Question: Question 2 Gulp Ltd retails two products: A and B. The budgeted income statement for the next period is as follows: - Units sold Sales

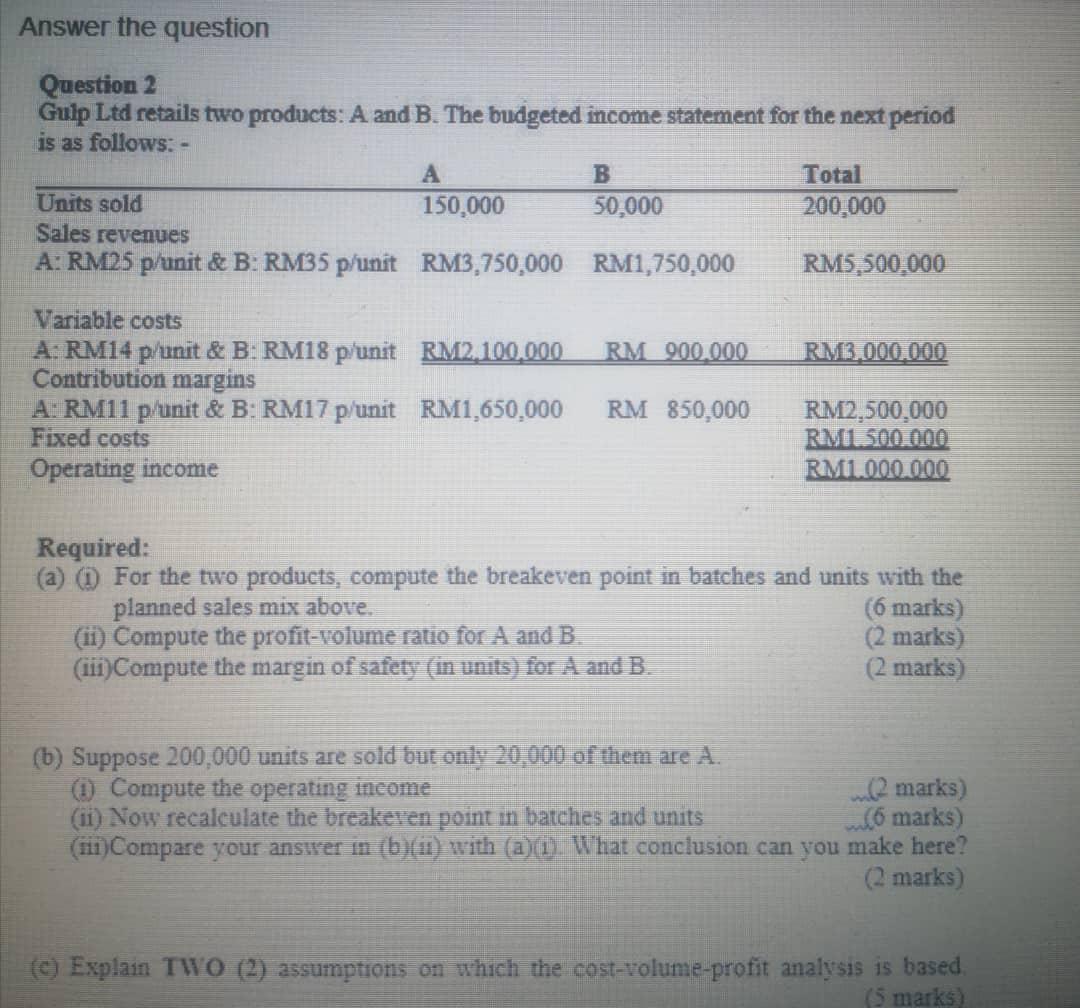

Question 2

Gulp Ltd retails two products: A and B. The budgeted income statement for the next period

is as follows: -

Units sold Sales revenues

A:RM25 p/unit & B: RM35 p/unit

A B Total

150,000 50,000 200,000

RM3,750,000! l,750,000 RM5,500,000

| Variable costs A:RM14 p/unit & B: Rlvll8 p/unit |

RM2 100 000 |

RM |

900 000 |

RM3 000 000 |

| Contribution margins |

|

|

|

|

| A:Rlvlll p/unit & B:RMI 7 p/unit Fixed costs Operating income | RMl,650,000 | RM | 850,000 | RM2,500,000 RM 1,500,000 RM1,000,000 |

Required:

- (i) For the two products, compute the breakeven point in batches and units with the planned sales mix above. (6 marks)

- Compute the profit-volume ratio for A and B. (2 marks)

- Compute the margin of safety (in units) for A and B. (2 marks)

- Suppose 200,000 units are sold but only 20,000 of them are A.

(!) Compute the operating income (0 marks) (ii)Now recalculate the breakeven point in batches and units (6 marks) (iii)Compare your answer in (b)(ii) with (a)(!).What conclusion can you make here?

(2 marks)

- Explain nvo (2) assumptions on which the cost-volume-profit analysis is based.

(5 marks) [Total: 25marks)

Answer the question Question 2 Gulp Ltd retails two products: A and B. The budgeted income statement for the next period is as follows: - A B Total Units sold 150,000 50,000 200,000 Sales revenues A: RM25 p/unit & B: RM35 p/unit RM3,750,000 RM1,750,000 RM5.500.000 RM 900.000 RM3.000.000 Variable costs A:RM14 p/unit & B:RM18 p/unit RM2,100,000 Contribution margins A: RM11 p/unit & B:RM17p/unit RM1,650,000 Fixed costs Operating income RM 850,000 RM2,500,000 RNIS00.000 RM1.000.000 Required: (a) (For the two products, compute the breakeven point in batches and units with the planned sales mix above. (6 marks) (ii) Compute the profit-volume ratio for A and B (2 marks) (iii)Compute the margin of safety (in units) for A and B. (2 marks) (b) Suppose 200,000 units are sold but only 20,000 of them are A. Compute the operating income (2 marks) (ii) Now recalculate the breakeren point in batches and units mk6 marks) (fi)Compare your answer in (b)(ii) with (a)(i). What conclusion can you make here? (2 marks) (c) Explain TWO (2) assumptions on which the cost-volume-profit analysis is based

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts