Question: Question 2 Lothian Engineering Ltd. has been offered a contract to supply one of its components to a company developing a new product. The contract

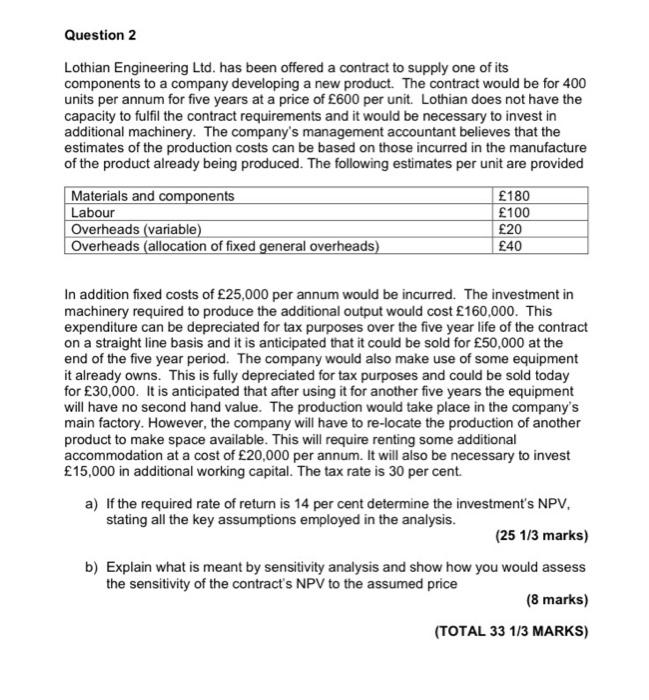

Question 2 Lothian Engineering Ltd. has been offered a contract to supply one of its components to a company developing a new product. The contract would be for 400 units per annum for five years at a price of 600 per unit. Lothian does not have the capacity to fulfil the contract requirements and it would be necessary to invest in additional machinery. The company's management accountant believes that the estimates of the production costs can be based on those incurred in the manufacture of the product already being produced. The following estimates per unit are provided Materials and components 180 Labour 100 Overheads (variable) 20 Overheads (allocation of fixed general overheads) 40 In addition fixed costs of 25,000 per annum would be incurred. The investment in machinery required to produce the additional output would cost 160,000. This expenditure can be depreciated for tax purposes over the five year life of the contract on a straight line basis and it is anticipated that it could be sold for 50,000 at the end of the five year period. The company would also make use of some equipment it already owns. This is fully depreciated for tax purposes and could be sold today for 30,000. It is anticipated that after using it for another five years the equipment will have no second hand value. The production would take place in the company's main factory. However, the company will have to re-locate the production of another product to make space available. This will require renting some additional accommodation at a cost of 20,000 per annum. It will also be necessary to invest 15,000 in additional working capital. The tax rate is 30 per cent. a) If the required rate of return is 14 per cent determine the investment's NPV. stating all the key assumptions employed in the analysis. (25 1/3 marks) b) Explain what is meant by sensitivity analysis and show how you would assess the sensitivity of the contract's NPV to the assumed price (8 marks) (TOTAL 33 1/3 MARKS) Question 2 Lothian Engineering Ltd. has been offered a contract to supply one of its components to a company developing a new product. The contract would be for 400 units per annum for five years at a price of 600 per unit. Lothian does not have the capacity to fulfil the contract requirements and it would be necessary to invest in additional machinery. The company's management accountant believes that the estimates of the production costs can be based on those incurred in the manufacture of the product already being produced. The following estimates per unit are provided Materials and components 180 Labour 100 Overheads (variable) 20 Overheads (allocation of fixed general overheads) 40 In addition fixed costs of 25,000 per annum would be incurred. The investment in machinery required to produce the additional output would cost 160,000. This expenditure can be depreciated for tax purposes over the five year life of the contract on a straight line basis and it is anticipated that it could be sold for 50,000 at the end of the five year period. The company would also make use of some equipment it already owns. This is fully depreciated for tax purposes and could be sold today for 30,000. It is anticipated that after using it for another five years the equipment will have no second hand value. The production would take place in the company's main factory. However, the company will have to re-locate the production of another product to make space available. This will require renting some additional accommodation at a cost of 20,000 per annum. It will also be necessary to invest 15,000 in additional working capital. The tax rate is 30 per cent. a) If the required rate of return is 14 per cent determine the investment's NPV. stating all the key assumptions employed in the analysis. (25 1/3 marks) b) Explain what is meant by sensitivity analysis and show how you would assess the sensitivity of the contract's NPV to the assumed price (8 marks) (TOTAL 33 1/3 MARKS)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts