Question: Question 2 (Marks: 40) You are the Chief Technical Engineer for Hamiliton Racing, which sells racing engines. The accountant is on leave in Florence. Mr

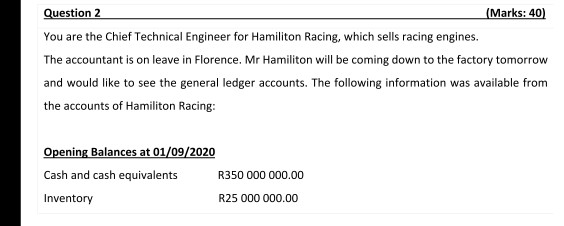

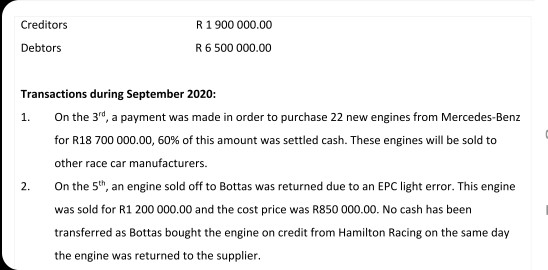

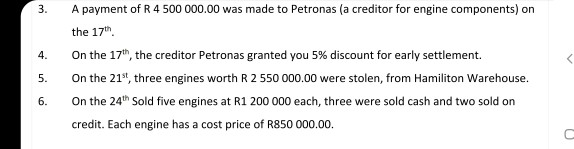

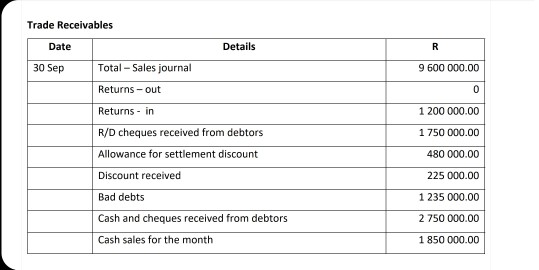

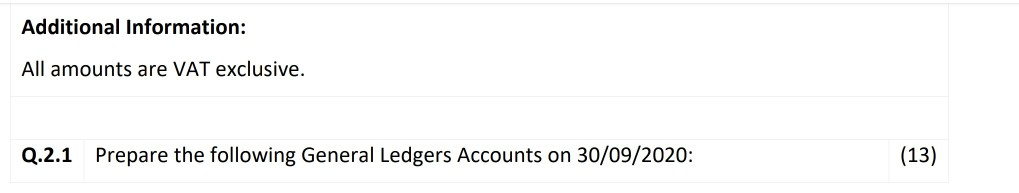

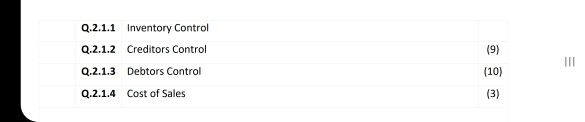

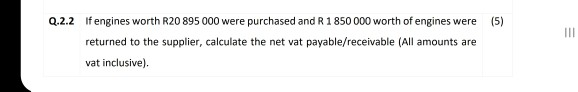

Question 2 (Marks: 40) You are the Chief Technical Engineer for Hamiliton Racing, which sells racing engines. The accountant is on leave in Florence. Mr Hamilton will be coming down to the factory tomorrow and would like to see the general ledger accounts. The following information was available from the accounts of Hamilton Racing: Opening Balances at 01/09/2020 Cash and cash equivalents R350 000 000.00 Inventory R25 000 000.00 Creditors R 1 900 000.00 R6 500 000.00 Debtors Transactions during September 2020: 1. On the 34, a payment was made in order to purchase 22 new engines from Mercedes-Benz for R18 700 000.00, 60% of this amount was settled cash. These engines will be sold to other race car manufacturers. 2. On the 5th, an engine sold off to Bottas was returned due to an EPC light error. This engine was sold for R1 200 000.00 and the cost price was R850 000.00. No cash has been transferred as Bottas bought the engine on credit from Hamilton Racing on the same day the engine was returned to the supplier. 3. 4. A payment of R4 500 000.00 was made to Petronas (a creditor for engine components) on the 17th On the 17th, the creditor Petronas granted you 5% discount for early settlement On the 21st, three engines worth R 2 550 000.00 were stolen, from Hamiliton Warehouse. On the 24th Sold five engines at R1 200 000 each, three were sold cash and two sold on credit. Each engine has a cost price of R850 000.00 5. 6. Trade Receivables Details R Date 30 Sep 9 600 000.00 0 Total - Sales journal Returns-out Returns - in R/D cheques received from debtors Allowance for settlement discount Discount received Bad debts Cash and cheques received from debtors Cash sales for the month 1 200 000.00 1 750 000.00 480 000.00 225 000.00 1 235 000.00 2 750 000.00 1 850 000.00 Additional Information: All amounts are VAT exclusive. Q.2.1 Prepare the following General Ledgers Accounts on 30/09/2020: (13) Q.2.1.1 Inventory Control Q.2.1.2 Creditors Control Q.2.1.3 Debtors Control (9) III (10) Q.2.1.4 Cost of Sales (3) (5) TIL Q.2.2 If engines worth R20 895 000 were purchased and R 1 850 000 worth of engines were returned to the supplier, calculate the net vat payable/receivable (All amounts are vat inclusive) Question 2 (Marks: 40) You are the Chief Technical Engineer for Hamiliton Racing, which sells racing engines. The accountant is on leave in Florence. Mr Hamilton will be coming down to the factory tomorrow and would like to see the general ledger accounts. The following information was available from the accounts of Hamilton Racing: Opening Balances at 01/09/2020 Cash and cash equivalents R350 000 000.00 Inventory R25 000 000.00 Creditors R 1 900 000.00 R6 500 000.00 Debtors Transactions during September 2020: 1. On the 34, a payment was made in order to purchase 22 new engines from Mercedes-Benz for R18 700 000.00, 60% of this amount was settled cash. These engines will be sold to other race car manufacturers. 2. On the 5th, an engine sold off to Bottas was returned due to an EPC light error. This engine was sold for R1 200 000.00 and the cost price was R850 000.00. No cash has been transferred as Bottas bought the engine on credit from Hamilton Racing on the same day the engine was returned to the supplier. 3. 4. A payment of R4 500 000.00 was made to Petronas (a creditor for engine components) on the 17th On the 17th, the creditor Petronas granted you 5% discount for early settlement On the 21st, three engines worth R 2 550 000.00 were stolen, from Hamiliton Warehouse. On the 24th Sold five engines at R1 200 000 each, three were sold cash and two sold on credit. Each engine has a cost price of R850 000.00 5. 6. Trade Receivables Details R Date 30 Sep 9 600 000.00 0 Total - Sales journal Returns-out Returns - in R/D cheques received from debtors Allowance for settlement discount Discount received Bad debts Cash and cheques received from debtors Cash sales for the month 1 200 000.00 1 750 000.00 480 000.00 225 000.00 1 235 000.00 2 750 000.00 1 850 000.00 Additional Information: All amounts are VAT exclusive. Q.2.1 Prepare the following General Ledgers Accounts on 30/09/2020: (13) Q.2.1.1 Inventory Control Q.2.1.2 Creditors Control Q.2.1.3 Debtors Control (9) III (10) Q.2.1.4 Cost of Sales (3) (5) TIL Q.2.2 If engines worth R20 895 000 were purchased and R 1 850 000 worth of engines were returned to the supplier, calculate the net vat payable/receivable (All amounts are vat inclusive)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts