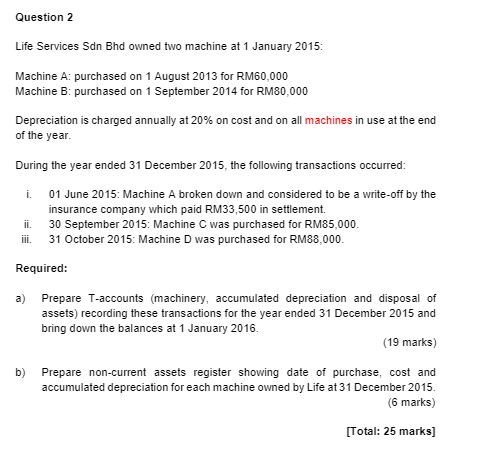

Question: Question 2 Life Services Sdn Bhd owned two machine at 1 January 2015: Machine A: purchased on 1 August 2013 for RM60,000 Machine B:

Question 2 Life Services Sdn Bhd owned two machine at 1 January 2015: Machine A: purchased on 1 August 2013 for RM60,000 Machine B: purchased on 1 September 2014 for RM80,000 Depreciation is charged annually at 20% on cost and on all machines in use at the end of the year. During the year ended 31 December 2015, the following transactions occurred: i. 01 June 2015: Machine A broken down and considered to be a write-off by the insurance company which paid RM33,500 in settlement. ii. 30 September 2015: Machine C was purchased for RM85,000. III. 31 October 2015: Machine D was purchased for RM88,000. Required: a) Prepare T-accounts (machinery, accumulated depreciation and disposal of assets) recording these transactions for the year ended 31 December 2015 and bring down the balances at 1 January 2016. (19 marks) b) Prepare non-current assets register showing date of purchase, cost and accumulated depreciation for each machine owned by Life at 31 December 2015. (6 marks) [Total: 25 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts