Question: question 2 i need help just any questions Question 2 (20 marks) arted out of (a) Suzyros wants to buy a house but does not

question 2 i need help just any questions

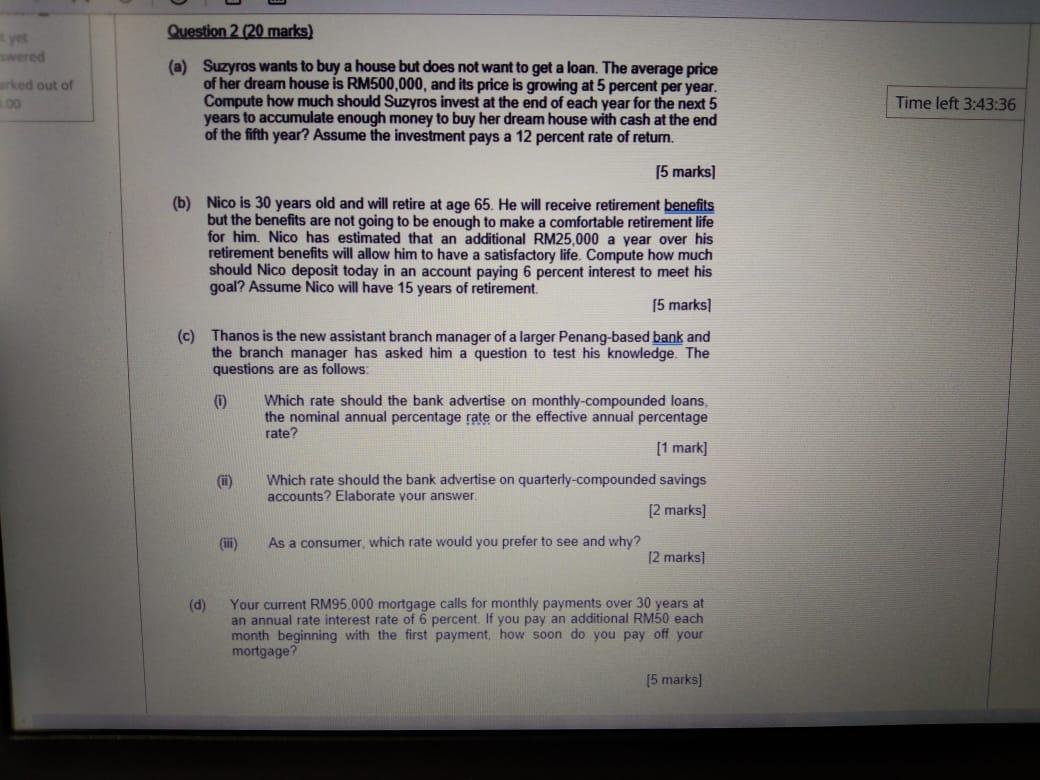

Question 2 (20 marks) arted out of (a) Suzyros wants to buy a house but does not want to get a loan. The average price of her dream house is RM500,000, and its price is growing at 5 percent per year. Compute how much should Suzyros invest at the end of each year for the next 5 years to accumulate enough money to buy her dream house with cash at the end of the fifth year? Assume the investment pays a 12 percent rate of return. Time left 3:43:36 15 marks] (b) Nico is 30 years old and will retire at age 65. He will receive retirement benefits but the benefits are not going to be enough to make a comfortable retirement life for him. Nico has estimated that an additional RM25,000 a year over his retirement benefits will allow him to have a satisfactory life. Compute how much should Nico deposit today in an account paying 6 percent interest to meet his goal? Assume Nico will have 15 years of retirement 15 marks] (c) Thanos is the new assistant branch manager of a larger Penang-based bank and the branch manager has asked him a question to test his knowledge. The questions are as follows: 0 Which rate should the bank advertise on monthly-compounded loans, the nominal annual percentage rate or the effective annual percentage [1 mark] rate? () Which rate should the bank advertise on quarterly-compounded savings accounts? Elaborate your answer [2 marks] As a consumer, which rate would you prefer to see and why? [2 marks] (ili) Your current RM95.000 mortgage calls for monthly payments over 30 years at an annual rate interest rate of 6 percent. If you pay an additional RM50 each month beginning with the first payment, how soon do you pay off your mortgage? (5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts