Question: Question 2: John has a utility function given by the expression U(x) = E(r) - A(s?). Where E(r) is the expected return on an asset

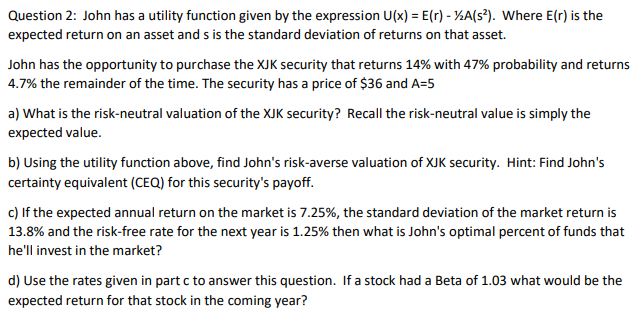

Question 2: John has a utility function given by the expression U(x) = E(r) - A(s?). Where E(r) is the expected return on an asset and s is the standard deviation of returns on that asset. John has the opportunity to purchase the XJK security that returns 14% with 47% probability and returns 4.7% the remainder of the time. The security has a price of $36 and A=5 a) What is the risk-neutral valuation of the XJK security? Recall the risk-neutral value is simply the expected value. b) Using the utility function above, find John's risk-averse valuation of XJK security. Hint: Find John's certainty equivalent (CEO) for this security's payoff. c) If the expected annual return on the market is 7.25%, the standard deviation of the market return is 13.8% and the risk-free rate for the next year is 1.25% then what is John's optimal percent of funds that he'll invest in the market? d) Use the rates given in partc to answer this question. If a stock had a Beta of 1.03 what would be the expected return for that stock in the coming year? Question 2: John has a utility function given by the expression U(x) = E(r) - A(s?). Where E(r) is the expected return on an asset and s is the standard deviation of returns on that asset. John has the opportunity to purchase the XJK security that returns 14% with 47% probability and returns 4.7% the remainder of the time. The security has a price of $36 and A=5 a) What is the risk-neutral valuation of the XJK security? Recall the risk-neutral value is simply the expected value. b) Using the utility function above, find John's risk-averse valuation of XJK security. Hint: Find John's certainty equivalent (CEO) for this security's payoff. c) If the expected annual return on the market is 7.25%, the standard deviation of the market return is 13.8% and the risk-free rate for the next year is 1.25% then what is John's optimal percent of funds that he'll invest in the market? d) Use the rates given in partc to answer this question. If a stock had a Beta of 1.03 what would be the expected return for that stock in the coming year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts