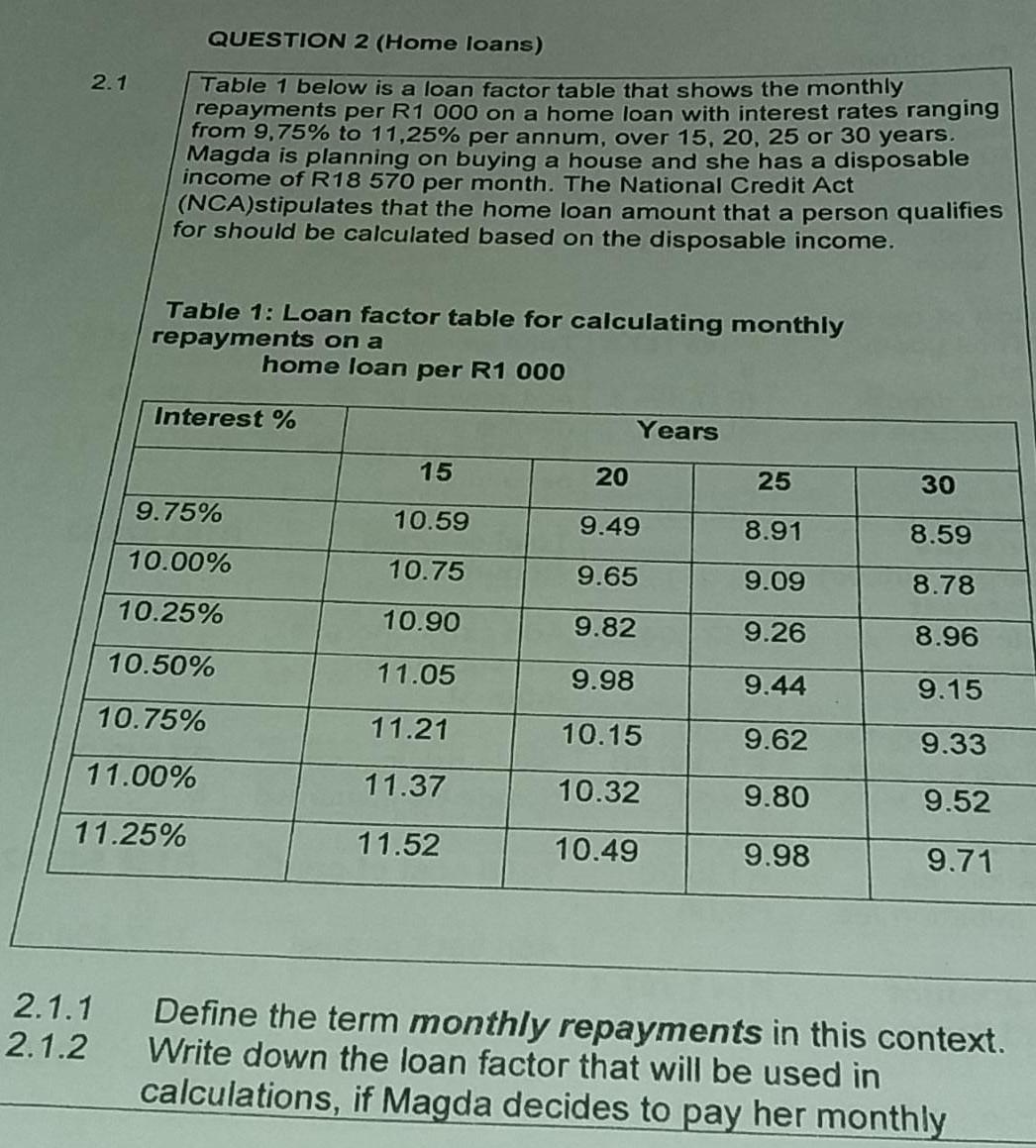

Question: QUESTION 2 (Home loans) 2.1 Table 1 below is a loan factor table that shows the monthly repayments per R1 000 on a home loan

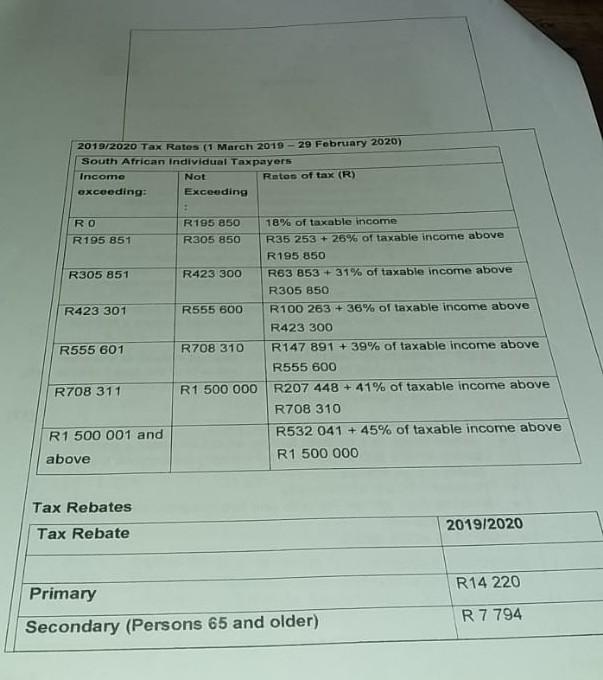

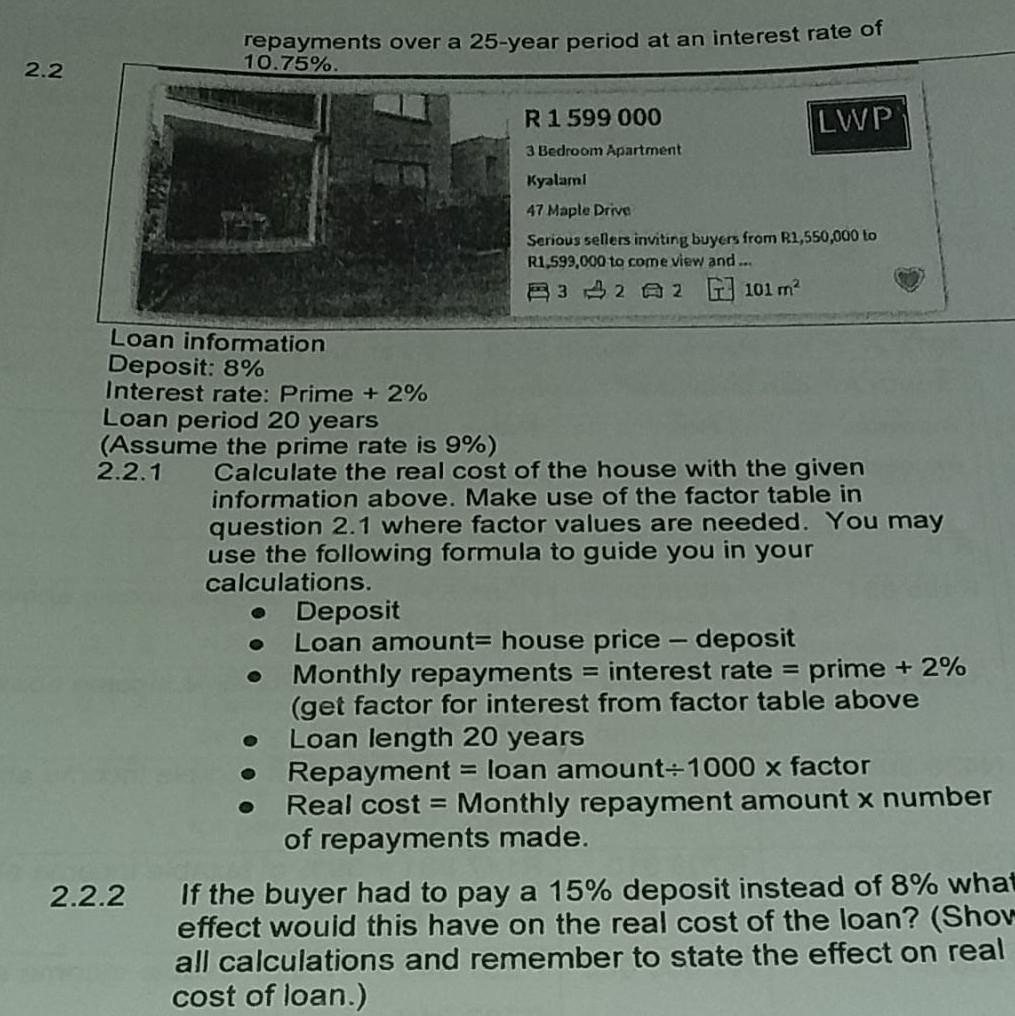

QUESTION 2 (Home loans) 2.1 Table 1 below is a loan factor table that shows the monthly repayments per R1 000 on a home loan with interest rates ranging from 9,75% to 11,25% per annum, over 15, 20, 25 or 30 years. Magda is planning on buying a house and she has a disposable income of R18 570 per month. The National Credit Act (NCA)stipulates that the home loan amount that a person qualifies for should be calculated based on the disposable income. Table 1: Loan factor table for calculating monthly repayments on a home loan per R1 000 Interest % Years 15 20 25 30 9.75% 10.59 9.49 8.91 8.59 10.00% 10.75 9.65 9.09 8.78 10.25% 10.90 9.82 9.26 8.96 10.50% 11.05 9.98 9.44 9.15 10.75% 11.21 10.15 9.62 9.33 11.00% 11.37 10.32 9.80 9.52 11.25% 11.52 10.49 9.98 9.71 2.1.1 Define the term monthly repayments in this context. 2.1.2 Write down the loan factor that will be used in calculations, if Magda decides to pay her monthly 2019/2020 Tax Rates (1 March 2019 - 29 February 2020) South African individual Taxpayers Income Not Rates of tax (R) exceeding: Exceeding RO R195 851 R195 850 R305 850 R305 851 R423 300 R423 301 R555 600 18% of taxable income R35 253 + 26% of taxable income above R195 850 R63 853 +31% of taxable income above R305 850 R100 263 + 36% of taxable income above R423 300 R147 891 + 39% of taxable income above R555 600 R207 448 + 41% of taxable income above R708 310 R532 041 +45% of taxable income above R1 500 000 R555 601 R708 310 R708 311 R1 500 000 R1 500 001 and above Tax Rebates 2019/2020 Tax Rebate R14 220 Primary R 7 794 Secondary (Persons 65 and older) Tertiary (Persons 75 and older) R 2 001 Medical Tax Credit Rates Per month(R) For the taxpayer who paid the medical scheme contributions For the first dependant For each additional dependant(s) 2019/2020 R 310 R 310 R 209 3.1 Study the fax tables above and use the information given to answer the following questions 3.1.1 Determine the amount James pays towards pension (2) every month. 3.1.2 How much of his pension can James deduct as a taxable (2) deduction? 3.1.3 What is James' contribution to UIF every month? 3.1.4 How much money will be deducted monthly from tax, (2) based on James' medical aid membership? 3.1.5 What do the non-taxable deductions add up to? 3.1.6 The following year, James is given a 12% increase Calculate James' new monthly taxable income. 3.1.7 Calculate James' annual income tax on his increased salary. Make use of the tax tables above. 3.1.8 Why do you think SARS makes these formulae available to the public and not only provides the deduction tables for personal income tax? (2) (6) (2) [22] repayments over a 25-year period at an interest rate of 10.75%. 2.2 R 1599 000 LWP 3 Bedroom Apartment Kyalarni 47 Maple Drive Serious sellers inviting buyers from R1,550,000 to R1,599,000 to come view and ... B3 2 A2 101 m Loan information Deposit: 8% Interest rate: Prime + 2% Loan period 20 years (Assume the prime rate is 9%) 2.2.1 Calculate the real cost of the house with the given information above. Make use of the factor table in question 2.1 where factor values are needed. You may use the following formula to guide you in your calculations. Deposit Loan amount= house price - deposit Monthly repayments = interest rate = prime + 2% (get factor for interest from factor table above Loan length 20 years Repayment = loan amount 1000 x factor Real cost = Monthly repayment amount x number of repayments made. 2.2.2 If the buyer had to pay a 15% deposit instead of 8% what effect would this have on the real cost of the loan? (Shov all calculations and remember to state the effect on real cost of loan.) = o O QUESTION 2 (Home loans) 2.1 Table 1 below is a loan factor table that shows the monthly repayments per R1 000 on a home loan with interest rates ranging from 9,75% to 11,25% per annum, over 15, 20, 25 or 30 years. Magda is planning on buying a house and she has a disposable income of R18 570 per month. The National Credit Act (NCA)stipulates that the home loan amount that a person qualifies for should be calculated based on the disposable income. Table 1: Loan factor table for calculating monthly repayments on a home loan per R1 000 Interest % Years 15 20 25 30 9.75% 10.59 9.49 8.91 8.59 10.00% 10.75 9.65 9.09 8.78 10.25% 10.90 9.82 9.26 8.96 10.50% 11.05 9.98 9.44 9.15 10.75% 11.21 10.15 9.62 9.33 11.00% 11.37 10.32 9.80 9.52 11.25% 11.52 10.49 9.98 9.71 2.1.1 Define the term monthly repayments in this context. 2.1.2 Write down the loan factor that will be used in calculations, if Magda decides to pay her monthly 2019/2020 Tax Rates (1 March 2019 - 29 February 2020) South African individual Taxpayers Income Not Rates of tax (R) exceeding: Exceeding RO R195 851 R195 850 R305 850 R305 851 R423 300 R423 301 R555 600 18% of taxable income R35 253 + 26% of taxable income above R195 850 R63 853 +31% of taxable income above R305 850 R100 263 + 36% of taxable income above R423 300 R147 891 + 39% of taxable income above R555 600 R207 448 + 41% of taxable income above R708 310 R532 041 +45% of taxable income above R1 500 000 R555 601 R708 310 R708 311 R1 500 000 R1 500 001 and above Tax Rebates 2019/2020 Tax Rebate R14 220 Primary R 7 794 Secondary (Persons 65 and older) Tertiary (Persons 75 and older) R 2 001 Medical Tax Credit Rates Per month(R) For the taxpayer who paid the medical scheme contributions For the first dependant For each additional dependant(s) 2019/2020 R 310 R 310 R 209 3.1 Study the fax tables above and use the information given to answer the following questions 3.1.1 Determine the amount James pays towards pension (2) every month. 3.1.2 How much of his pension can James deduct as a taxable (2) deduction? 3.1.3 What is James' contribution to UIF every month? 3.1.4 How much money will be deducted monthly from tax, (2) based on James' medical aid membership? 3.1.5 What do the non-taxable deductions add up to? 3.1.6 The following year, James is given a 12% increase Calculate James' new monthly taxable income. 3.1.7 Calculate James' annual income tax on his increased salary. Make use of the tax tables above. 3.1.8 Why do you think SARS makes these formulae available to the public and not only provides the deduction tables for personal income tax? (2) (6) (2) [22] repayments over a 25-year period at an interest rate of 10.75%. 2.2 R 1599 000 LWP 3 Bedroom Apartment Kyalarni 47 Maple Drive Serious sellers inviting buyers from R1,550,000 to R1,599,000 to come view and ... B3 2 A2 101 m Loan information Deposit: 8% Interest rate: Prime + 2% Loan period 20 years (Assume the prime rate is 9%) 2.2.1 Calculate the real cost of the house with the given information above. Make use of the factor table in question 2.1 where factor values are needed. You may use the following formula to guide you in your calculations. Deposit Loan amount= house price - deposit Monthly repayments = interest rate = prime + 2% (get factor for interest from factor table above Loan length 20 years Repayment = loan amount 1000 x factor Real cost = Monthly repayment amount x number of repayments made. 2.2.2 If the buyer had to pay a 15% deposit instead of 8% what effect would this have on the real cost of the loan? (Shov all calculations and remember to state the effect on real cost of loan.) = o O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts