Question: QUESTION 2 In the current year, Mark provided more than half the support for his cousin, his nece, and a close family friend. Mark lives

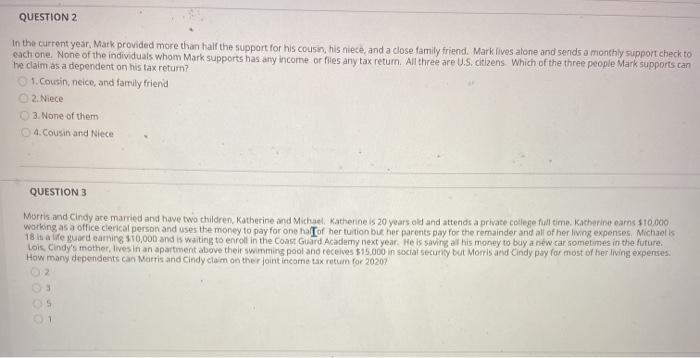

QUESTION 2 In the current year, Mark provided more than half the support for his cousin, his nece, and a close family friend. Mark lives alone and sends a monthly support check to each one. None of the individuals whom Mark supports has any income or files any tax return. All three are U.S. citizens Which of the three people Mark supports can he claim as a dependent on his tax return? 1. Cousin, neice, and family friend 2. Niece 3. None of them 4.Cousin and Niece QUESTION 3 Morris and Cindy are married and have two children, Katherine and Michael Katherine is 20 years old and attends a private college full time, Katherine earns $10.000 warlong as a office clerical person and uses the money to pay for one her tuition but her parents pay for the remainder and all of her living expenses Michaelis 18 in a lifeguard eaming $10,000 and is waiting to enroll in the Coast Guard Academy next year. He is saving all his money to buy a new car sometimes in the future. Lois Cindy's mother, lives in an apartment above their swimming pool and receives $15,000 in social secunty but Morris and Cindy pay for most of her living expenses How many dependents can Morris and Cindy claim on the joint income tax return for 20207

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts