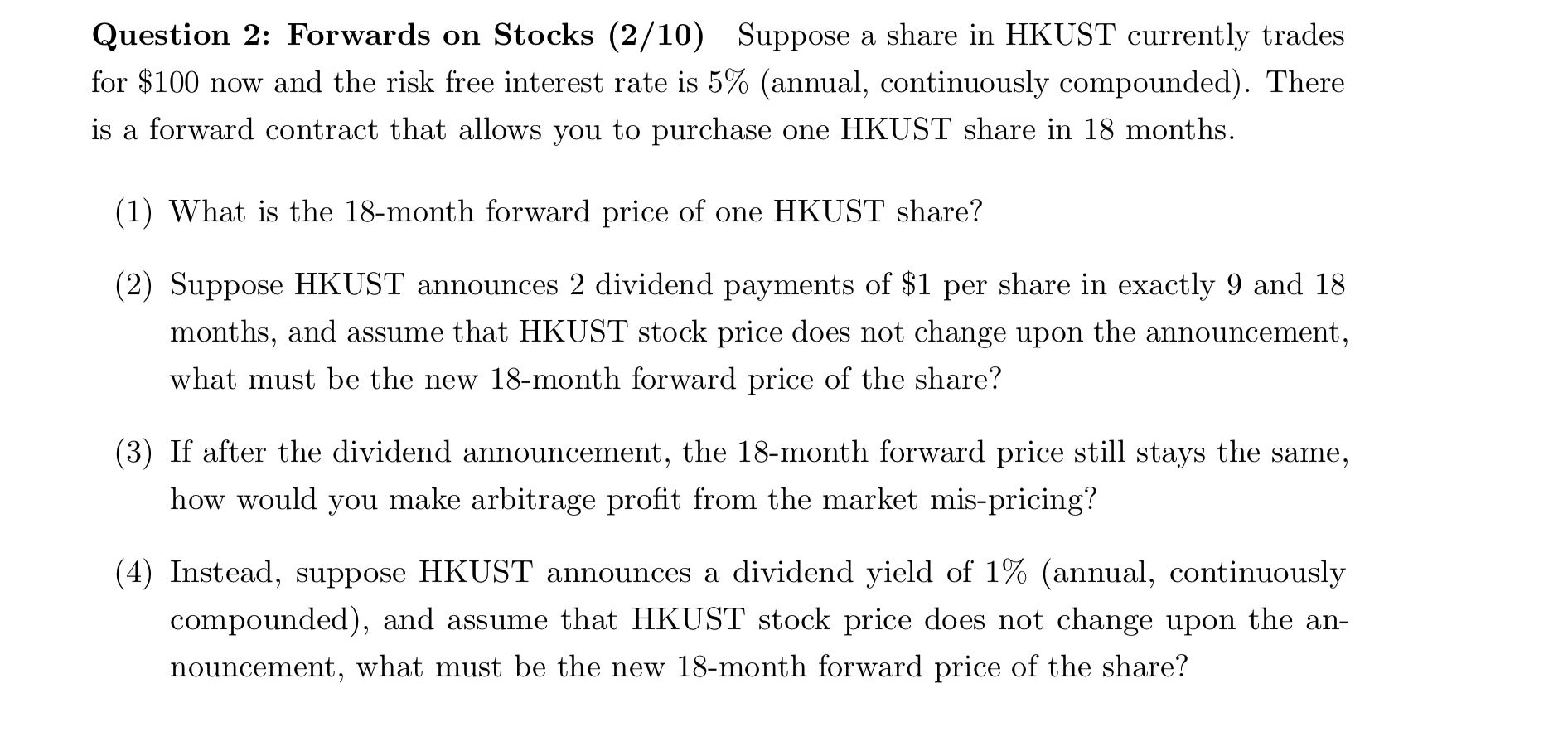

Question: Question 2 : Forwards on Stocks ( 2 / 1 0 ) Suppose a share in HKUST currently trades for $ 1 0 0 now

Question : Forwards on Stocks Suppose a share in HKUST currently trades for $ now and the risk free interest rate is annual continuously compounded There is a forward contract that allows you to purchase one HKUST share in months.

What is the month forward price of one HKUST share?

Suppose HKUST announces dividend payments of $ per share in exactly and months, and assume that HKUST stock price does not change upon the announcement, what must be the new month forward price of the share?

If after the dividend announcement, the month forward price still stays the same, how would you make arbitrage profit from the market mispricing?

Instead, suppose HKUST announces a dividend yield of annual continuously compounded and assume that HKUST stock price does not change upon the announcement, what must be the new month forward price of the share?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock