Question: Question 2 - Intertemporal Choice (4 marks) Suppose that you are offered the choice between two options: Option 1 gives you a payment of $200

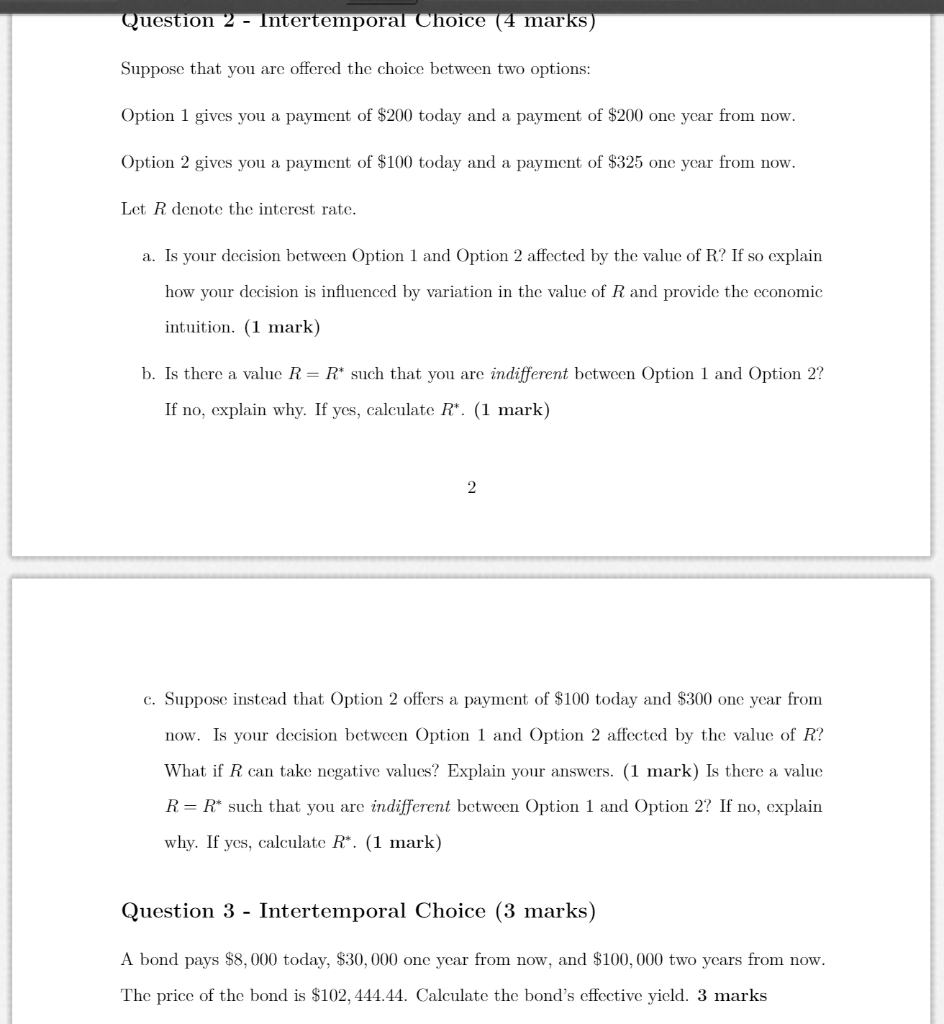

Question 2 - Intertemporal Choice (4 marks) Suppose that you are offered the choice between two options: Option 1 gives you a payment of $200 today and a payment of $200 one year from now. Option 2 gives you a payment of $100 today and a payment of $325 one year from now. Let R denote the interest rate. a. Is your decision between Option 1 and Option 2 affected by the value of R? If so explain how your decision is influenced by variation in the value of R and provide the economic intuition. (1 mark) b. Is there a value R=R* such that you are indifferent between Option 1 and Option 2? If no, explain why. If yes, calculate R*. (1 mark) 2 c. Suppose instead that Option 2 offers a payment of $100 today and $300 one year from now. Is your decision between Option 1 and Option 2 affected by the value of R? What if R can take negative values? Explain your answers. (1 mark) Is there a value R=R* such that you are indifferent between Option 1 and Option 2? If no, explain why. If yes, calculate R*. (1 mark) Question 3 - Intertemporal Choice (3 marks) A bond pays $8,000 today, $30,000 one year from now, and $100,000 two years from now. The price of the bond is $102, 444.44. Calculate the bond's effective yield. 3 marks Question 2 - Intertemporal Choice (4 marks) Suppose that you are offered the choice between two options: Option 1 gives you a payment of $200 today and a payment of $200 one year from now. Option 2 gives you a payment of $100 today and a payment of $325 one year from now. Let R denote the interest rate. a. Is your decision between Option 1 and Option 2 affected by the value of R? If so explain how your decision is influenced by variation in the value of R and provide the economic intuition. (1 mark) b. Is there a value R=R* such that you are indifferent between Option 1 and Option 2? If no, explain why. If yes, calculate R*. (1 mark) 2 c. Suppose instead that Option 2 offers a payment of $100 today and $300 one year from now. Is your decision between Option 1 and Option 2 affected by the value of R? What if R can take negative values? Explain your answers. (1 mark) Is there a value R=R* such that you are indifferent between Option 1 and Option 2? If no, explain why. If yes, calculate R*. (1 mark) Question 3 - Intertemporal Choice (3 marks) A bond pays $8,000 today, $30,000 one year from now, and $100,000 two years from now. The price of the bond is $102, 444.44. Calculate the bond's effective yield. 3 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts