Question: QUESTION 2 If a particular stock does not pay dividends and is currently priced at $24 per share, what should be the price of a

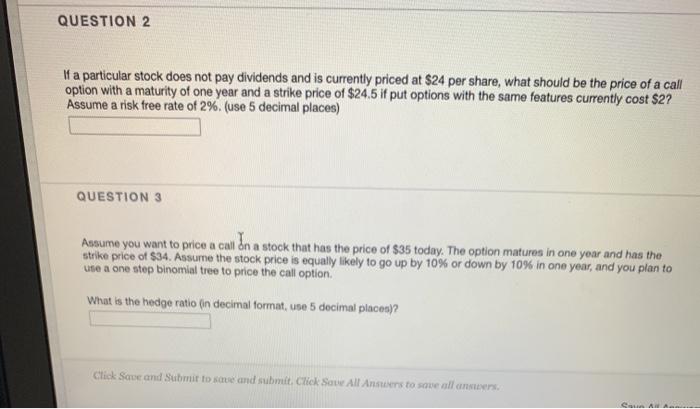

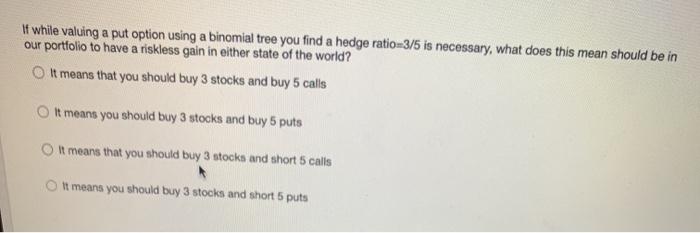

QUESTION 2 If a particular stock does not pay dividends and is currently priced at $24 per share, what should be the price of a call option with a maturity of one year and a strike price of $24.5 if put options with the same features currently cost $2? Assume a risk free rate of 2%. (use 5 decimal places) QUESTION 3 Assume you want to price a call on a stock that has the price of $35 today. The option matures in one year and has the strike price of $34. Assume the stock price is equally likely to go up by 10% or down by 10% in one year, and you plan to use a one stop binomial tree to price the call option What is the hedge ratio in decimal format, use 5 decimal places)? Click Save and Submit to see and submit. Click Save All Ansans to one all answer If while valuing a put option using a binomial tree you find a hedge ratio-3/5 is necessary, what does this mean should be in our portfolio to have a riskless gain in either state of the world? It means that you should buy 3 stocks and buy 5 calls It means you should buy 3 stocks and buy 5 puts It means that you should buy 3 stock and short 5 calls it means you should buy 3 stocks and short 5 puts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts