Question: Question 2 Given how sensitive the Sleeping Beauty bonds are to changes in interest rates, we want to hedge against interest rate movements. Suppose

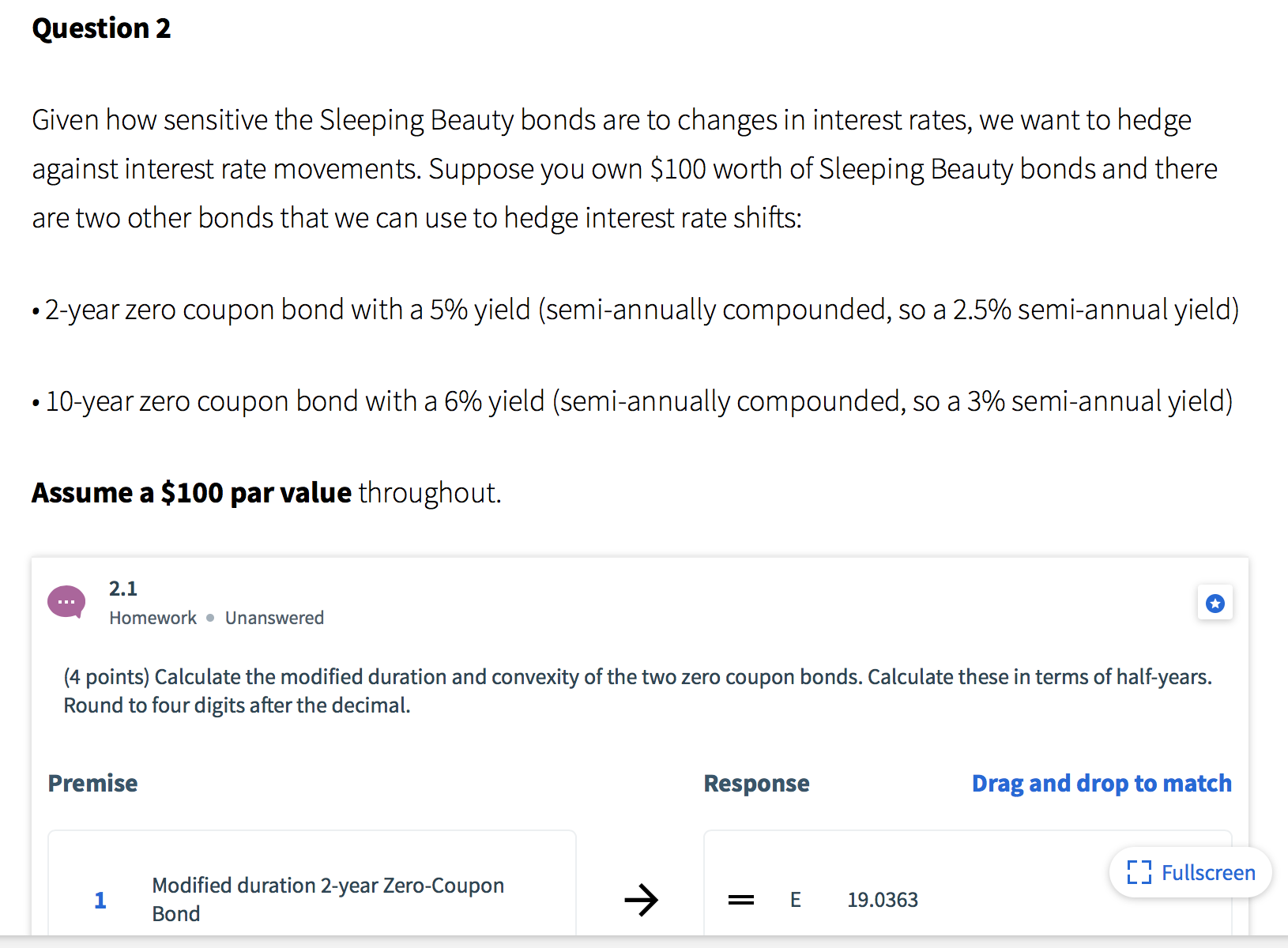

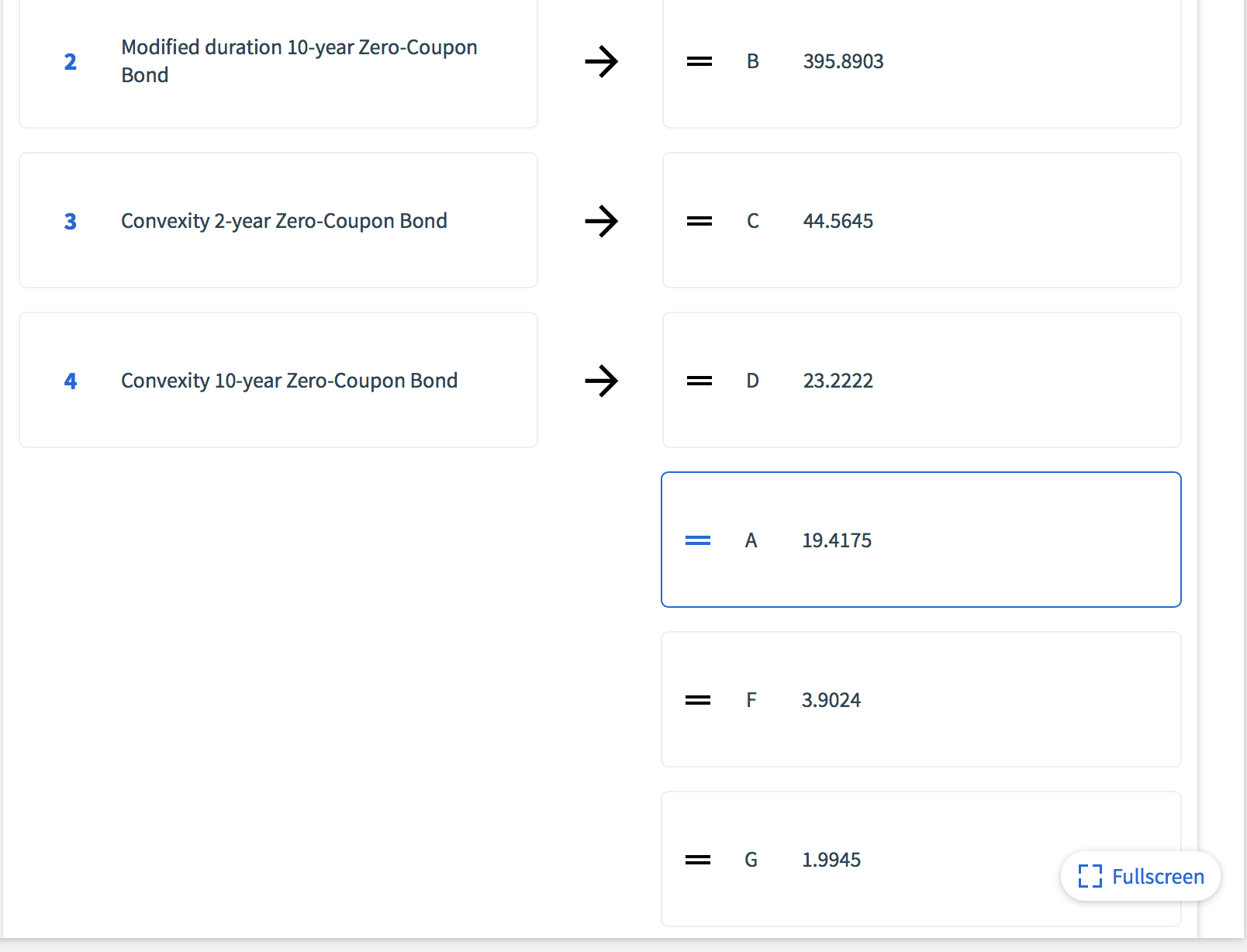

Question 2 Given how sensitive the Sleeping Beauty bonds are to changes in interest rates, we want to hedge against interest rate movements. Suppose you own $100 worth of Sleeping Beauty bonds and there are two other bonds that we can use to hedge interest rate shifts: 2-year zero coupon bond with a 5% yield (semi-annually compounded, so a 2.5% semi-annual yield) 10-year zero coupon bond with a 6% yield (semi-annually compounded, so a 3% semi-annual yield) Assume a $100 par value throughout. 2.1 Homework Unanswered (4 points) Calculate the modified duration and convexity of the two zero coupon bonds. Calculate these in terms of half-years. Round to four digits after the decimal. Premise Modified duration 2-year Zero-Coupon 1 Bond Response = E 19.0363 Drag and drop to match LJ Fullscreen 2 3 Modified duration 10-year Zero-Coupon Bond Convexity 2-year Zero-Coupon Bond 4 Convexity 10-year Zero-Coupon Bond = B 395.8903 = C 44.5645 = D 23.2222 = A 19.4175 = F 3.9024 = G 1.9945 [Fullscreen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts