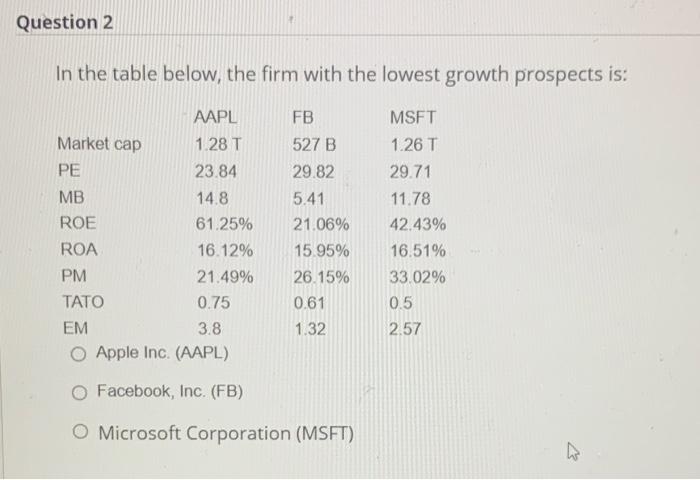

Question: Question 2 In the table below, the firm with the lowest growth prospects is: AAPL Market cap 1.28 T PE 23.84 MB 14.8 ROE 61.25%

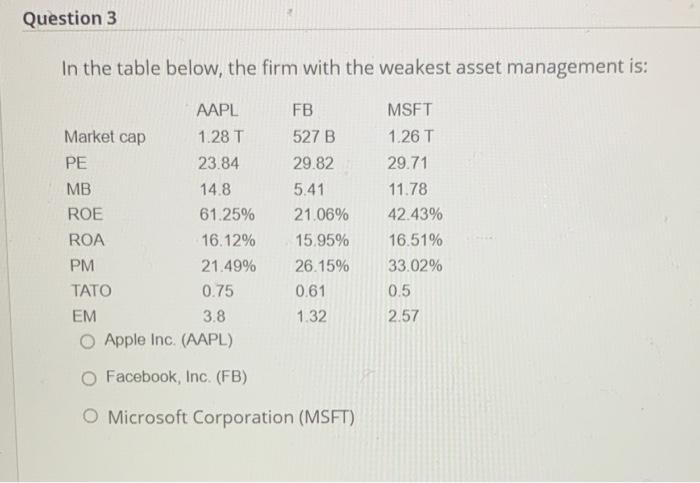

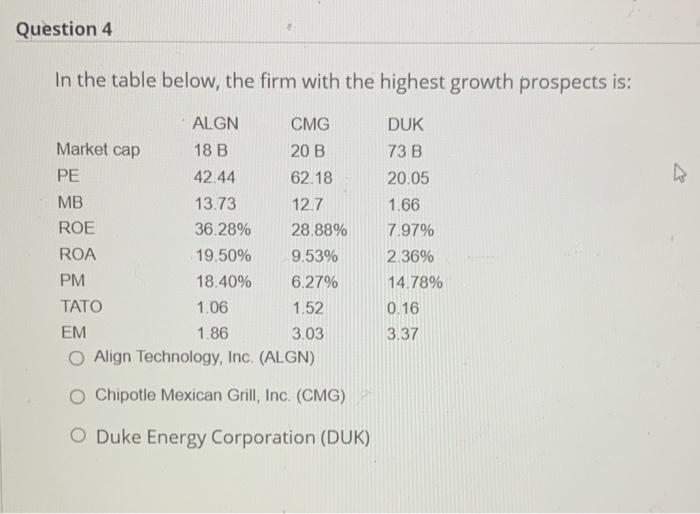

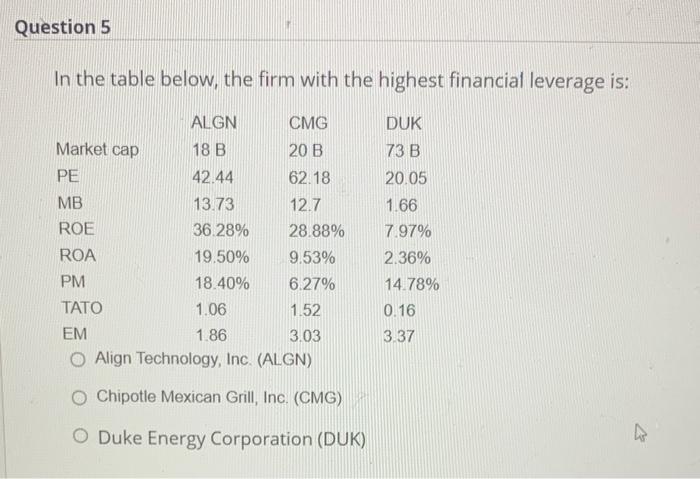

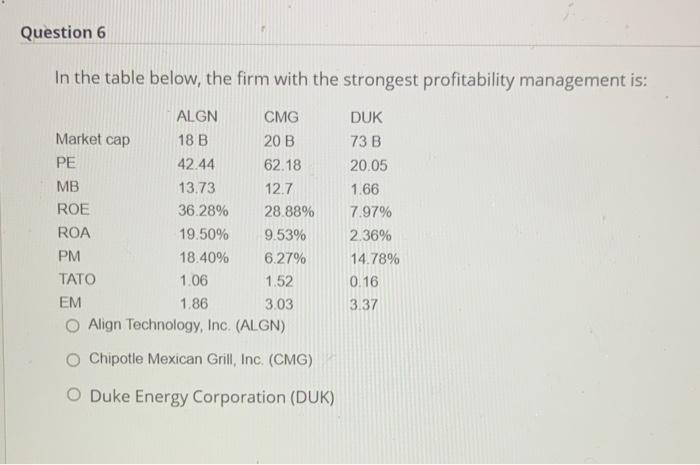

Question 2 In the table below, the firm with the lowest growth prospects is: AAPL Market cap 1.28 T PE 23.84 MB 14.8 ROE 61.25% ROA 16.12% PM 21.49% TATO 0.75 EM 3.8 O Apple Inc. (AAPL) FB 527 B 29.82 5.41 21.06% 15.95% 26.15% 0.61 1.32 MSFT 1.26 T 29.71 11.78 42.43% 16.51% 33.02% 0.5 2.57 O Facebook, Inc. (FB) O Microsoft Corporation (MSFT) Question 3 In the table below, the firm with the weakest asset management is: AAPL Market cap 1.28 T PE 23.84 MB 14.8 ROE 61.25% ROA 16.12% PM 21.49% TATO 0.75 EM 3.8 O Apple Inc. (AAPL) FB 527 B 29.82 5.41 21.06% 15.95% 26.15% 0.61 1.32 MSFT 1.26 T 29.71 11.78 42.43% 16.51% 33.02% 0.5 2.57 Facebook, Inc. (FB) O Microsoft Corporation (MSFT) Question 4 In the table below, the firm with the highest growth prospects is: ALGN CMG Market cap 18 B 20 B PE 42.44 62.18 MB 13.73 12.7 ROE 36.28% 28.88% ROA 19.50% 9.53% PM 18.40% 6.27% TATO 1.06 1.52 EM 1.86 3.03 Align Technology, Inc. (ALGN) O Chipotle Mexican Grill, Inc. (CMG) DUK 73 B 20.05 1.66 7.97% 2.36% 14.78% 0.16 3.37 O Duke Energy Corporation (DUK) Question 5 In the table below, the firm with the highest financial leverage is: DUK 73 B ALGN CMG Market cap 18 B 20 B PE 42.44 62.18 MB 13.73 12.7 ROE 36.28% 28.88% ROA 19.50% 9.53% PM 18.40% 6.27% TATO 1.06 1.52 EM 1.86 3.03 O Align Technology, Inc. (ALGN) 20.05 1.66 7.97% 2.36% 14.78% 0.16 3.37 O Chipotle Mexican Grill, Inc. (CMG) Duke Energy Corporation (DUK) Question 6 In the table below, the firm with the strongest profitability management is: ALGN CMG Market cap 18 B 20 B PE 42.44 62.18 MB 13.73 12.7 ROE 36.28% 28.88% ROA 19.50% 9.53% PM 18.40% 6.27% TATO 1.06 1.52 EM 1.86 3.03 Align Technology, Inc. (ALGN) Chipotle Mexican Grill, Inc. (CMG) DUK 73 B 20.05 1.66 7.97% 2.36% 14.78% 0.16 3.37 O Duke Energy Corporation (DUK)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts