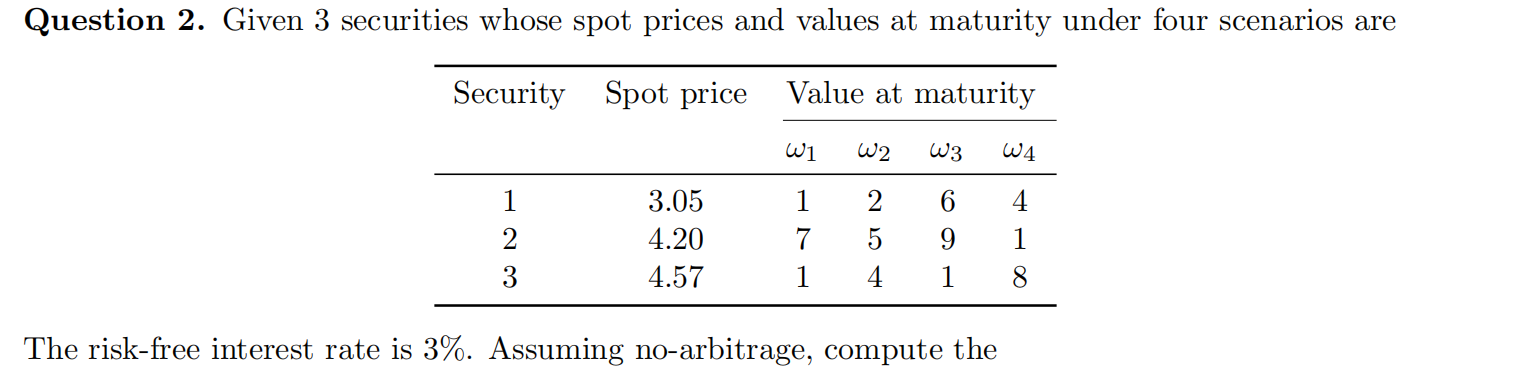

Question: Question 2. Given 3 securities whose spot prices and values at maturity under four scenarios are Security Spot price Value at maturity W1 W2 W3

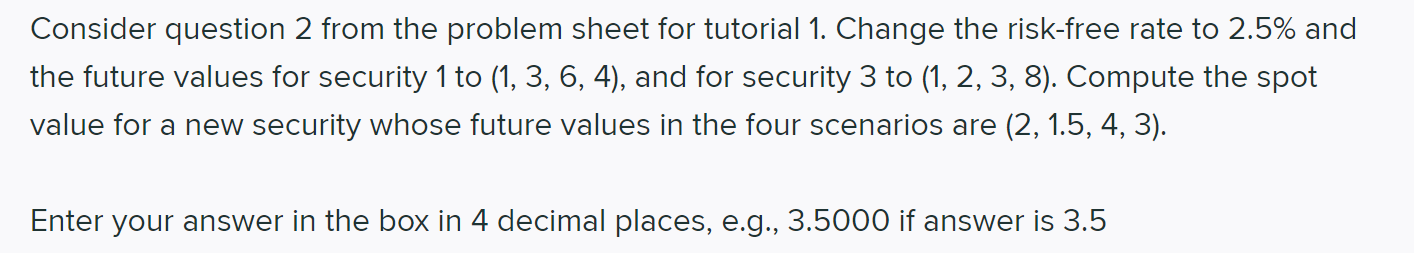

Question 2. Given 3 securities whose spot prices and values at maturity under four scenarios are Security Spot price Value at maturity W1 W2 W3 W4 3.05 4.20 4.57 1 7 2 3 2 5 4 6 9 1 4 1 1 8 The risk-free interest rate is 3%. Assuming no-arbitrage, compute the Consider question 2 from the problem sheet for tutorial 1. Change the risk-free rate to 2.5% and the future values for security 1 to (1, 3, 6, 4), and for security 3 to (1, 2, 3, 8). Compute the spot value for a new security whose future values in the four scenarios are (2, 1.5, 4, 3). Enter your answer in the box in 4 decimal places, e.g., 3.5000 if answer is 3.5 Question 2. Given 3 securities whose spot prices and values at maturity under four scenarios are Security Spot price Value at maturity W1 W2 W3 W4 3.05 4.20 4.57 1 7 2 3 2 5 4 6 9 1 4 1 1 8 The risk-free interest rate is 3%. Assuming no-arbitrage, compute the Consider question 2 from the problem sheet for tutorial 1. Change the risk-free rate to 2.5% and the future values for security 1 to (1, 3, 6, 4), and for security 3 to (1, 2, 3, 8). Compute the spot value for a new security whose future values in the four scenarios are (2, 1.5, 4, 3). Enter your answer in the box in 4 decimal places, e.g., 3.5000 if answer is 3.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts