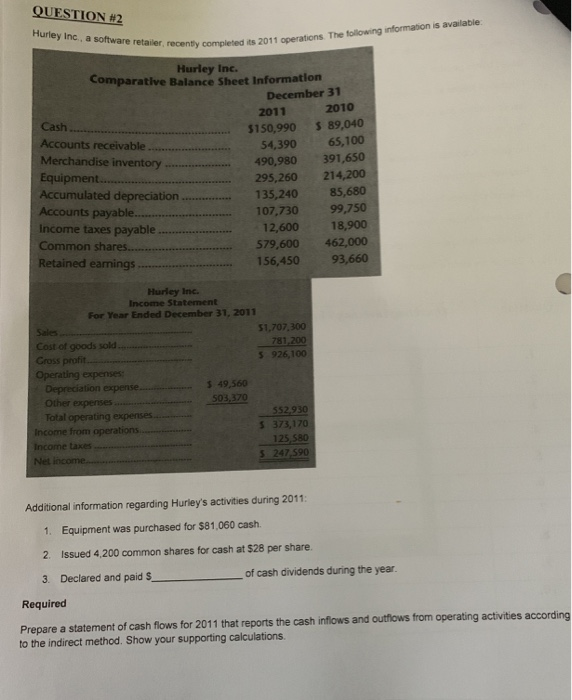

Question: QUESTION #2 Hurley Inc, a software retailer recently completed endy completed its 2011 operations. The following information is available Cash ........ Hurley Inc. Comparative Balance

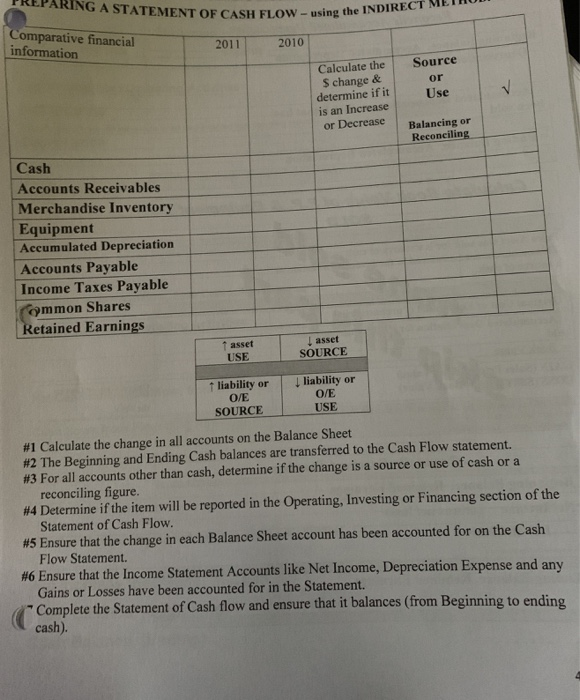

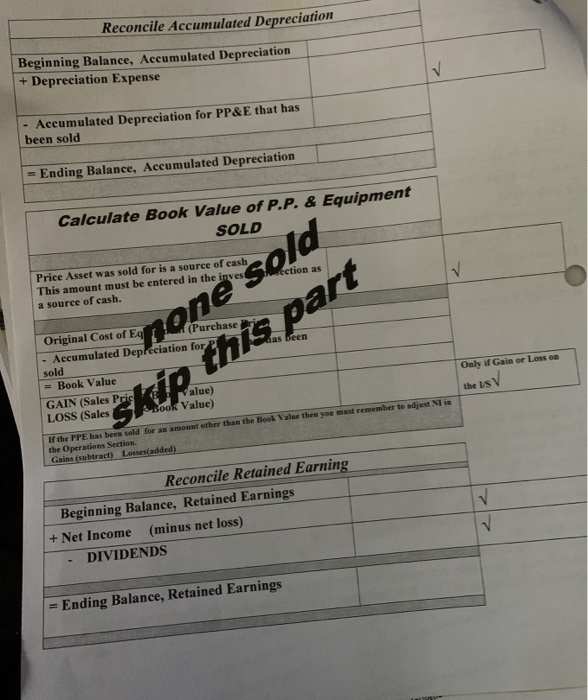

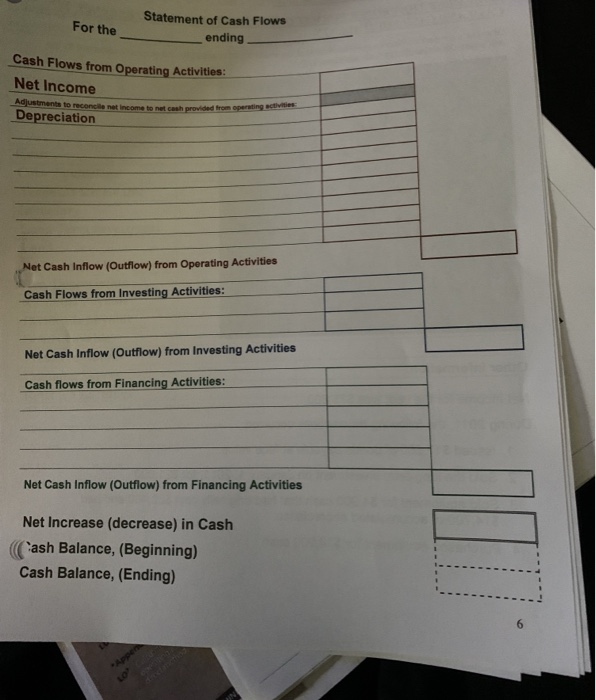

QUESTION #2 Hurley Inc, a software retailer recently completed endy completed its 2011 operations. The following information is available Cash ........ Hurley Inc. Comparative Balance Sheet Information December 31 2011 2010 5150,990 $ 89,040 Accounts receivable ....... 54,390 65,100 Merchandise inventory ............. 490,980 391,650 Equipment............... 295,260 214,200 Accumulated depreciation ........... 135,240 85,680 Accounts payable. 107,730 99,750 Income taxes payable... 12,600 18,900 Common shares......... 579,600 462,000 Retained earings ........ 156,450 93,660 Hurley Inc. Income Statement For Year Ended December 31, 2011 51.707.300 Cost of goods sold .... ...--------- 781,200 Cross profit 5 926,100 Operating expenses: Depreciation expense....... 5 49.560 Other expenses 503,370 Total operating expenses.... 552,930 Income from operations...... 5373,170 Income taxes ....... 125 580 Net income............ 5 247.590 Additional information regarding Hurley's activities during 2011: 1. Equipment was purchased for $81,060 cash. 2 Issued 4 200 common shares for cash at $28 per share. 3. Declared and paid $ of cash dividends during the year. Required Prepare a statement of cash flows for 2011 that reports the cash inflows and outflows from operating activities according to the indirect method. Show your supporting calculations PREPARING A STATEMENT OF CASH FLOW - using H FLOW - using the INDIRECT METHOD Comparative financial information 2011 2010 Source or Calculate the $ change & determine if it is an Increase or Decrease Use Balancing or Reconciling Cash Accounts Receivables Merchandise Inventory Equipment Accumulated Depreciation Accounts Payable Income Taxes Payable Common Shares Retained Earnings Tasset USE asset SOURCE liability or SOURCE liability or O/E USE #1 Calculate the change in all accounts on the Balance Sheet #2 The Beginning and Ending Cash balances are transferred to the Cash Flow statement. #3 For all accounts other than cash, determine if the change is a source or use of cash or a reconciling figure. #4 Determine if the item will be reported in the Operating, Investing or Financing section of the Statement of Cash Flow. #5 Ensure that the change in each Balance Sheet account has been accounted for on the Cash Flow Statement. #6 Ensure that the Income Statement Accounts like Net Income, Depreciation Expense and any Gains or Losses have been accounted for in the Statement. Complete the Statement of Cash flow and ensure that it balances (from Beginning to ending cash). Reconcile Accumulated Depreciation Beginning Balance, Accumulated Depreciation + Depreciation Expense - Accumulated Depreciation for PP&E that has been sold = Ending Balance, Accumulated Depreciation Calculate Book Value of P.P. & Equipment SOLD e ction as Price Asset was sold for is a source of cash This amount must be entered in the invest a source of cash. as been none sold Only if Gain or Loss on the Is V Original Cost of Eq . (Purchase - Accumulated Depreciation for sold = Book Value GAIN (Sales Price value) LOSS (Sales SOOK Value) If the PPE has been sold for an amount other than the Book Value then you must remember to adjust Nin the Operations Section. Gains (subtract) Lossesadded) se skip this part Reconcile Retained Earning Beginning Balance, Retained Earnings + Net Income (minus net loss) - DIVIDENDS = Ending Balance, Retained Earnings For the Statement of Cash Flows ending Cash Flows from Operating Activities: Net Income Adjustments to reconcile net income to nesh provided from operating Depreciation Net Cash Inflow (Outflow) from Operating Activities Cash Flows from Investing Activities: Net Cash Inflow (Outflow) from Investing Activities Cash flows from Financing Activities: Net Cash Inflow (Outflow) from Financing Activities Net Increase (decrease) in Cash Cash Balance, (Beginning) Cash Balance, (Ending)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts