Question: Question 2 - IRP, PPP and foreign currency risk management ZPS Co, whose home currency is the dollar, took out a fixed-interest peso bank

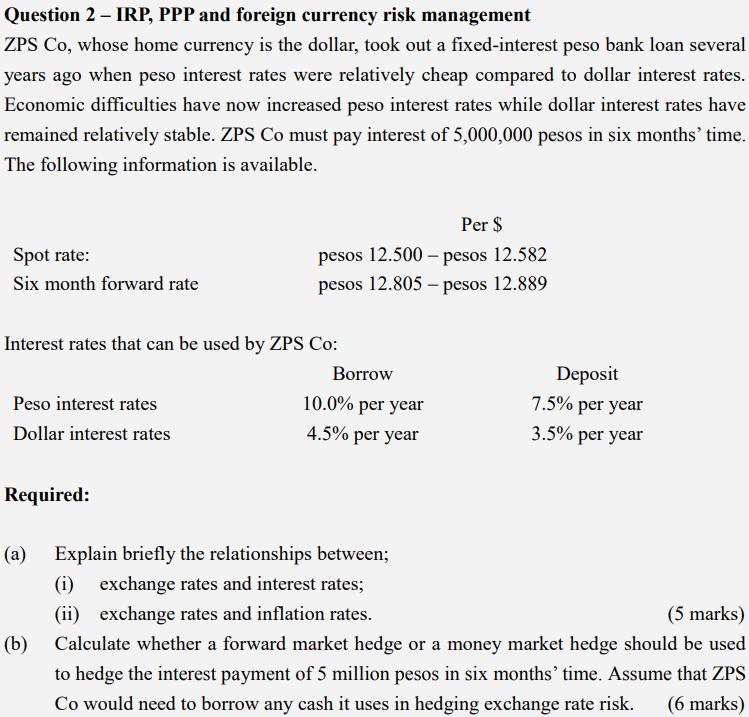

Question 2 - IRP, PPP and foreign currency risk management ZPS Co, whose home currency is the dollar, took out a fixed-interest peso bank loan several years ago when peso interest rates were relatively cheap compared to dollar interest rates. Economic difficulties have now increased peso interest rates while dollar interest rates have remained relatively stable. ZPS Co must pay interest of 5,000,000 pesos in six months' time. The following information is available. Spot rate: Six month forward rate Interest rates that can be used by ZPS Co: Peso interest rates Dollar interest rates Required: pesos 12.500 pesos 12.805 (a) Borrow 10.0% per year 4.5% per year Explain briefly the relationships between; (i) exchange rates and interest rates; (ii) exchange rates and inflation rates. Per $ pesos 12.582 pesos 12.889 Deposit 7.5% per year 3.5% per year (5 marks) (b) Calculate whether a forward market hedge or a money market hedge should be used to hedge the interest payment of 5 million pesos in six months' time. Assume that ZPS Co would need to borrow any cash it uses in hedging exchange rate risk. (6 marks)

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

a i Exchange rates and interest rates are positively related Higher interest rates in a country tend to attract foreign investment increasing the dema... View full answer

Get step-by-step solutions from verified subject matter experts