Question: question 2 help! show calculations 2. As a financial analyst for Moore Enterprises, you are charged with rate for the company's upcoming projects. You are

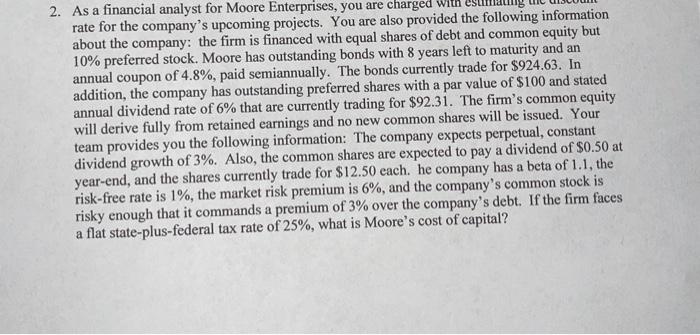

2. As a financial analyst for Moore Enterprises, you are charged with rate for the company's upcoming projects. You are also provided the following information about the company: the firm is financed with equal shares of debt and common equity but 10% preferred stock. Moore has outstanding bonds with 8 years left to maturity and an annual coupon of 4.8%, paid semiannually. The bonds currently trade for $924.63. In addition, the company has outstanding preferred shares with a par value of $100 and stated annual dividend rate of 6% that are currently trading for $92.31. The firm's common equity will derive fully from retained earnings and no new common shares will be issued. Your team provides you the following information: The company expects perpetual, constant dividend growth of 3%. Also, the common shares are expected to pay a dividend of $0.50 at year-end, and the shares currently trade for $12.50 each. he company has a beta of 1.1, the risk-free rate is 1%, the market risk premium is 6%, and the company's common stock is risky enough that it commands a premium of 3% over the company's debt. If the firm faces a flat state-plus-federal tax rate of 25%, what is Moore's cost of capital? 2. As a financial analyst for Moore Enterprises, you are charged with rate for the company's upcoming projects. You are also provided the following information about the company: the firm is financed with equal shares of debt and common equity but 10% preferred stock. Moore has outstanding bonds with 8 years left to maturity and an annual coupon of 4.8%, paid semiannually. The bonds currently trade for $924.63. In addition, the company has outstanding preferred shares with a par value of $100 and stated annual dividend rate of 6% that are currently trading for $92.31. The firm's common equity will derive fully from retained earnings and no new common shares will be issued. Your team provides you the following information: The company expects perpetual, constant dividend growth of 3%. Also, the common shares are expected to pay a dividend of $0.50 at year-end, and the shares currently trade for $12.50 each. he company has a beta of 1.1, the risk-free rate is 1%, the market risk premium is 6%, and the company's common stock is risky enough that it commands a premium of 3% over the company's debt. If the firm faces a flat state-plus-federal tax rate of 25%, what is Moore's cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts