1 RRSP Mutual funds Total assets Liabilities $6,000 Credit card balances $3,000 American Express Card (22% interest) $500 Master Card (20%) $780,000 Car loan $15,000 Loan from Antonia's mother $5,000 Mortgage $8,000 $1,500 $6,500 $15,000 $835,300 Total liabilities $8,000 $13,000 $150,000 $400,000 $563,000 Net Worth $272,300 (Part A) If the average spending of Tobias and Antonia is $61,200 per year, (1) compute their liquidity ratio and (2) explain if their liquidity ratio is in appropriate range. Round to two decimal places of percentage (e.g. 11.11%) (10 marks) (Part A) If the average spending of Tobias and Antonia is $61,200 per year, (1) compute their liquidity ratio and (2) explain if their liquidity ratio is in appropriate range. Round to two decimal places of percentage (e.g., 11.11%) (10 marks) (Part B) How much interest could be saved annually if Tobias and Antonia can convert credit card debt to investment loan? They can get investment loan at 6% interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts