Question: Question 2 Learning LO 2 : Prepare consolidated financial statements for a complex group structure and its changes in the composition of the group On

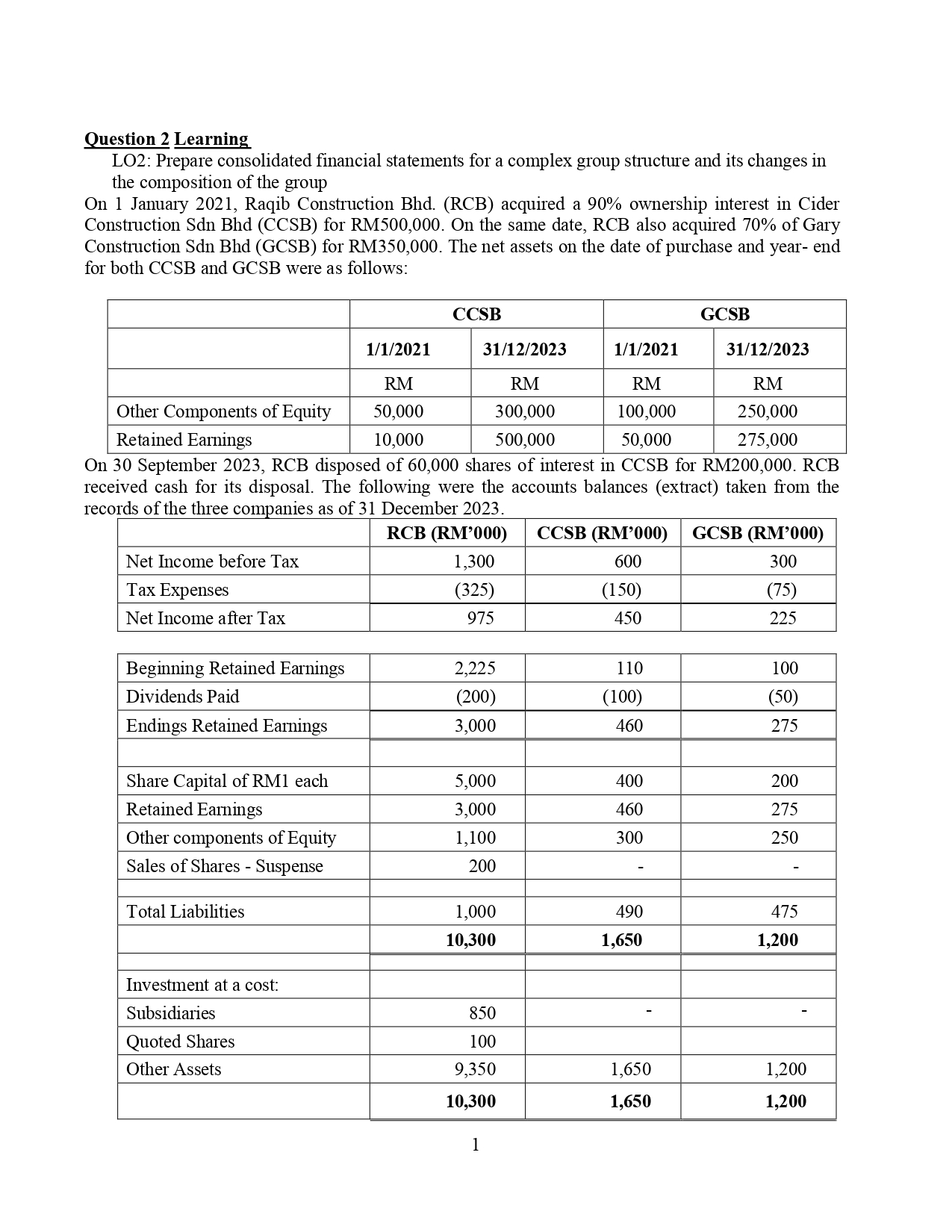

Question Learning LO: Prepare consolidated financial statements for a complex group structure and its changes in the composition of the group On January Raqib Construction BhdRCB acquired a ownership interest in Cider Construction Sdn Bhd CCSB for RM On the same date, RCB also acquired of Gary Construction Sdn Bhd GCSB for RM The net assets on the date of purchase and year end for both CCSB and GCSB were as follows: begintabularlllllhline & multicolumncCCSB & multicolumncGCSBhline & & & & hline & RM & RM & RM & RM hline Other Components of Equity & & & & hline Retained Earnings & & & & hline endtabular On September RCB disposed of shares of interest in CCSB for RM RCB received cash for its disposal. The following were the accounts balances extract taken from the records of the three companies as of December begintabularlccchline & RCB RM & CCSB RM & GCSB RMhline Net Income before Tax & & & hline Tax Expenses & & & hline Net Income after Tax & & & hline endtabularbegintabularllllhline Beginning Retained Earnings & & & hline Dividends Paid & & & hline Endings Retained Earnings & & & hline & & & hline Share Capital of RM each & & & hline Retained Earnings & & & hline Other components of Equity & & & hline Sales of Shares Suspense & & & hline Total Liabilities & & & hline & & & hline & & & hline Investment at a cost: & & & hline Subsidiaries & & & hline Quoted Shares & & & hline Other Assets & & & hline & & & hline endtabular

Additional information:

The shareholders' funds are assumed to be representative of the fair values of the identifiable

assets of CCSB and GCSB at the date of acquisitions. It is the group policy to allocate

goodwill to NonControlling Interest NCI and there was no impairment of goodwill for the

current year.

During the year RCB bought merchandise from GCSB for RM in total. The year

end inventory of RCB included RM purchased from GCSB The inventory cost for

GCSB was RM

On December RCB sold a used machine to GCSB for RM The carrying

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock