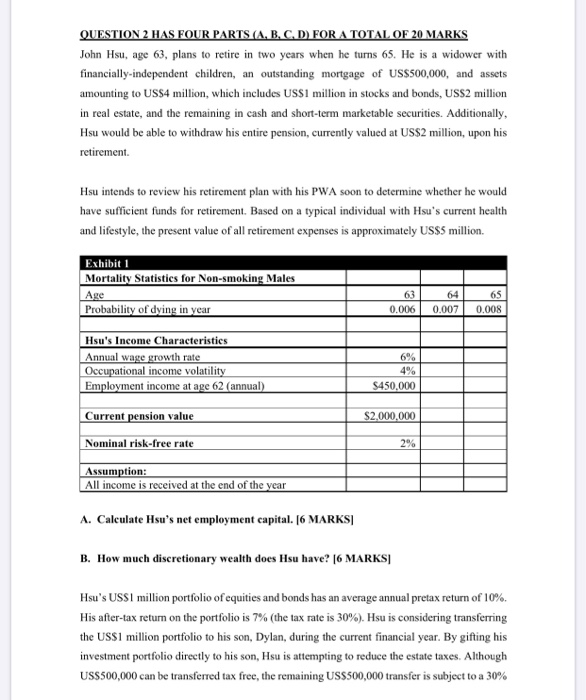

Question: QUESTION 2 HAS FOUR PARTS (A, B, C, D) FOR A TOTAL OF 20 MARKS John Hsu, age 63, plans to retire in two years

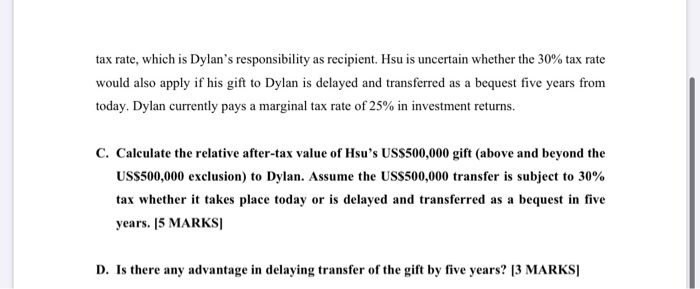

QUESTION 2 HAS FOUR PARTS (A, B, C, D) FOR A TOTAL OF 20 MARKS John Hsu, age 63, plans to retire in two years when he turns 65. He is a widower with financially-independent children, an outstanding mortgage of US$500,000, and assets amounting to US$4 million, which includes US$1 million in stocks and bonds, US$2 million in real estate, and the remaining in cash and short-term marketable securities. Additionally, Hsu would be able to withdraw his entire pension, currently valued at US$2 million, upon his retirement Hsu intends to review his retirement plan with his PWA soon to determine whether he would have sufficient funds for retirement. Based on a typical individual with Hsu's current health and lifestyle, the present value of all retirement expenses is approximately US$5 million Exhibiti Mortality Statistics for Non-smoking Males Age Probability of dying in year 0.006 0.007 0.008 Hsu's Income Characteristics Annual wage growth rate Occupational income volatility Employment income at age 62 (annual) 6% 4% $450,000 Current pension value $2.000.000 Nominal risk-free rate 2% Assumption: e is received at the end of the year A. Caleulate Hsu's net employment capital. 16 MARKS B. How much discretionary wealth does Hsu have? 16 MARKS Hsu's USSI million portfolio of equities and bonds has an average annual pretax return of 10%. His after-tax return on the portfolio is 7% (the tax rate is 30%). Hsu is considering transferring the USS1 million portfolio to his son, Dylan, during the current financial year. By gifting his investment portfolio directly to his son, Hsu is attempting to reduce the estate taxes. Although US$500,000 can be transferred tax free, the remaining US$500,000 transfer is subject to a 30% tax rate, which is Dylan's responsibility as recipient. Hsu is uncertain whether the 30% tax rate would also apply if his gift to Dylan is delayed and transferred as a bequest five years from today. Dylan currently pays a marginal tax rate of 25% in investment returns. C. Calculate the relative after-tax value of Hsu's US$500,000 gift (above and beyond the US$500,000 exclusion) to Dylan. Assume the US$500,000 transfer is subject to 30% tax whether it takes place today or is delayed and transferred as a bequest in five years. 15 MARKS D. Is there any advantage in delaying transfer of the gift by five years? 13 MARKSI QUESTION 2 HAS FOUR PARTS (A, B, C, D) FOR A TOTAL OF 20 MARKS John Hsu, age 63, plans to retire in two years when he turns 65. He is a widower with financially-independent children, an outstanding mortgage of US$500,000, and assets amounting to US$4 million, which includes US$1 million in stocks and bonds, US$2 million in real estate, and the remaining in cash and short-term marketable securities. Additionally, Hsu would be able to withdraw his entire pension, currently valued at US$2 million, upon his retirement Hsu intends to review his retirement plan with his PWA soon to determine whether he would have sufficient funds for retirement. Based on a typical individual with Hsu's current health and lifestyle, the present value of all retirement expenses is approximately US$5 million Exhibiti Mortality Statistics for Non-smoking Males Age Probability of dying in year 0.006 0.007 0.008 Hsu's Income Characteristics Annual wage growth rate Occupational income volatility Employment income at age 62 (annual) 6% 4% $450,000 Current pension value $2.000.000 Nominal risk-free rate 2% Assumption: e is received at the end of the year A. Caleulate Hsu's net employment capital. 16 MARKS B. How much discretionary wealth does Hsu have? 16 MARKS Hsu's USSI million portfolio of equities and bonds has an average annual pretax return of 10%. His after-tax return on the portfolio is 7% (the tax rate is 30%). Hsu is considering transferring the USS1 million portfolio to his son, Dylan, during the current financial year. By gifting his investment portfolio directly to his son, Hsu is attempting to reduce the estate taxes. Although US$500,000 can be transferred tax free, the remaining US$500,000 transfer is subject to a 30% tax rate, which is Dylan's responsibility as recipient. Hsu is uncertain whether the 30% tax rate would also apply if his gift to Dylan is delayed and transferred as a bequest five years from today. Dylan currently pays a marginal tax rate of 25% in investment returns. C. Calculate the relative after-tax value of Hsu's US$500,000 gift (above and beyond the US$500,000 exclusion) to Dylan. Assume the US$500,000 transfer is subject to 30% tax whether it takes place today or is delayed and transferred as a bequest in five years. 15 MARKS D. Is there any advantage in delaying transfer of the gift by five years? 13 MARKSI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts